Knight Therapeutics has gone through a few narratives in its life. The stock chart does a good job of showing these changes.

It started out as Jonathan Goodman’s new venture, which he hoped to build into a new and improved Paladin Labs, Paladian being the company he led from its founding to its sale to Endo Pharmaceuticals while generating a 27% annual return over 19 years.

This early period in Knight’s life was filled with new product deals, new loans and investments made by Knight, and a bunch of equity raises. Goodman’s name still had the Paladin shine, investors wanted more.

I wasn’t paying attention to it then.

Knight Therapeutics came on my radar in mid 2018. I actually managed to find what I wrote about Knight at the time, but trust me you don’t want to read it. It’s bad. It included terrible analysis of what drugs in the pipeline might be worth. It’s poorly written. I could go on. This was the conclusion of that post though:

However, if I knew more about drugs and felt more confident valuing them, I could see how Knight is undervalued at $8.00. I don’t know what I’m looking at, so I can’t bring myself to buy GUD. If anyone ever forced me to buy a pharma stock, it would be Knight though. The downside is low in a sector known for risk and blow ups, and the upside is whatever Goodman wants it to be.

Most of my investments are bets on the CEO as a steward of capital. I invest in Brookfield because I trust Bruce Flatt. I trust Alain Bedard to use Transforce’s money wisely, I trust Duncan Jackman will continue creating value at E-L Financial for years to come. I trust Rai Sahi, Bob Dhillon, etc, etc. I trust Goodman the same way. But I can analyze those other industries half ass well. I can’t analyze the drug industry, and for that reason I’m out.

In ten years, I’ll kick myself that I looked so long at GUD and passed on it. But for now I’m okay with my rationale.

The writing was bad, a lot of the analysis was bad, but the conclusion wasn’t.

At this point in 2018, Knight had become a sum of the parts story. At the time I found it, the stock was ~$8.00 and Knight had:

$5.60 per share of cash

$0.75 of fund investments, equity investments in other pharma companies, and loans outstanding to pharma companies

28.3% of an Israeli pharmaceutical company, Medison Biotech, which was paying Knight ~$5 million in dividends each year (and which Knight sold in 2020 for $77 million, or ~$0.55/share).

A pipeline of product rights/licenses

Knight became a pretty popular stock among value investors at this time, and for good reason. Looking back on what Knight sold Medison for, it owned almost $7.00 of financial assets, a small pipeline of product rights, and had a bonafide Outsider CEO at the helm. The valuation offered little downside, and Jonathan Goodman had a huge war chest with which to run his Paladin playbook again.

Without looking back through brokerage statements and what not, I don’t know when I ended up changing my mind about Knight, but I did. I bought it at around the same price (I think it had declined to in the $7’s but for all intents and purposes it was the same price).

Knight continued on with that narrative for a while, including through an “activist” battle with the owner of Medison, until late 2019, when Goodman finally did something with a large portion of his cash, buying Grupo Biotoscana (GBT) for ~$370 million. Knight paid ~8.5x EV/EBITDA for GBT, not a bad price, but the big idea behind the acquisition was this gave Knight a much larger territory to use its business plan on.

Over the life of Paladin and Knight, Canada had become a competitive market for the kind of “under marketed” drugs that Knight wanted to license. Other companies were willing to put in the work to get drugs approved in Canada, so Knight could no longer put capital to work at the returns that Goodman sought (7x earnings or thereabouts). There was no way Knight could ever use its cash pile in Canada, so it had to expand. GBT offered a fairly priced way of doing that. Instead of competing with the likes of Biosyent for the rights to a drug in Canada, Knight could get the license for that same drug but in Colombia and Argentina, or Brazil, or a bunch of countries in Latin America.

The deal was likely not what most Knight shareholders wanted, but the deal had a logical rationale.

Then COVID hit… the stock recovered, and starting in May 2020 the stock has been on a relentless ride down, trading well under $5 today. The Knight narrative is definitely not a sum of the parts story anymore.

I sold my shares long ago - I lost money, so this isn’t me bragging about selling before the price went down - but I still am interested in Knight and have kept an eye on the stock price. Between the price, my lingering interest in the company, and a reader emailing me asking me about Knight, I thought it might be kind of fun looking into the company and writing about it again.

Returns on Capital

Knight has done done two major deals ($100 million plus). It acquired GBT, and it acquired the Canadian and LATAM rights to Exelon. Both of those have been closed for over a year (though Exelon has been closing in stages as more territories get transferred to Knight). I think it’s fair to make a preliminary judgement how Knight has allocated capital.

Going back to 2018, here is what Knight’s income statement looked like:

For all intents and purposes, Knight’s EBITDA was a loss of $3.85 million. The balance sheet meanwhile:

Since Knight’s business was so small, it’s cash needs were not high, so let’s say all but $20 million of that cash is excess. In that case, Knight had EBITDA of -$3.85 million on roughly $35 million of invested capital. This isn’t the fairest comparison, because at the time a lot of Knight’s financial assets were tied to product rights they had received - for instance, they invested in the stock of a company and received the Canadian rights to a product from that company - so some of Knight’s financial assets should be included in invested capital. But I’m trying something here (I’m in the arena, trying things).

Fast forward to 2022.

EBITDA has increased to ~$35 million, and YTD 2023 is around $28 million (up year over year and without too much new investment), so we’ll have to make some adjustments to normalize that.

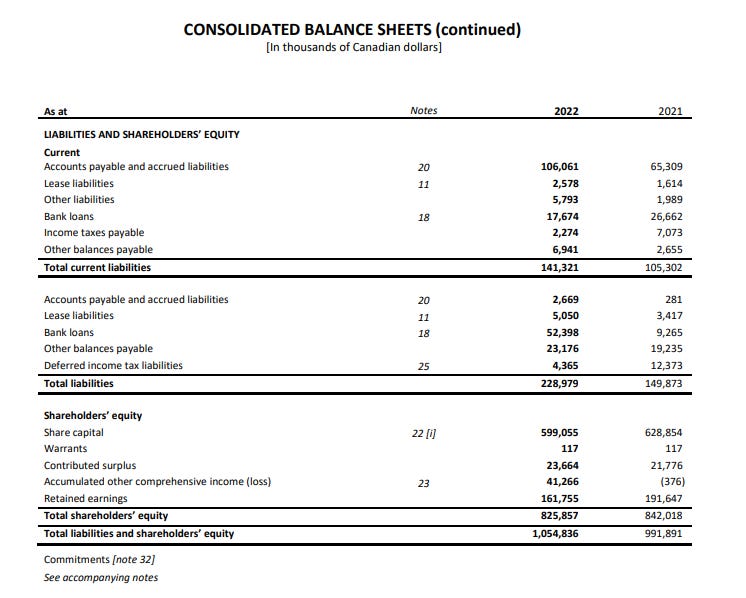

Meanwhile, here is how the balance sheet changed:

Invested capital is up to ~$585 million or so (kind of keeping apples to apples). So Knight, having invested ~$550 million, has increased EBITDA by let’s call it $50 million. That’s picking a somewhat halfway point between last year’s $35 million and this year’s increase year to date.

The $550 million jives with what Knight claims as cash invested in investing activities:

$175 million in 2019 (GBT and intangible assets/PP&E)

$190 million in 2020 (GBT and intangible assets/PP&E)

$224 million in 2021 (intangible assets/PP&E)

Those actually total ~$590 million but let’s call it $550 million.

Going simply EBITDA/invested capital, Knight has earned a 9.1% return on its capital. That’s not great.

Now, Knight’s investments have also bought it a pipeline of drugs coming to market, and has developed its existing pipeline somewhat:

Looking at that pipeline, you can see that there are quite a few products that can/will contribute to future earnings. Anywhere you see “pre-registration”, “submitted”, “approved”, and any recent date, we can expect at least some of those will contribute to future earnings. Perhaps looking out a few years is more indicative of the return on Knight’s investments. 2025 EBITDA has a good chance to be materially higher. Could EBITDA be $60 million? More? It’s hard to say, but maybe. At $60 million, which would be organic growth of 71% in three years, Knight’s return on capital would be more like 11-12%. Better, probably good enough to argue that investing in the business has created value, but almost certainly not what Knight shareholders were expecting when they bought their shares.

As a comparison, in 2012 Paladin Labs had something like $75 million of EBITDA on ~$230 million of invested capital (a 32% return). Then, having invested ~$62 million in acquisitions of subsidiaries and intangible assets, Paladin’s EBITDA grew to over $90 million in 2013, again suggesting that the return on new invested capital was very high or that the $230 million invested the year before was returning even more than 32%.

Looked at this way, I think it’s fair to be disappointed in Knight’s capital allocation or simply to question it.

Amortization

Why was I using EBITDA as my numerator in ROIC calculations? It was a courtesy to Knight.

If you look back at the financial statements of Paladin Labs, you’ll notice a striking difference from Knight….

Paladin had net income after amortization. Scroll up to Knight’s 2022 income statement. $35 million of EBITDA vs $51 million of amortization of intangible assets.

You see, the products Knight in-licenses have an expiration or best-before date. Either Knight’s deal will expire and it will have to renew it (entailing another upfront payment) or the patent will end and the drug can face competition from cheaper generics. Either way, amortization is a very real expense.

Including Knight’s amortization expense, hence using EBIT as the numerator in the ROIC calculation, the company now has no earnings. Even assuming that organic growth to $60 million in EBITDA in 2025, EBIT is a more or less negligible $10-$15 million (negligible in relation to the $550 million in invested capital). Again using Paladin as a comparison, 2012 EBIT was ~$59 million, reducing its ROIC down to a still very impressive 25.6%.

In the post-mortem for my investment in Knight, I mostly used Knight’s lack of deals as a signal that deals were not available at the returns Knight wanted. I actually didn’t fear that Knight would lower its hurdle rate for investments. My main fear that Knight would just sit on cash more or less indefinitely. Either would have been bad. I think the former has hurt the stock price worse.

Knight Therapeutics Post-Mortem

As mentioned in the Jonathan Goodman post, republishing this post-mortem of my investment in Knight Therapeutics will provide additional context for my thoughts about it currently. While Knight has managed to put more capital to work, including a large deal for the rights to Exelon across all its territories (the exact kind of deal I’d been wanting), I …

Now is this comparison to Paladin in 2012 fair? There is a case for yes and a case for no.

On the one hand, Knight' is hovering around $300 million in sales, while Paladin had $276 million in sales in 2013. So the sizes of the companies were close. On the other hand, Knight has been public for just under a decade, and realistically Knight in its current iteration was born when it purchased the first tranche of GBT. In 2012 Paladin was a mature company, and had been executing its business model for almost 19 years.

My point isn’t that Knight isn’t living up to Paladin’s standard. Knight’s return on its investments is mediocre on its own. If Knight was earning 15% on its capital, that would be fine, even if it didn’t compare to Paladin’s peak. The Paladin comparison to me is possibly indicative of the market’s expectations - it’s possible that investors have decided Knight has had enough time to play out, and it isn’t living up to their expectations (those expectations being a new Paladin). The difference in returns might be an indication that the chance of being another Paladin is beyond Knight’s grasp. The outsized returns Jonathan Goodman and Mark Beaudet might not be out there anymore. That is my working theory.

If nothing else, that would reduce the optionality investors can attribute to Knight’s cash balance.

Right now, Knight has around $175 million in cash (or assets that could be turned to cash near term), as well as $140 million of investments that are expected to mature and be paid back to Knight over the next ten years or so. That is a lot of cash that Knight is going to be looking to invest over the next few years. The stock is worth two very different prices if Knight is investing that cash at 10% vs 15% or 20% or whatever.

Valuation

As I said, Knight earned ~$35 million in EBITDA in 2022. This year it might do $45 million. Its enterprise value is in the neighbourhood of $330 million if you don’t subtract all the cash of the business (only subtract excess cash), or $280 million if you do. This leaves Knight’s EV to EBITDA as 6.2x to 7.3x.

Is that a fair price?

If you hold the belief that Knight is investing capital at around a 10% return, and is investing as much as it can at those returns - and that the $50 million amortization figure is an accurate gauge of how much Knight needs to invest in its business to maintain its current profitability, then I don’t think Knight is particularly undervalued. Subtracting all cash from the EV (not how I would do it), here’s Knight’s share price at a few multiples:

8x = $5.24

9x = $5.63

10x = $6.00

Admittedly, $6.00 represent upside of ~33%. But I think underwriting 10x EV/EBITDA for Knight is optimistic in a world where you can buy a 5 year GIC for 5+%. Nothing that Knight has shown so far indicates its an above average company. If Knight is only able to invest at 10% returns (using EBITDA as the numerator), why would I pay more than 10x for it? Especially when you think that Knight is engaged in pharmaceutical sales in Latin America - not exactly a risk-free endeavour nor one you’re likely to have in your circle of competence - you should expect the valuation to reflect that risk.

Some could argue that perhaps a higher multiple is warranted based on the organic growth that Knight’s portfolio can show without further investment. Unfortunately, the amortization issue comes back. When annual EBITDA is $40-$50 million and growing, but amortization is $50 million, it’s hard to count on organic growth outweighing maintenance capex (in this case, acquisition of intangibles) for very long.

Share Buybacks

It is worth noting that Knight is spending a tonne of money buying back its stock. When I was looking at Knight back in 2018, it had 143 million or so shares outstanding. At the end of Q2 this year, that was done to 114.5 million (counting some options). And if you believe Knight is attractively priced, as I know some smart people that do, you have to be very happy with the returns on those buybacks. Heck, using my own calculations, Knight is earning a 13.7%-16.1% return (EBITDA/EV) on those buybacks. If Knight can earn ~15% buying back its stock, I am fully in favour.

This is merely interesting to note, and depending on how you see Knight’s value, you will view the buybacks differently. I personally give management a thumbs up for it, but that’s it. It can’t really change how I value the stock.

Conclusion

I remain very interested in Knight. I like seeing the company announce deals, because I like to believe those deals could resemble old Paladin deals. I like to believe that Jonathan Goodman and Samira Sakhia still have some of tha old Paladin magic.

But Knight hasn’t shown me that yet, and it gets harder and harder to have faith.

One of my favourite Jonathan Goodman quotes is this:

For investors, if their investment horizon is not their grandchildren, we are not the right company for them. Paladin had 19 years of record revenues but for 12 of those years, our stock was flat. It took us 19 years to become an overnight success.

Knight has now racked up 9 years of record revenues, and the stock has been flat for 9 years - giving him the benefit of the doubt of measuring from Knight’s IPO vs from anytime since then when the stock would be down a lot.

I concluded my post-mortem by stating maybe I am just impatient. I love the idea of "investing for my grandchildren”. I believe I’ve proven to have the temperament for that with other stocks I hold. My opinion of Knight doesn’t have to do with the stock price. If anything, the stock being down so much makes me like it more. But a long investment horizon should be earned by the company. The company should prove to you, through its actions and results and returns on capital, that it deserves to be held for decades. Knight hasn’t shown me that.

What are the other Canadian companies that "were willing to put in the work to get drugs approved in Canada" and doing the same playbook? Thank you so much.

Great write-up. As a shareholder, I appreciate the less obscured view on knight. As you mentioned, knight's current iteration is really only since they acquired GBT in late 2019. So, it's effectively only been three years of operations under their management. I purchased my first tranche after the market sold off in covid and then built my position over 2021/22 in the low $5 range and recently added on at $4.60, so it may be easier for me to have a "long-term" view as it's only been a little over 2 years that I've held GUD.

Having said that, I think the valuation is very attractive (although that's been the case since day 1) and I think they are still going through growing pains of adding Exelon and integrating the 4 companies of GBT during the middle of covid. Now that is mostly behind GUD and we will see if they can fully execute without major restrictions. I was even thrown off recently with how much cash was going into working capital related to inventory purchases for Exelon, so they are still working through integrating the drug today.

Without being too long winded, I think there is a lot to be positive about today. The pipeline and sales are growing, the share count is shrinking, the float is also shrinking as major shareholders (Armoyan 12%, Goodman 22%, and another institution owns 10%) are buying large chunks of the company and there is a path to exit the funds and redirect that money to core operations. All while pessimism is at an all-time high. I'll give the team another 2 years.