“We used Ken Cooper as an inspirational guest speaker at LTV in 1968 or 1969. We looked carefully at trying to tie Cooper and the Aerobics Center into Wilson. You’d set up a number of tennis and health centers and sell your Wilson merchandise there. But I’m afraid that due to a lot of diversionary activities, that thought was never pursued. I don’t remember the reasons why, but two or three years ago I came across a memo delineating the concept. I’m not sure Cooper would ever have fit into that structure, either. But the real estate [for the tennis centers] would be a holding ground. There’s not much involved in building tennis courts, but it would have been a great way to inventory real estate. You’d buy three or four acres in a growth area, and then if tennis sort of phased out…. It would have been a hell of an investment.”

Jimmy Ling. Source

I imagine I’ve read more about Jimmy Ling than most people. Amongst what I’ve read, it might be this quote, Jimmy thinking back to a deal that could have been, that I think about the most.

It’s a chicken and egg situation. Do I think about this quote a lot because I’ve invested a lot of money in land or do I invest in land a lot because this quote has worked its way into my consciousness? I suspect it’s the former.

Canlan Ice Sports, possibly more than any other company, always comes to mind when I think of this quote. There are others that the idea of land covered with cheap intermediate money makers fits better (TWC being the best example I think), but Canlan is so seldom discussed that I think the land angle deserves more attention.

Canlan is in the business of operating and managing arenas and sports facilities. It owns 12 facilities, on 180 acres of land (which we’ll get to), and leases/manages/operates another four locations.

80% of Canlan’s revenue comes from renting its playing surfaces or running recreational leagues on those surfaces. The only other source of revenue of any consequence is selling food and beverages at its facilities (14% of revenue in 2023). Sponsorships/advertising, space rentals, pro shop sales, and management agreements combined added up to just 6% of revenue in 2023.

How is the arena business?

Prior to 2020, Canlan was consistently growing its revenue.

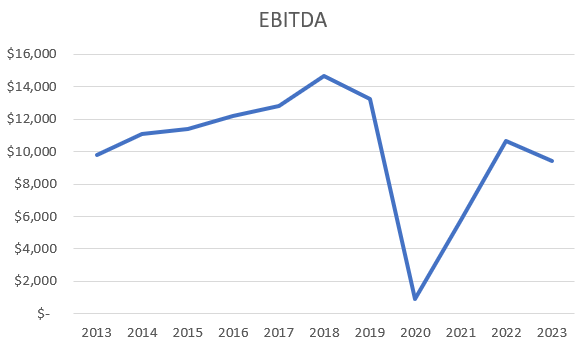

And EBITDA:

The trouble is that this growth did not result in much net income.

Over this eleven year period, Canlan earned just $7.9 million combined. If you take away 2020 and 2021, or even adjust them to be somewhat normalized, Canlan still has not earned very much. And just once over this period has return on equity been greater than 10%. Again, prior to 2020, ROE was increasing but low.

There are indications that Canlan might be able to improve returns in the future. Prior to now, Canlan managed two arenas in British Columbia on behalf of municipalities, for which Canlan earned management fees of $100,000 and $200,000 respectively. I don’t know much about managing arenas (despite my semi-frequent daydreaming about that very thing), but if I were to bid for the contract to manage my local arena, I doubt that I would bid anywhere near that low. It’s unclear how many costs are borne by Canlan, but even just a few employees would make those unprofitable. One of these management agreements has expired, and the second finishes at the end of this year. I suspect those were very unprofitable agreements (I’d have questions for whoever at Canlan bid on those tenders), and those ending should provide a boost to earnings.

That said, it’s tough to get excited about Canlan as an operating business. The returns on capital and equity are low. Growth is muted, and Canlan is trading at maybe 15x normalized earnings, with little reason to think it deserves a higher multiple.

Why I’m writing this is because I was interested in whether Canlan makes sense as a covered land play.

It owns ~170 acres of land. I tried measuring its land at each location using Google Maps, which is tough to do because in a lot of cases you have no idea where the property lines are, and it’s not a given that the distances on Google are accurate. Taking a guess where the property lines are, I got a total of ~120 acres, which should give you either an idea of the margin for error in this method or how bad your author is at guessing where property lines are*.

*Going on almost ten years ago now I was a manager of a fertilizer and crop inputs plant. Most farmers know how many acres each of their fields is, but every once in a while they don’t, and this is the method we used to estimate the size of their fields. It usually was a lot closer than the 1/3rd I am off here which tells me I’m off mostly because I got the property lines wrong.

Let’s use my numbers to start, as the extra 50 acres that I haven’t accounted for can serve as a margin of safety.

Canlan owns one location in BC, Burnaby’s Scotiabarn.

My best guess is that it is sitting on ~12 acres. The whole surrounding area is devoted to recreation (soccer fields, a community centre, a sports centre, archery, range, tennis, playgrounds, etc), so I’m not very confident that Canlan could ever get the site approved to be zoned for anything but what it is, but if it did, the land holds a lot of value. Whether that land could ever get rezoned as industrial or residential, the land would be worth a lot.

While vacancy and availability is increasing, the Vancouver area is still a very tight market, and there is not a lot of available land. This has led to very high prices. In 2023, ~200 acres of industrial land sold for $4.7 million per acre. That’s not far off of what residential land values are. This is out in Burnaby, not Vancouver proper, but from what I can tell the difference isn’t that large.

Like I said, I think everyone would be up in arms if this site was ever planned for development. Vancouver is already bad for NIMBYism, I can’t imagine what they’d do if a developer wanted to take away the arenas from a very clearly recreation focused area. But if land availability remains an issue, it would need to be considered, and having homes nearby your recreation seems like a good thing. Because I think it would be such a struggle to develop, I can’t really say this land is worth $4 million an acre, but it is worth a lot.

Canlan owns two arenas in Saskatoon and one in Winnipeg, collectively on ~18 acres. These aren’t particularly hot markets, but high quality industrial land could still fetch ~$500,000 an acre. The value of this land isn’t a particularly large component of the value of Canlan, so I’m not going to spend too much time worrying about whether it’s worth $200,000 or $500,000. At $500,000, the 18 acres is worth ~$9 million.

I’ll also note that while this land will not be nearly as revered as Canlan’s Burnaby location (probably) is, Saskatoon and Winnipeg residents won’t give up their arenas easily either.

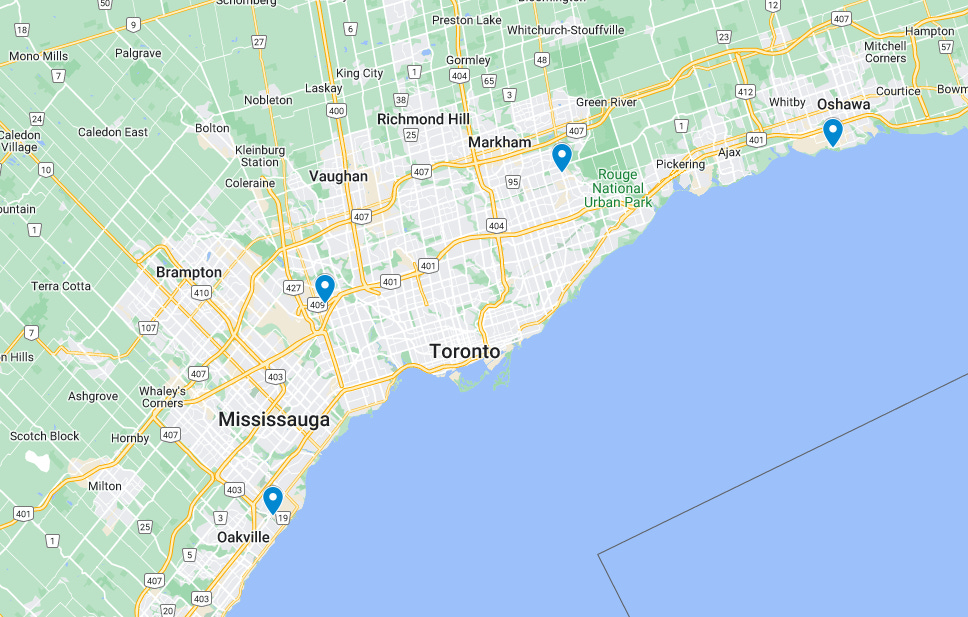

If you believe Canlan can be a land play, you have to believe in the value of its four outer GTA locations.

The largest of these I believe is the Oakville site, at an estimated 12 acres.

The large tire distribution centre right beside it is an obvious deterrent, but this land also could plausibly serve as residential land some day, making its value, if not higher, at least more likely.

The GTA remains a hot industrial market, with industrial land now trading hands for over $2 million an acre. Well over in a lot of cases; that link highlights transactions in Brampton or Mississauga as high as $4 million, and a land developers conference last year noted a range of $2-4 million as well.

According to Colliers, the locations of Canlan’s arenas are probably on the lower end of GTA values. With the exception of Oshawa though, sales prices in these areas are still over $300 per sq.ft, so not terribly far off average. $2 million is probably not far off, and the lands seem much less strategic than the Burnaby arena, with more options for arenas in the area. I’m guessing Canlan would face much less backlash trying to develop these (though resistance to building housing never ceases to amaze me). At $2 million an acre, the 40 acres of GTA land is worth around $80 million.

Finally, Canlan owns 4 facilities in Illinois:

I won’t lie to you, I know little to noting about Chicago area industrial land prices. I looked closer at these locations, and three of them looked like they could possibly serve as residential land (ie. people lived in the vicinity), or industrial. I’m confident in my sources for Canadian land values; I’m not at all confident in my ability to vet sources for industrial land values in these areas. One somewhat credible source I found suggested Chicago industrial land could be valued at $1 million an acre or more, but I doubt that Romeoville, Libertyville, West Dundee and Lake Barrington would be valued similarly.

These US facilities are located on ~40 acres of land, land I have a lot of trouble valuing.

Last February, Canlan exercised its option to purchase the Libertyville facility, which is on 17 acres or so, for $5.1 million CAD. Possibly Canlan got a good price, the company likely thinks so, but that purchase price suggests the land isn’t terribly valuable. Let’s say half the purchase price is land value, that gets us a land value of ~$150,000 per acre. That’s a number I’m comfortable applying to the Illinois lands, making them worth ~$6 million.

There are a lot of fuzzy numbers in these estimates. I appreciate that. But Canlan’s enterprise value is just $77 million. If you agree that Canlan’s GTA lands are worth roughly what I think they are, the whole company is selling for what four of its twelve owned locations might be worth to developers. Then you have the Illinois, Saskatoon, and Winnipeg locations, and the large, very valuable Scotiabarn location in Burnaby. All that land is worth a lot and I don’t think is valued by the market.

Plus, Canlan owns another 50 acres on those locations over and above what I estimated. Those acres are worth something, I just don’t know what since I don’t know exactly where they are.

If you were willing to be a long term owner of Canlan, you might be able to wait around hoping that the plan is to some day develop the land under the arenas. However, there is a good chance that you don’t ever get to participate in that.

Canlan is almost 93% owned by Bartrac Investments (75%) and Anita Zucker (17%). The stock not owned by those two is worth less than $5 million. Neither controlling shareholder seems to be particularly interested in realizing value here - it is a very small position for Zucker, and Bartrac has held its shares forever at this point.

Even though the land underneath Canlan’s owned facilities might be worth twice twice the enterprise value, I don’t think an investment can be made on that basis. I think Canlan investors are investing in an arena operator, not a land bank. The arena operations are not particularly cheap, aren’t growing particularly fast, and don’t earn particularly high returns. I don’t believe that Bartrac has any interest in maximizing Canlan’s value, which to me would involve selling off the land. If I am right about the value of the land, and Bartrac sees it, I think Bartrac ultimately writes a small cheque and takes it private for a small premium.

Canlan has a very Canadian feel, and I’m sure there are worse things you could do with your money than buy it. But it probably doesn’t work as a covered land play, even though the numbers suggest it could. And if that is what you are looking for, there are better options out there (TWC Enterprises being the obvious example).

I like this sort of idea. But there are actual real estate companies that trade at prices far below the value of their land.