As of now, I have full intentions of writing a new post on AutoCanada. This intention led me to re-read this piece and realize that I hadn’t ever republished this from the old site. A lot of what is in this turned out wrong (mostly the digital business), but I think this piece stands. And it will serve as a good reference should I ever publish the new AutoCanada post I’m writing.

I’ll admit that I used to be a big watcher of Market Call on BNN. Even before I was particularly interested in investing, our tv at home was often tuned into it.

One under appreciated thing that has resulted from this past watching is I’ve seen sentiment changes up close on a wide variety of companies. There are a lot of interesting examples of this (anyone remember Patient Home Monitoring?) that would make for fun case studies; the one I want to talk about today is AutoCanada (if you haven’t figured it out yet).

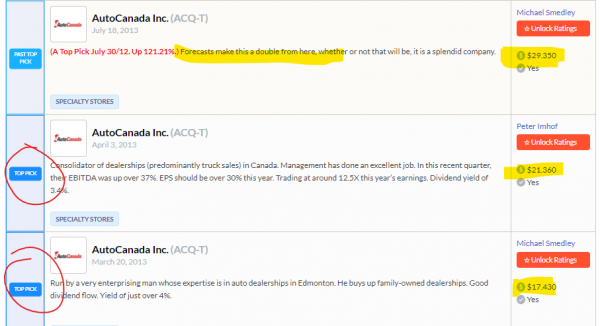

AutoCanada was one of those Market Call darlings. It had some crazy streak of raising its dividend every quarter (quarter, not year), and over a three year period from 2011 to mid-2014 the stock went on a run from ~$5 to over $90. Stockchase is a site that compiles the opinions of Market Call guests each day, so I can go back and find some examples of guest opinions. When the price was going up in 2013, everyone was on board:

That Bill Carrigan is a technical analyst, and he missed more than a 100% move up, but to his credit the comment was spot on

I could keep going all day, I skipped over quite a few. The stock was going up, it was a growth story and a dividend growth stock, everything looked great. Going on BNN and saying it’s a great company when the stock chart is straight up and to the right is easy.

But we weren’t far from the end.

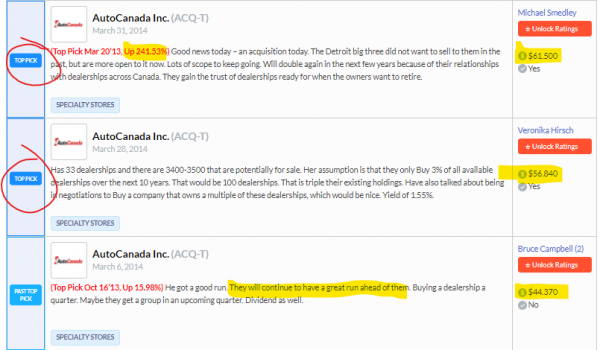

Teal Linde said “I don’t see why you’d ever want to sell this” like two weeks before Autocanada started its relentless march down. Hindsight is 20/20 and all but…

The stock tops and is on its way back downto earth, but it’s still acknowledged as a compounder.

My favourite part of this one is all three guys trying to explain why the stock is down.

More rationalizing

Now it’s late 2014, oil has crashed and suddenly selling trucks to rig workers in Fort McMurray isn’t such a good business. The stock is down 50% in about six months, and bulls start doubting it.

The stock had issues before the price drop Bruce? Why didn’t you mention them? Waiting for it to stabilize Teal? What happened to never selling it?

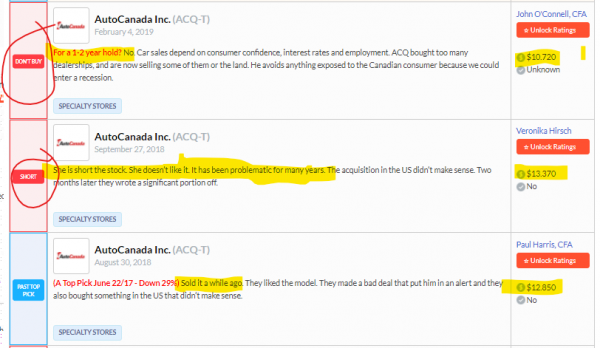

I’d love to keep doing this, but I’ll wrap it up with one final screenshot. Almost everyone has given up.

Hopefully you found that informative, because it was pretty fun for me. The stock still had its bulls after the crash, but I don’t think my screenshots are misleading. Other than a few technical analysts (who I like to make fun of but they are the only ones who look smart when you go through these opinions), everyone loved AutoCanada on the way up, and almost everyone hated it on the way down.

The end result is a lot of burned investors with scarred egos and investors who don’t know anything about AutoCanada except “didn’t it crash like 80%?”. I said I was going to quit it with the screenshots, but a few more will help illustrate the apathy.

If you scroll up you’ll see that Veronka Hirsch said she’d overweight the stock at $70 and is now short at $13.

You’ll see in that last screenshot that the stock has been discussed just twice this year. For those that don’t know the show, a stock will only have opinions here if it is asked about or if it is a guest’s top pick. No opinions means no interest in the stock. Not only have fund managers left it for dead, but retail investors don’t care enough to even ask about it.

The lack of interest may not surprise you when you think about a stock that has been such a dog for so long, but the stock chart this year should raise questions…

In a year with a global pandemic, an auto dealership group has returned over 100%. If you were lucky enough to be watching it at the bottom you made out like gangbusters.

What I think a lot of investors are missing is that this isn’t the old AutoCanada. A very brief and incomplete history might help show this.

March 2016 – Patrick Preistner, the founder, chairman, and CEO of AutoCanada steps down as CEO and moves to non-executive chairman. Steven Landry becomes CEO.

March 2017 – Tom Orysiuk resigns as president. Steven Landry takes over those duties. Mark Warsaba becomes COO.

May 2018 – Paul Antony appointed to the board of directors.

June 11 2018 – Roland Keiper sends a letter to the board requesting a special committee to explore a sale of AutoCanada while also expressing disappointment in the operating performance of AutoCanada.

June 17 2018 – Special committee formed. Paul Antony is chair. He says “As part of our ongoing review of the Company’s strategy and performance, which has included discussions with management, our shareholders, and our financial and legal advisors, the Board established a Special Committee of independent directors charged with completing a strategic review to explore a range of strategic and financial alternatives that could enhance shareholder value. In addition the Special Committee will evaluate potential changes to the Company’s Board of Directors.“

June 20 2018 – Two directors “retire” – chairman Gordon Barefoot and Michael Ross. Antony takes over as chairman.

June 26 2018 – Arlene Dickinson, who for some reason was on the board (for all of one year), resigns.

July 3 2018 – Michael Rawluk is hired as president. Mark Warsaba resigns as CEO (and senior vice president).

August 2018 – Rawluk appointed to the board of directors. In his month with the company, he has come up with a “go forward” plan. A few more board members are appointed. A new president of US operations is hired. CEO Steven Landry steps down. CFO Chris Burrows resigns. Antony becomes executive chairman.

Roland Keiper writes a letter and three months later half the board and the entire management team is gone. As you can hopefully see, the company and strategy from before 2018 shouldn’t weigh heavily in your mind when looking at AutoCanada now. You’ll also notice in the Market Call screenshots that only Ryan Bushell even acknowledged all the changes after they happened, indicating investors really weren’t/aren’t aware the company is different.

A good way I found to see this is the different discussion points on conference calls before the summer 2018 shake up and after.

At the 2018 AGM, held in June, Landry described the AutoCanada strategy and advantage as basically being scale. For the most part all he said was “we let the dealerships run themselves and we do all the support/back office stuff in Edmonton. Our advantage is scale”. It was pretty uninspiring. With all the screenshots above this post is pretty long without me saying anything yet, so as much as I’d like to include the full quotes because they are quite illuminating, I’ll just let you find the transcript yourself if you want to read it (TIKR is my favourite resource for call transcripts). Here are a few snippets though that give you a feel for what he said (edited for brevity):

Our strategy and our levers in the last couple of years has been, for us, centrally, is to focus internally with our own field people on sales operations and fixed operations, marketing and advertising and digital tools and website are done from our office in Edmonton.

We met with our dealers 2 weeks ago in Edmonton, sharing best practices, going through their financial statements, going through their metrics and all of the departments and the dealership sales, both new and used in service and parts and F&I, and we also do training… So we try to have a decentralized operation with our dealers in the market. We want them to deal with the customers. We want them to focus on sales and service with the customers, and we try to take the back end items and things and do those in Edmonton.

Our strategic levers haven’t changed in 2 years, one being operational excellence, running the railroad I call it, and making sure our dealers hit their targets and hit their numbers, not only for the OEMs but also for AutoCanada.

Our CFO Chris Burrows, his massive focus on keeping our cost in line, our cost of debt managed as we go forward to be able to fund these acquisitions as we grow as a company, and also managing centrally our expenses and finding ways to lower costs with vendors and to try to provide for our dealers a less expensive cost of goods sold and also sales operations expense or operating expense.

That’s what AutoCanada was. I’m not saying scale is a horrible strategy. A dealership roll-up with scale as its secret sauce is a decent enough business. But it’s not anything special. AutoCanada would grow by acquisition, it could squeeze a few synergies out of the dealerships it buys by centralizing the back end and getting some bulk procurement deals.

Contrast that to the Go Forward Plan:

Realize actual synergies with bulk purchasing from vendors (AutoCanada said it was doing that but wasn’t)

Sell underperforming dealerships and excess land

Sale leasebacks of properties

Focus on finance, insurance, parts, service, collision repair

Start a specialty finance (mostly subprime) offering

Focus on increasing the sale of used cars as a proportion of cars sold (with a target of 1:1 used:new)

Start a wholesale division for the sale of used cars

Increase the occupancy of service bays

Within a month of Rawluk being names president, AutoCanada had the above plan and a target of increasing EBITDA by $30 million.

Boy has AutoCanada improved.

In 18 months (from Q2 2018 to YE 2019) AutoCanada paid off about $200 million of debt. Property & equipment dropped by roughly the same (consistent with the new real estate strategy). The company’s definition of capital employed (book value plus debt minus floorplan financing)is down from almost $900 million to a little over $500 million. Gross margins are up. Sales are up (with fewer dealerships).

I’d like to give you some special insight into the new strategy, but Antony and Rawluk have been pretty clear on it, and it’s easy to see how it’s an improvement.

AutoCanada is in the auto dealership business, it’s stuck with the low margin auto sales, but those sales can bring in the higher margin business, with very little incremental investment (EBITDA margins are roughly: <2% on new car sales, 7% on used cars, 10% on collision repairs and ~25% on parts and service). I don’t think the market is appreciating the renewed focus, the operating leverage, nor the synergies that can result.

For instance, currently AutoCanada owns 16 collision centres. Most of these are in AutoCanada dealerships, but most dealerships do not have one nor do they have a company owned centre nearby.

For whatever reason, people are damaging their cars and then going into a local dealership to ask where to get it fixed. AutoCanada has to send a lot of them away. It has said it wants to grow by acquisition, and the sales leads from the dealerships should mean sales synergies once it is under the AutoCanada umbrella. We are starting to see that play out; in October AutoCanada bought a collision centre focused on luxury vehicles in Dorval, QC. The centre is BMW certified, and now the company’s two BMW dealerships in Montreal can profit when someone comes in asking to repair their Beamer (profit more, AutoCanada had centre in one of its dealerships there).

I don’t think AutoCanada’s collision repair business will have the same competitive advantages that compounder bro favourite Boyd has (and therefore you can’t just say “collision earnings should trade at Boyd’s multiple”), but it’s also not without its advantages. And Boyd has shown that these facilities can be purchased at attractive multiples.

The last new initiative I want to highlight is the digital retail.

AutoCanada has started what it is calling its used digital retail initiative, essentially a platform for selling used cars entirely online or with an omnichannel strategy. We’re starting to see the makings of it with the recent acquisition of Haldimand Motors in Caygua, ON. Haldimand is a huge facility (20 acres) and will likely serve as a used car pickup location for cars bought online.

The reason this is worth dwelling on is that there are several companies doing this in the States. Caravana is the easiest one to point to and is the purest comparison. Caravana’s stock is up ~25x since its 2017 IPO. Its market cap is almost $50 billion, and in the third quarter of 2020 it set a quarterly revenue record with ~$1.5 billion (mentioned to show you the revenue multiple if it wasn’t clear).

Again, there are lots of reasons why Carvana should be valued more dearly than AutoCanada’s digital division, but it shows the market should come to like the business, and if the market is right about the business of selling used cars mostly online, then Carvana’s valuation is also an indication of the value the AutoCanada could be creating.

The other big reason the used digital retail initiative is noteworthy is that selling used cars online has been a money sink in the US. Antony has said AutoCanada would build this without “meaningful cash burn”. When asked why AutoCanada’s digital retail would be different than the companies doing it in the States, he had this to say:

So I don’t want to get into the exactly how we’re going about doing this. It will be evident here within the next month or 2. And I think we intend to basically put on show what we’ve been building in the background. And — but I — obviously, to us, we look at the U.S. and the U.S. peers, where in the digital retail space, they’re losing hundreds of millions of dollars, and that’s not an option for us. And we think we’ve come up with a pretty elegant way to take advantage of our size and scale, our geographic diversity, our brands that we have and the growing reputation that we’re building across the country to build up this platform, and we think that, that’s going to supercharge this business.

I don’t know what the secret sauce will be. The Haldimand acquisition was announced about two weeks after this call, so when Antony says “how we’re going to do this will be evident in the next month” my guess is the press release for that acquisition is supposed to be what makes it evident. And I think it gives a good hint that the AutoCanada model will probably look a lot like what CarMax is doing in the States right now:

Customers nationwide can leverage CarMax’s personalized e-commerce capabilities to shop for, save, and transfer vehicles; secure financing pre-approval; and obtain an online appraisal. Customers can opt to complete the car buying experience in-person at one of CarMax’s 220 stores nationwide; or buy the car online and receive delivery through contactless curbside pickup, available nationwide, or home delivery, available to most customers. In addition, CarMax has the nation’s largest used car inventory of more than 55,000 vehicles, which makes it easy for a customer to find the ideal car for them.

However it will look, at the very least it will lead to more cars out the door, at best it creates a giant growth engine like Carvana and establishes itself as the leader of selling cars online. And if I’m reading the strategy right – to buy large used car dealers that are already (likely) profitable and build a platform that works with those to add incremental sales to all of AutoCanada’s dealerships – then there really should be minimal cash burn. The upside is substantial (even though shareholders are going to share some of that upside with Antony who gets 15% of the initiative’s value above the contributed capital and a rate of return hurdle) and the downside should be limited to the costs of setting up the app/website/backend/etc.

Valuation

While the valuation is attractive, it’s not easy to figure out given the pandemic and turnaround efforts. This year, for the most part, I have been ignoring 2020’s financials and instead looking at 2019’s and/or what 2020 would have been without COVID. Between CEWS, layoffs that won’t be permanent, layoffs that will be permanent but we don’t know it yet, the effects of being closed for business for X number of months, the effect of crowd limits, whatever the case may be, I think for many companies their earnings this year are more or less irrelevant.

The caveat is you need to account for how the capital structure has changed (debt balance changes, up or down, won’t reverse just because COVID goes away) and one has to try to figure out how the pandemic has structurally changed the business if at all. For instance, if you’re looking at an office REIT I don’t think you can simply use 2019’s FFO going forward. You have to make your own estimation of how much demand for the REIT’s space will go down (and it will for all but the very best) and include that in your model.

In addition to the regular effects of the pandemic (will car sales go up because people are moving out of the city and have become accustomed to local road trips since international travel wasn’t an option, or will sales go down because of the financial impact on so many Canadians, or possibly just go from buying new to used) we also have to take into account the turnaround efforts. Ex-COVID AutoCanada would have had better results than 2019. Because of this there is some uncertainty what new run-rate financials are, but even using 2019’s numbers AutoCanada looks attractively valued.

In 2019 AutoCanada earned almost $65 million in adjusted EBITDA (the adjustments strike me as fair, and this is pre-IFRS 16 EBITDA which doesn’t add back lease costs). With the net debt at the end of Q3, the company’s enterprise value is ~$750 million. Free cash flow in 2019 was around $40 million* or $1.40 per share.

*My free cash flow number differs from what AutoCanada reported (~$98 million) because I deducted the principal portion of lease payments and added back the working capital difference of $40 million. I normally like to ignore working capital differences if I see a trend in them more or less averaging out to zero, but in this case management has been able to reduce working capital by a lot in their time, and specifically sought to do so, mostly by utilizing floor plan financing more. I am not sure this adjustment is entirely warranted but I’ll make it for now.

Using these numbers I get a valuation of ~12x EV/EBITDA and ~17x free cash flow. Those don’t seem outstanding on their own, but I think AutoCanada is going to show growth that makes those valuations look very cheap.

I don’t want to turn this into a sum of the parts, but I do think the exercise is helpful for showing the potential of what AutoCanada is building. You can apply a much higher multiple to AutoCanada’s collision centre business and the digital/omni-channel business, and you could add those to the stub dealership business. I estimate the collision centres contribute less than $5 million EBITDA and the digital retail hasn’t started up, but if you look out two to four years when there might be 30 collision centres and a few thousand cars sold either completely online or mostly online those businesses will be worth quite a bit. Boyd trades at 23x 2019 EBITDA, Carvana and Vroom, the most “pure play” digital players in the States, trade at multiples of sales not EBITDA.

It will take some work to get to the point these businesses are material to the story, but AutoCanada management deserves a bit of faith given the work they’ve done in the past two years.

Risks

I won’t talk much about the risks here. You know what they are. Vehicles are moving closer to driving on their own, so people will need fewer cars (someday). Cars driving themselves will get in fewer accidents than humans. Ride sharing is becoming more practical. OEMs might be more willing to sell direct to consumer. Electric cars will need less service. Kids don’t seem to care about driving anymore. Carvana or Vroom comes to Canada and throws money around to take digital share and show growth to shareholders. The list goes on.

I don’t want to blow past these large risks, but they are tough for a simpleton like me to 1) judge the likelihood of them affecting AutoCanada; 2) determine when they will affect AutoCanada; and 3) quantify the effect. I acknowledge them. I probably think they are further away than others do, or I think they will have a lower impact or slower adoption than most think. I could be wrong. I’ll let smarter people than me discuss the likelihood and magnitude of these disruptions; investors need to assess these risks for themselves.

Conclusion

AutoCanada is Canada’s only publicly traded auto dealership group. In two years the new management team of Paul Antony, Michael Rawluk (the two constants, not to diminish the impacts of current CFO Mike Borys and president of US operations Tamara Darvish) have proven to be great operators. Management has finally righted the ship and is ready to start acquisitions again; they’ve said their pipeline of opportunities has never been so big, and the multiples they’re seeing have come down, giving AutoCanada a great opportunity to put capital to work at high returns. Management will be able to improve returns by implementing the go Forward plan at the acquired dealerships. The company is also building up two “new” businesses that will have better economics than the old dealership business, collision and digital/omni-channel. Not only will the economics be better, but the market has assigned these businesses higher multiples than AutoCanada.

All this presents a high likelihood of earnings growth coming organically and through M&A, and a decent chance of multiple expansion.

It’s very possible that in 4 years AutoCanada is earning $3 per share in free cash flow with a much stronger business than it was a few years ago. If the company is less cyclical/economically sensitive, it is adapting to one of its threats (digital taking share), and it is growing like I think it can, why couldn’t this trade at 20x free cash flow? That’s being conservative. Why couldn’t it be 25x? If AutoCanada is selling 5,000 cars a year through its digital division at that time (Carvana was selling almost 20,000 four years after starting up and didn’t have the dealership infrastructure in place already), what could that be worth? Vroom is trading at $170,000 (USD) per car sold online. Carvana is higher but around the same. Why couldn’t AutoCanada’s digital division be worth $100,000 (CAD) per car? That would be like $18 per share on its own. If AutoCanada executes it well and is the unquestioned leader in four years, why would the business not be worth $200,000 per car sold (still a discount) or $36 per share? I don’t want to paint myself into a corner saying I expect the digital initiative will be worth $36 in four years, I’m just saying that it could be.

I started looking at AutoCanada mostly as an exercise in looking at companies whether the value jumped off the page or not (which I regret not doing more in the past). I am glad I did, if I hadn’t learned so much about management, and hadn’t looked at how they’ve improved things since they came in, I probably wouldn’t have thought it was cheap. I would have been like one of those Market Call guests and had the old crashed-and-burned, Alberta-centric AutoCanada in my head.

I don’t know if I’d set a $60 target for four years from now, but I do think it’s more likely to be $60 than under $30 at that time, with a decent chance of being well over $60. With the market the way it is, that’s an attractive bet.