Here’s another from the archives post. Two things prompted me to post this when I otherwise probably wouldn’t have. One, a reader commented on the last post asking for what I’ve written on Crescita. Whenever someone wants something I’ve written I’m happy to share it (if I’ve saved it), so I shared this article with him privately.

Two, I was reading the Joel Greenblatt class notes and read Bruce Newberg discuss his investment in MIPS (starts on page 34 of that pdf). It struck me as vaguely Crescita related - a company with a lot of cash (hence a low EV), an attractive royalty stream, and a few other lines of business. It’s not as attractive - MIPS had a negative EV for a lot of the time Newberg was buying it. But the story is similar enough that reading that made me think Crescita, and I checked up on it again.

The story remains similar to when I wrote this, and while I lost the first post I wrote on Crescita (linked in the first line), I think this post provides enough background for someone who wants to research Crescita to get started. Enough has happened since I wrote this - the most noteworthy of which is several Pliaglis licensing deals, but also Taro’s royalty restructuring (and getting less lucrative) and a bunch of growth in the CDMO and skincare lines - that I may choose to write a new post about Crescita. It’s a simple enough company and investment thesis (as you’ll read below) that I might choose to write a new post about it. The idea is intriguing enough - like Bruce Newberg said in that lecture, if Crescita sold off everything but Pliaglis and went down to one employee who simply cashes royalty cheques, it would be worth more than the stock price today - that it might hold my interest through the process of researching and writing a new article. It might not though. In the meantime, I hope you enjoy this and/or find it interesting enough to prompt some thinking on Crescita.

A Quick Idea – Why Isn’t Anyone Acquiring Crescita Therapeutics?

If you haven’t, I suggest you read my previous post about Crescita Therapeutics. I am going to blow past some background on it here so if you want a full story this post won’t cut it. I’ll also point you to Battleship Investing, a blog that has covered the company several times.

There is a pretty easy investment case for Crescita right now – the sum of the parts are worth way more than the whole and if there are any smart pharmaceutical companies out there they will acquire Crescita some time soon.

Pliaglis

Pliaglis is what Crescita will be acquired for, make no mistake.

I won’t make too much of a case for Pliaglis’ appeal (read that first post for one, or this VIC write-up). What I will say here is that two large pharmaceutical companies – Taro Pharmaceuticals and Cantabria Labs – have paid good money for the rights to Pliaglis.

That’s two companies that in theory should represent “smart money” that are saying the rights to Pliaglis are worth somewhere between $0.009-$0.016 per capita (not sure that’s a great metric but work with me here).

Let’s imagine there is some Canadian pharmaceutical company with operations in other countries that wanted the rights to Pliaglis. If Knight I mean the hypothetical company wanted the rights for Canada, it might pay $400,000-$600,000 up front, along with possible milestone payments down the road.

But Pliaglis is approved in over 20 more countries. Maybe those other markets are worth less than the range Cantabria and Taro paid (due to being less developed pharmaceutical markets), but the rights are worth something. Pliaglis is approved in Mexico – maybe those rights are wroth $600,000 up front ($0.005 per capita). It’s approved in Australia and New Zealand, the rights in those countries are probably worth another $300,000 at the low end. It’s approved in Brazil, those rights are probably worth more than $1 million. And so on.

The Pliaglis rights are valuable is what I’m getting at. But if Pliaglis was all Crescita had, it wouldn’t be the no brainer I think it is, at the current ~$11 million market cap. Here’s why acquiring Crescita is a great way to get the Pliaglis rights.

Some quick math…

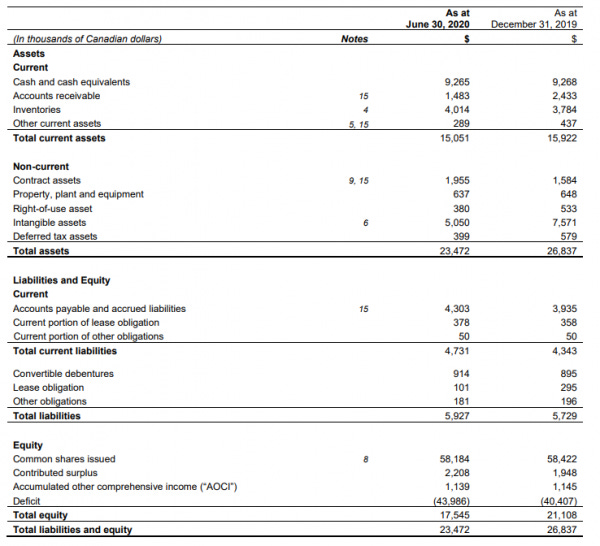

$15,051,000 in current assets minus 5,927,000 in total liabilities divided by ~24.6 million shares outstanding equals $0.37 per share net current asset value. But wait, there’s more!

Crescita is receiving $5.2 million from Taro for amending their agreement at some point in Q3. Add that cash to the NCAV calculation and now you have $0.58. Crescita is a net-net!

An acquirer isn’t going to get to buy all of Crescita for below $0.58 (the stock is $0.53 as I type this), but that should appeal to you as an individual investor just after a few shares. I still haven’t got to the real appeal of Crescita to Knight/Cipher/Biosyent/whomever.

Let’s say Tyler Pharmaceuticals offered to acquire Crescita for $1.00 per share tomorrow. That’s almost a 50% premium to today’s price, and other than one glorious week last year, is a price that Crescita hasn’t been since early 2017. I’m not saying a $1 offer would be accepted, but insider ownership isn’t high (~11%) and there aren’t any big blocks of shares, so there would be a chance.

At $1.00 per share, I’d be paying ~$24.6 million for all of Crescita (my shares outstanding number includes options with strike prices higher than $1, so I’m being overly conservative here).

I’d acquire $8.5 million of net cash (cash after paying all liabilities, but not including cash from the options). So my purchase price is down to $16.1 million. That would of course be paying too much for the rights to Pliaglis though, so what else do I get?

I would also get the skincare and contract manufacturing business (collectively Crescita calls these the “product sales” segment) that did almost $4.4 million in gross margin in 2019. What is the business worth? Tough to say. If you allocate all of Crescita’s R&D and SG&A expenses to the product sales business, it isn’t profitable. Sold to a larger player it probably does have value since it could get rid of most of that overhead. I still don’t know what it would be worth though. Crescita paid ~$9.7 million for its two acquisitions in the product sales segment, though the big one, INTEGA, was done with overvalued (in hindsight) stock. Could I sell this business for 1x gross margins? I think it’s possible, let’s say I could sell this and get $4.4 million. Now we’re down to a purchase price of $11.7 million. Still too much for just Pliaglis.

Hold up… wait a minute… Taro and Cantabria are still paying me royalties for their sales of Pliaglis. Recurring royalties were $4.2 million in 2018 (mostly from Taro) and were around $3 million in 2019 (again due to Taro, though the distributor overstocked so there were very few royalties in Q4 2019). It’s important to note this though:

In Q4-19, the Company was informed by Taro of certain restrictive amendments to managed care in the U.S. which may have an adverse impact on Pliaglis sales in the future.

Let’s be conservative and say Taro ends up paying me $2 million per year in royalties. I think that is low.

The Cantabria deal is weird and includes minimum guaranteed royalties, and it has just started; it’s tough to say what its peak revenues will be. Let’s say just $1.5 million. I know that is low since in 2019 the guaranteed minimum royalties were $1.7 million, but I can be low on this and still make my point.

These royalties don’t have 100% gross margins – you do have to pay someone to watch the money pile up – but they are close enough I think it’s a moot point. I’m counting on just $3.5 million of revenues from royalties that paid $4 million in 2018 when Pliaglis was being sold in fewer countries (and in Italy by a partner that was clearly phoning it in). What is a $3.5 million annual stream of cash flows worth? How about 5x? That seems fair in a world of zero interest rates and royalty companies (precious metals, DIV, Alaris, Altius, you name it) trading at much more expensive valuations, and I’m pretty sure if you gave Taro a chance to buyout Crescita’s royalty it would gladly pay $10 million (keep in mind it just paid $5.2 million to just amend the agreement slightly).

Deducting the value of my royalties at 5x, I would now be getting paid to take the rights for Pliaglis. I could have the rights to Pliaglis in 20+ countries for negative $5.8 million.

This also ascribes no value to the two drugs currently in Crescita’s pipeline (CTX-101 and CTX-102, in phase 3 and 2 respectively, the R&D completely funded by a partner). It assumes the inventory is worthless and could not be sold alongside the product sales business. It assumes that two cannabis partnerships and a cannabis research license are worthless (to be fair they probably are). It assumes no further milestone payments from Cantabria (there will be some), it assumes no collection of the $1.5 million of accounts receivable. It assumes no cash coming in from options exercised.

At $1, acquiring Crescita seems like a slam dunk for Tyler Pharmaceuticals. What if instead of Tyler Pharma, Knight Therapeutics bought Crescita? Knight has owned (still owns?) Crescita stock in the past, has loaned the company money, and has a member on the board. There’s history there and it seems reasonable that Knight could make an offer for it.

Knight has operations in several countries that Pliaglis is approved in, at the very least Canada, Mexico, and Brazil (I’m not sure all of the Latin America countries Pliaglis is approved in). Those rights alone are worth millions (somewhere between $2 million and $4 million roughly using the previously mentioned per capita range). Knight could then outlicense Pliaglis in the other countries, and if it just wanted whatever cash it could get could probably do so quickly. Or it could hold onto those rights for when it moves into other countries.

While Cipher Pharmaceuticals has a weaker balance sheet and could not utilize the international rights as well, Crescita would provide more value to Cipher than its cost. The same goes for so many other companies I won’t bother listing them all – I mention Knight because I am a shareholder and Cipher because it has a decent dermatology product line already so Pliaglis would be a good fit.

You might be thinking “fine Tyler, at $1.00 Crescita makes a great acquisition but I think you’re wrong it could be acquired for that”. You could be right, unless I bought in the last couple months, I’d probably vote no on a $1 offer. though I still think $1 is likely to get it done.

Would $1.50 be accepted? That’s almost a 200% premium and higher than the share price has been since October 2016. I think that would pass almost unanimously. At $1.50, you’re paying ~$37 million for the company. Using the same values and assumptions as above, the acquirer would be paying $6.5 million for the rights to Pliaglis. As I said, the rights to Pliaglis in just three countries is almost worth that to Knight, and you still get the rights in in 20 other countries and all of that other stuff for free.

As a Knight shareholder, I would be ecstatic if Knight paid $1.50 per share for all of Crescita, which I think suggests even $1.50 is low (but I like to believe that Knight is a savvy buyer, despite how the Grupo Biotoscana acquisition looks so far).

If Crescita is worth more than $1.50 to an acquirer, isn’t it worth a lot more than $0.53 on the open market? Yes.

How much is Crescita worth if it isn’t acquired? It is EBITDA negative for now without milestone or upfront payments, so those losses should make it worth less than its private market value. If the product sales segment doesn’t grow fast enough to be at least break even soon, I don’t know if it is worth even $4.4 million within Crescita. Crescita’s cost structure, which an acquirer could completely eliminate, has to pull down its fair value. The unproven management team could always misallocate capital, there will be options issued at low prices if it stays public, etc.

I don’t know how to balance the value of Crescita to an acquirer vs the value of Crescita as a standalone public company. If the price of Crescita stays where it is, without any action from the company (big acquisition, SIB, negative development, etc) we’re going to wake up one day to find it has been acquired by a larger pharma company for a very large premium.

When that happens, I hope you’ll vouch for my role in the deal when I argue I deserve a cut of the investment bankers’ fees.

Looking at them now, I would probably give them 6 more months to figure out, how their newly launched products do. If they do well, chances are the company is still cheap regardless. But then it might be even more attractive to buy in.

I followed them for quite a whole but gave up. I even discussed the business with the management directly before investing in them, but my feeling is the current management is not particularly interested in shareholder value. The undervaluation may only be lifted, once am activist enters the scene. At least that is possible with the large float.