I’ve written about Dream Impact Trust a few times.

On the old blog, I had a post about the old Dream Hard Assets Alternatives Trust, I want to say written in 2018 or 2019. I have doubts about the quality of the writing and the research, but the gist of it was that Dream Alternatives was likely the cheapest way to buy Toronto development land.

Then the company changed its mission and name to Dream Impact Trust. I wrote something quickly about that, along with an idea that the parent company’s incentive was to see the unit price of Dream Impact Trust increase to NAV or greater, so it could grow by issuing equity. I’ll touch on that again in a bit, because even though the idea has worked out spectacularly badly, I think it’s still accurate.

Then finally, I wrote this Twitter thread:

https://twitter.com/cdnvaluestocks/status/1562857185327034368

Not many people read that (not that many people read what I write generally, but especially that) so I might cover some of the same ground in this article. We’ll see.

Dream Impact Trust gets brought up a lot to me as it is frequently mentioned in the same breath as Dream Unlimited. They’re obviously named similarly and are highly related. Of the Dream entities, Dream Impact is most similar to Dream Unlimited (owning some income properties and a bunch of development assets), and its valuation, if you believe the company reported NAVs, is the most compelling of the Dream subsidiaries/REITs (though Dream Office is giving it a run for its money). And as seen here, Dream Unlimited and Dream Impact own a lot of the same assets.

Most of those DRM/MPCT assets are split 75/25 MPCT/DRM, and Dream Impact Trust is smaller and much more focused, so if you are very partial to an asset or assets they own together, Dream Impact gets you more exposure.

I’ve answered enough people asking for my thoughts on MPCT that I have finally given in and decided to put the thoughts here. This will be similar to my Meandering Posts on Dream Unlimited that it will be written more conversationally. I’m going to jump all over the place. I apologize in advance.

As you are reading this, I believe for the most part, if you read “Dream”, I’m referring to Dream Unlimited, either as its own company or as acting as the asset manager of Dream Impact Trust. If I write “Impact” (with a capital i) or “Dream Impact” I’m referring to Dream Impact Trust, whereas “impact” (lowercase i) refers to the idea of impact investing. I’m sure there are points I mix that up, I’m sure many sentences look weird or are ambiguous, I also apologize for that.

NAV

Dream Impact Trust is a net asset value (NAV) story right now. Similar to Dream Unlimited, I think that is going to change significantly over the next few years, but as it stands, if you are valuing Dream Impact Trust, you are valuing it on the value of its assets.

The company chooses that as its way of presenting its value:

Dream Unlimited as the parent company has told the market it thinks NAV is the number to look at, electing to receive its fees as units valued at NAV.

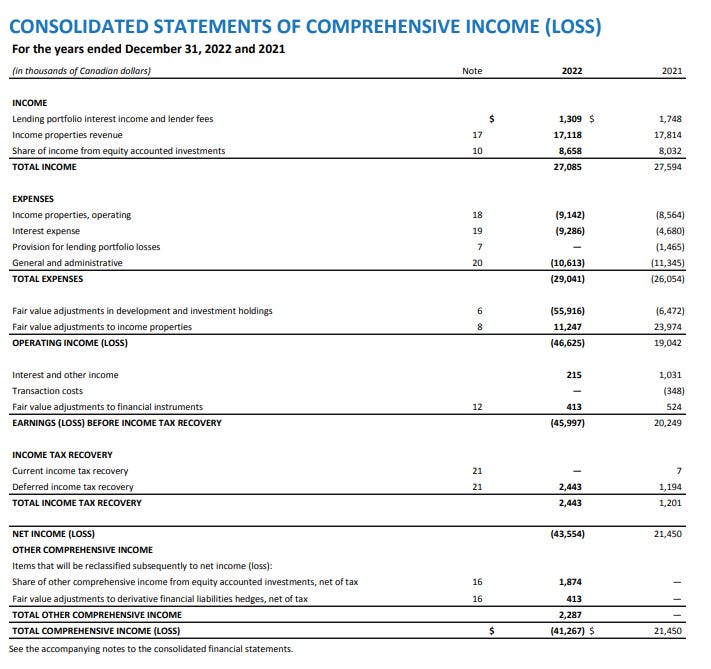

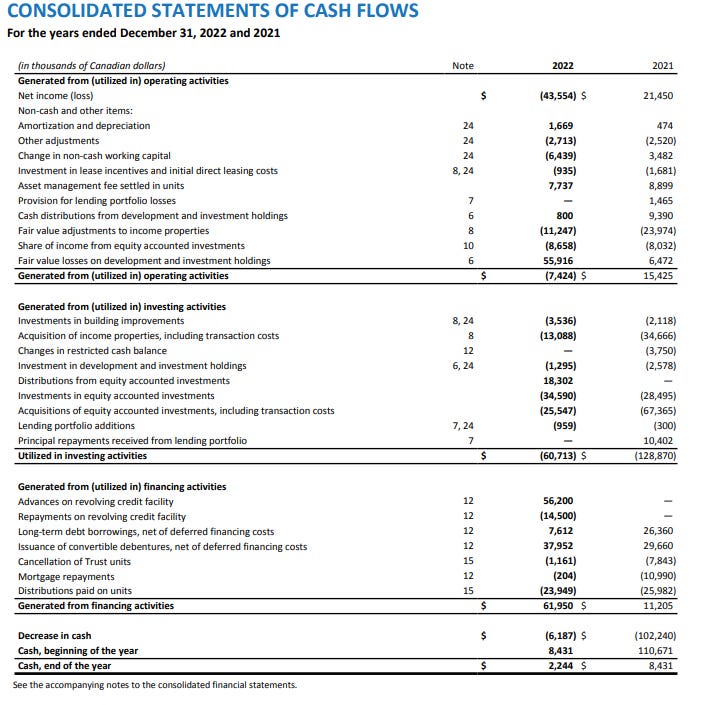

And perhaps most of all, the income statement and cash flow statement do not tell the story well*:

*By this I don’t mean that these statements look bad but the story is good, I simply mean that whatever the story is, it’s not evident from the financial statements.

The development segment is always going to make these statements noisy, but the development segment is large enough now that its swings affect the financials more than other companies.

With that said, what is NAV?

TD says $7 (down from $7.70 after the latest earnings). Dream says $8.25. Book value is something like $7.

I’ve entertained arguments that Dream Impact’s value is in excess of NAV. I fully understand arguments that NAV is lower than either of those estimates, or that Dream Impact’s true value is below NAV. TD’s target price for instance is a 35% discount to NAV (which I view as more or less arbitrary and likely derived by the target price providing the desired upside from the price at the time) with the rationale:

We believe Impact should trade at a discount to NAV owing to its external management structure, relatively high portion of developments (i.e., increased development risk), and relatively smaller trading liquidity.

I don’t disagree with that, and I’d add the high debt as another reason for a discount. Not to mention that diversified REITs (actually maybe all REITs right now?) trade at substantial discounts to NAV, and we have an environment where Dream Impact isn’t going to trade at NAV.

I don’t see that always being the case though. I do not foresee debt remaining above 60% of assets. Dream has set a target of 70% of its assets being recurring income assets, and that goal is completely in its control so there’s no reason it shouldn’t be accomplished, so that will reduce the “high portion of development”/”increased development risk”. Trading liquidity should resolve with Dream Impact becoming more attractive and increased investor interest, though Dream Unlimited’s large stake likely puts an upper limit on trading liquidity.

Debt

You could call me overly bullish on Dream Impact. I don’t think I’d even argue with you. Even I know though that this debt is hurting.

Since the end of 2021, Dream Impact’s debt has gone up by $130 million, debt-to-assets increased from 49% to almost 62%, and the rate went from 3.9% to 6.0%. Looking at that in hindsight, of course the units have done terribly and of course the distribution has been cut.

While this past quarter saw a big jump in debt again, I believe management is acknowledging the debt situation. The big jump in Q1 was refinancing two assets which have seen their values jump quite a bit (49 Ontario and Victory Silos), and for the moment, it looks like Dream Impact is holding on to some cash to preserve liquidity.

Since spending over $100 million on acquisitions in 2021 (a necessary part of the strategy shift, acquisitions that look like they’ve done well as we’ll see), the trust has held little to no cash, ending 2021 with $8 million and 2022 with just $2 million in cash. That balance is now $25 million, which could prove too low still.

On top of that, Dream Impact will need about $20 million a year to fund its developments.

Dream Impact’s covenants are for debt-to-assets to remain below 40% (Trust level), and for unitholder’s equity to remain above $375 million. We’re creeping up on the first one (35.5%). Developments finishing up will help this through a combination of assets going up and income coming in (assuming some is used to pay down debt), but it likely gets a bit closer.

There aren’t too many ways for me to spin this section positively. It’s a sticky situation.

Distribution

If one were to look at Dream Impact’s cashflow, they could believe that the distribution, recently cut from $0.40 to $0.16 annually, might still be unsafe.

To start with, there are roughly 68 million units outstanding. The DRIP participation (the only ones enrolled in the DRIP seem to be me and Dream Unlimited) is at 33%. Therefore the cash outflow each year going forward will be ~$11 million. Interest will be roughly $16 million. Cash overhead in 2022 was ~$3 million (given the asset management fees are paid in units). Dream Impact will spend maybe $1 million on lease incentives/costs, and another $2 million in building improvements (though this could obviously be deferred to preserve cash, at a cost of course).

NOI from properties, including from the equity accounted investments, is probably ~$18 million. The lending portfolio is being run off but likely brings in $1 million in earnings and the possibility of principal repayments ($5 million is listed as a current asset that could come in this year).

But in addition to those projects that are finishing and going to be held (thus contribution to recurring income), Dream Impact has quite a few projects finishing in the next few years which are being sold, which could see the return of cash.

The Las Vegas hotel is not included above, but it is another asset which could get sold for something in the next year or two, providing additional liquidity.

Higher distributions from equity accounted investments could sway this, but the new distribution amount was determined accounting for the recurring income developments finishing in the next few years, so the distribution will likely look iffy for a few years yet. I particularly could see investors not considering DRIP participation, and that the majority of overhead is paid in units, and overestimating the cash shortfall.

It’s likely to be a few lean years. The payout ratio will be high, but from what I see the current distribution should be adequate to get through to when the above projects are paying off.

Impact Vs Distribution

This is just a quick one, but given that the Trust has declared that it wants to make an impact with its assets, I view the new distribution, or an even lower one, as more consistent with the mission.

Dream Alternatives, having so many development assets, was already a strange candidate for a high distribution. But it did have a renewable energy portfolio, it did have a significant lending portfolio. It wasn’t the craziest thing to pay out a lot of its cash flow (and then some given the consistent payout ratios over 100%).

In the Dream Alternative days, it said its objectives were to:

provide investors an opportunity to invest in alternative assets

build and maintain a growth oriented portfolio

provide predictable, tax efficient cash distributions

grow and reposition the portfolio to increase cash flow, book value, and net asset value

A wide scope, but the distribution was an explicit objective.

Here is what Dream Impact Trust states as its objectives. To:

• Create positive and lasting impacts for our stakeholders through our three impact verticals: environmental sustainability and resilience, attainable and affordable housing, and inclusive communities;

• Balance the growth and stability of the portfolio, increasing cash flow, unitholders’ equity and net asset value over time;

• Leverage our access to an experienced management team and strong partnerships in order to generate attractive returns for investors;

• Provide investors with a portfolio of high-quality real estate assets, concentrated in core geographic markets.

As you can see, paying a distribution at all is no longer an objective. The objectives are now, for all intents and purposes, to do “good” and give investors an attractive return. Given the stated goal of increasing book value and NAV, I’d argue the unitholder returns objective could be accomplished through capital gains. And given the first objective is best accomplished by investing more money into more assets and more improvements, I’d say a distribution of any sort is at odds with Dream Impact Trust’s stated objectives.

If I want more affordable apartments in the world, I want buildings to be greener, and I want to create more inclusive communities, it doesn’t make sense for me to take cash and give it to you, who may or may not use it to accomplish the same goals. It makes sense for me to keep all my cash, and all my incoming cash flow, and reinvest it to meet my goals… unless, by paying my investors cash, I can sell equity of my trust to new investors, who by buying in will provide the cash I want to accomplish my goals…

If you are reading this though you are well aware that when someone invests in real estate, they really prefer to receive dividends or distributions. They want cash flow. Since the final objective is to provide investors a real estate portfolio, a distribution is par for the course. I get the current payout. Investors want yield, Dream wants investors, Dream Impact pays a yield. It makes sense.

In 2025 or 2026 the payout will dip below 100%. Then a few years down the line I suspect the payout ratio starts looking a little low to some. People start think Dream Impact could start increasing the distribution. It’s at that point that the competing goals might come into play. Dream, as the asset manager, will have to look at its potential investors and decide whether growth in the payout will attract more investors, leading to a higher unit price, which could lead to Dream Impact growing its asset base by issuing units at an attractive price. This is possible. It’s also possible that distribution growth is for some reason not seen as an avenue to a higher unit price and it makes more sense to keep the excess cash flow. That’s a question for 2026 or so.

Dream Unlimited’s Incentive

I’ve covered this, and covered it, and covered it, but I think it’s worth reiterating.

Dream Unlimited is Dream Impact Trust’s asset manager. The fees Dream Impact pays are based on the cost of the assets it owns. Hence, Dream Unlimited collects more fees as Dream Impact buys more assets (not to mention the acquisition fees and the development fees and the fees based on capital invested into assets).

Dream wants Dream Impact to grow its assets. Tying this to the distribution discussion, there’s a few ways to do that.

Lever up (check)

Reinvest cash flows (nope)

Issue equity (nope… so far)

Dream Unlimited has a similar agreement with Dream Industrial REIT, and we can see there how Dream will leverage equity markets to grow its fees.

On December 31st 2019, Dream Industrial had 153 million units outstanding, gross leasable area was 21.9 million sq.ft, and it had paid Dream Unlimited $5.2 million in base fees during the year.

Units outstanding have grown to 276 million today, while GLA has grown to 42.4 million sq.ft (and another 28 million sq.ft under management but not owned), and run rate asset management fees are now ~$14 million per year.

That growth has been made possible by Dream Industrial’s unit price spending most of that period around NAV. Some units got issued below, some above, but generally speaking the market price of Dream Industrial has allowed it to issue equity on attractive terms to grow its portfolio.

The price of Dream Impact, and before that Dream Alternatives, has made it very difficult, if not impossible, to justify issuing units to grow assets. Here is what TD has published as a P/NAV chart.

For the last eight years, the average discount to NAV was over 30%, and it spent a very brief time above that (which coincided with a big buyback/tender at the time, with more tenders and their price disclosed to the market). The asset manager would have a very hard time saying “our units are cheap, but we are going to sell them as very expensive paper to buy some more assets”.

It seems apparent that Dream sees assets worth buying, given how many acquisitions Dream Impact has made, but the price of units being what it is is what has led to debt rising like it has. On the one hand people see the third party management of Impact as a negative (remember TD’s justification for a discount to NAV. On the other though, Dream has proven to be if anything overly fair to Dream Impact unitholders.

It has elected to receive its fees as units to conserve Impact’s cash, but not only as units, but as units valued at NAV. Since electing to do so, Dream has received half as many units, or fewer, as it could have (other managers have certainly done the same thing but used market price).

It has steadfastly refused to issue units at a large discount to NAV. Other managers have definitely done so, and it can always be “justified” by saying “while it hurts to issue equity at this price, we are always looking at the return on assets and these assets will return enough to make it worthwhile”.

Dream Impact has bought back lots of units over the years. Given the price of units and the debt situation, that looks silly in hindsight, but it’s evident the rationale was to benefit unitholders even if it didn’t work out that way (and even if there was always an argument it was the wrong move).

Yes, the third party management is a negative. Dream Impact has higher G&A than REITs that are a fair bit larger than it. Dream Impact owns ~$760 million in assets, with G&A of roughly $11 million (which would be even higher if the management fees were being paid in cash). A few examples to illustrate the high overhead:

Boardwalk REIT has roughly $7 billion in assets, almost 10x higher than Impact’s, with administration costs of ~$33 million, or 3x Impact’s.

Nexus REIT has ~$2 billion in assets compared to $6.5 million in overhead in 2022.

Plaza REIT has $1.2 billion in assets vs administrative expenses of $8 million.

While none of those are great head-to-head comparisons, and I’m not arguing that Dream’s management is or isn’t worth the price paid, you can see how given the high cost of the Trust’s management, a discount to NAV is a valid adjustment to make to your personal valuation of Dream Impact.

A discount makes sense - capitalize the excess costs in the structure, subtract that off NAV or book value, there’s your valuation. But even if you question the costs, I don’t think you can question the parent also wants unitholders to do well (for both their sake and its own).

Dream Unlimited wants the price of Dream Impact to be higher. Much higher. If units were $7, compared to book value of $7.14 and a NAV of $8.25, I think management could issue units to acquire some asset with a straight face. It’s been done before, at worse discounts. It could work out from both a unitholder’s perspective and Dream’s by acquiring the right assets.

Dream wants to grow Impact and would love to issue units as currency to do it. Since that is the parent’s incentive, I think unitholders can rest assured that the parent’s goals are the same as their own, if for different reasons.

Takeunder

The other thing Dream wants is Impact to be successful. I firmly believe that Michael Cooper and Dream’s management have shifted, or more accurately vocalized, their commitment to impact for altruistic purposes. I think they want to do good.

I also believe they thought it would be better received by the market.

Dream Unlimited has hung its hat on this concept, not only through Dream Impact, but through a private Impact Fund and through a focus in its own projects.

Dream has a fair bit riding on impact investments showing good returns for investors.

I have seen it proposed that Dream Impact could be privatized by the parent, in a BAM/BPY style takeunder. I get someone thinking about that risk. I don’t think it plays here. Personally, as a fan of the assets Dream Impact owns, I would love if Dream Unlimited could increase its ownership of them by taking out Dream Impact at the current market price. I’d love if Dream Unlimited owned 100% of Zibi, Impact’s portion of the Toronto multifamily portfolio, Impact’s 23.3% of Brightwater, and so on.

But as valuable as it would be to acquire these assets at such a discount, the harm to the burgeoning asset management would far outweigh any benefit.

If Dream were to raise more impact funds in the future, which I fully expect and hope for, after taking under Dream Impact, they would have to answer questions about why investors in Dream’s public impact vehicle did so poorly. Why should these new private fund investors expect to earn whatever return Dream is pitching when Dream Impact investors earned a negative return with a similar strategy and then had their equity taken from them at a cheap price? Why would potential new investors trust Dream in that scenario?

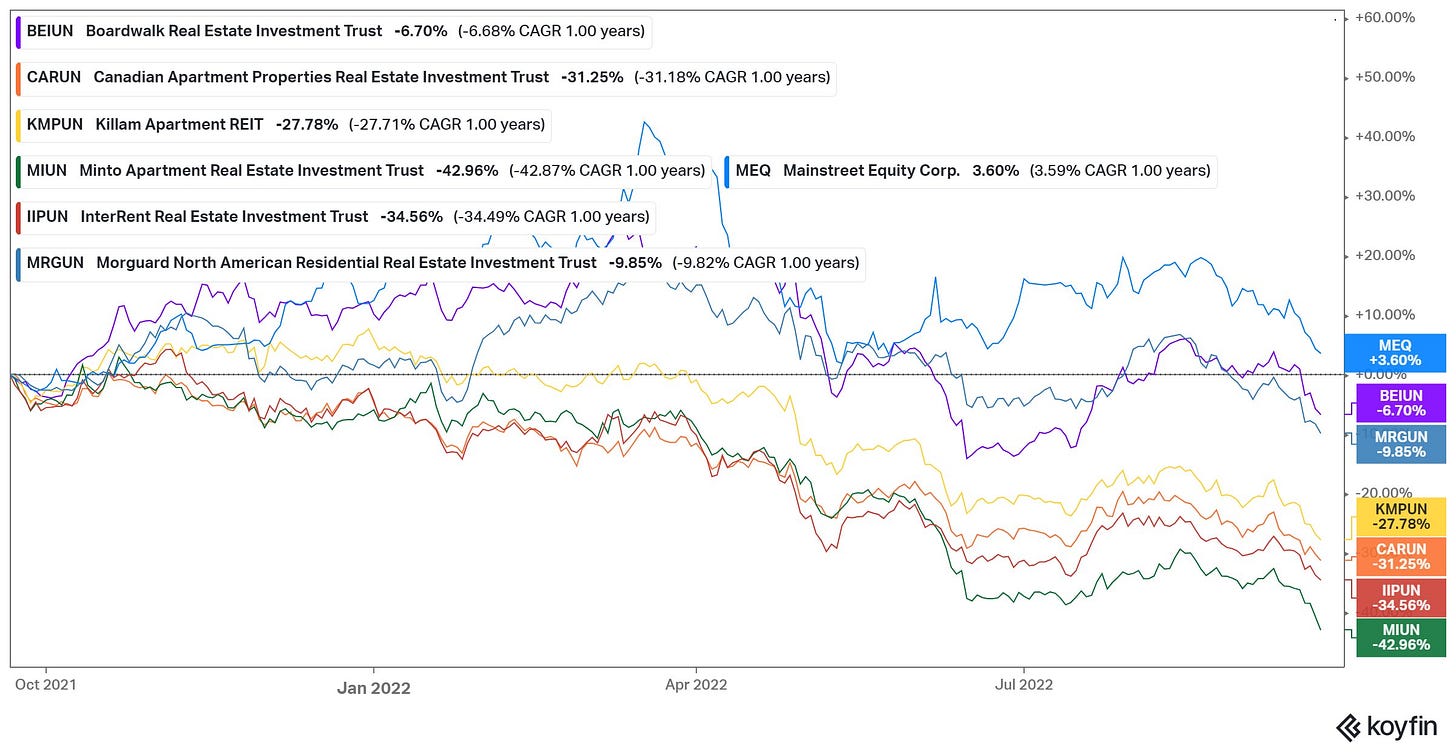

A similar story holds true in the scenario where Dream Impact trades like crap, as it’s doing now, but I believe it is easier (not easy) to spin the story to sophisticated investors that Dream Impact’s market cap isn’t indicative of its value, look at NAV, look at the growing cash flow, etc. Private REITs have been doing it for over a year now. These charts are out of date, they were part of a draft on a post I gave up on last year, but look at what Skyline Apartment REIT was claiming for returns last August:

Versus what apartment REITs had performed at the time:

I could in theory have updated those charts, but I had those accessible and the point remains the same. There’s a precedent for an asset manager raising funds to claim that the valuations of public market comparables are not indicative of the performance of a private fund.

Brookfield, when it took Brookfield Property Partners private at a pittance compared to what they were saying NAV was, had hundreds of billions of dollars in AUM. They had been a leading alternative asset manager for years. They had a long track record of successful outcomes for investors. They could absorb the reputational hit they took from how BPY both performed and ended. Dream just started Dream Equity Partners, the arm that manages private funds, three years ago. Dream has been managing public REITs for quite a while to add to the track record, but does the successful exit of Dream Global and the continued success of Dream Industrial hold enough weight to outshine a Dream Impact takeunder? I doubt it.

A takeunder is still a risk, the company could view the risk-reward differently than I do, or Dream may have more confidence in its ability to fundraise than I as an outsider understand. To me, everything points to Dream needing Dream Impact’s unit price to go up. A healthy valuation could lead Impact to grow more, generating more fees, plus allowing Dream to collect fees in cash vs units once again (this is a function of Impact’s cash flow, which becomes less of an issue if it can grow with equity versus debt). And Dream Impact being a success makes future fundraising much easier.

Units Outstanding

This is worth noting, though there isn’t much to say about it. Dream Impact’s unit outstanding number is growing, and will continue to grow quite a bit.

First is the DRIP. As mentioned above, DRIP participation is at 33%. That likely slowly increases (as all the units that are issued from reinvested distributions will logically also participate in the DRIP), but just from that 33%, we can see the impact (no pun intended) on units outstanding.

The $0.16 distribution is an annual outflow of a little under $11 million. 33% participation in the DRIP means ~$3.6 million of units issued this year. At a $3 unit price (here’s hoping for unitholders’ sake that looks low in a few months), that is 1.2 million units, or 1.8% of today’s ~68 million units outstanding.

In addition, Dream Unlimited is receiving its fees as units. The past two quarters have seen ~390,000 units and ~450,000 units issued to resolve these fees. For easy math, let’s say a decent run-rate average is 425,000 units quarterly.

At that pace, each year will see 1.7 million units issued to Dream, another 2.5% of units outstanding.

Without accounting for the gradual increase as Dream DRIPs its new units, and I DRIP my new units (me being the only one besides Dream enrolled in the DRIP), we’re looking at units outstanding increasing over 4% annually.

Again, as long as I’m noting my thoughts on Dream Impact, that is one of my thoughts. I don’t think there’s anything to do with that information, but some people are going to look at Dream Impact for the first time, and I hope they read this and are at least made aware of the units outstanding creep up. Maybe they’ll do something with the info. I’m not really. It’s a part of investing in the assets. Since I’m DRIPping my units, and I like Dream increasing its ownership, the dilution is more or less neutral to me, though others will view it differently.

Land Prices vs MPCT

Source: Bullpen and Batory Research

Land prices are down. As Brandon Donnelly has noted:

Development charges (here in Toronto) are set to increase by 49%

Hard costs have seen double digit increases (with some inputs increasing by 30-40%)

Inclusionary zoning is on the horizon and will add another additional cost to new housing

And rising interest rates are both increasing project costs (higher interest charges) and slowing the macro economy

Let’s quickly imagine a world where Dream Impact is just a collection of assets, not an operating company/trust/fund. It is put up for sale for its current enterprise value of ($177 million market cap - $25 million cash + $470 million of debt including project-level debt) $620 million.

For $620 million, you are buying:

$10 million-ish of NOI and 800,000 sq.ft from a commercial real estate portfolio that looks like this:

A multifamily portfolio that is going to do ~$6 million in NOI this year. At Impact’s share this is 600 units. These apartments have performed very well.

You get these projects, which Impact claims are going to be worth $500 million, but the market is obviously skeptical. Regardless, they are another 843 brand new apartments and 63,000 sq.ft of commercial real estate at Impact’s share.

A ~$16 million lending portfolio.

This collection of land and development assets:

It’s not too hard to arrive at a decent half-assed value for some of these.

Office REITs are trading at like 8% cap rates (quickly checked a few analyst reports, forgive this number being off). $10 million NOI at 8% is a value of $125 million, which also implies a value of ~$156 per sq.ft. That seems reasonable to me.

A 5% cap rate for the multifamily would be $120 million, which is also $200,000 per door.

Haircut the lending portfolio 50%. $8 million

$300,000 per apartment and $250 per sq.ft for the commercial space (those values are pretty close to the hard costs according to Altus) being completed in the next 3 years is ~$270 million.

If you agree with the above values, or just think they’re not horrifically wrong, you are paying just $97 million for the development assets (not including the projects finishing in the next three years).

Forma East has just started the foundation work and is largely pre-sold. It’s 147,500 sq.ft at Impact’s share. (416)

Impact’s stake in Brightwater, a great asset (Michael Cooper has sang its praises several times in the past), is 882,000 sq.ft. This includes over 150,000 sq.ft that are under construction and and completing by 2025. (905)

144,000 sq.ft at the to be completed in 2024 Ivy Condos. (416)

22,000 sq.ft at the sold-out, under construction Queen Central condos. (416)

Dream Impact’s portion of Quayside is 425,000 sq.ft. (416)

WDL Block 20 (206,000), Forma West (277,000), and Victory Silos (487,500) is another 970,000 sq.ft in the 416

Scarborough Junction is almost 2.5 million sq.ft.

Almost 1.6 million sq.ft in future blocks at Zibi

100 Steeles and 49 Ontario are already accounted for under the recurring income assets, but both are being rezoned for a lot more density. 49 Ontario’s value in particular is easy to point imagine given it was just refinanced for $80 million.

Compare the square footage I listed with the land prices (which admittedly are from Q3 2022 but roll with me for a second) at the top of this section.

313,000 sq.ft are under construction in the 416. At the zoning approved valuation of $137, that’s $43 million. Valuing Quayside, WDL Block 20, Forma West, and Victory Silos at just $100/sq.ft (lower than pre-application and zoning submitted values) they are worth $140 million. Valuing all of the other projects (almost 5 million sq.ft) at even $30/sq.ft, would mean a value of $150 million.

You’re getting at least $233 million of high value development land for $97 million and I think I was very conservative with everything here. This says nothing for the over 1 million additional sq.ft at 49 Ontario and 100 Steeles. There’s no way pre-sold under construction projects are worth the same as projects with no presales or construction done but have their zoning approved. Those projects I said are worth $100/sq.ft are worth way more than that.

Dream Impact doesn’t come without costs though. The excess overhead reduces value a little bit. The dilution hurts it a little bit. The debt risk has to be accounted for. There’s also value to having access to the Dream platform. There’s upside unaccounted for. I’ve laid out one way to look at things, I’ll leave it to you to determine what you think these things are worth.

Multifamily Portfolio

This will just be a quick section too, as it won’t take long. Look at this again:

My point here is simply that Dream Impact’s multifamily portfolio has performed very well. I think any REIT would be envious of these numbers. I know everybody is getting big jumps in rents, but Impact increased occupied monthly rent by 10.4% while increasing occupancy almost 17% and having ~25% of its apartments deemed affordable. Most of the apartment REITs haven’t reported Q1 results, but I expect we’ll see that 10% rental growth on occupied apartments, with increased occupancy will prove to be one of the better results.

Who knows how much more juice there is to squeeze - does occupancy settle around 95%? 97%? - but I don’t think anyone can be unhappy with the assets.

MPCT now vs MPCT in 5 years

I touched on this, but I’ll reiterate it here. Assuming that Impact survives to 2026, it is going to look substantially different. Right now, NOI is weighted ~63%/37% commercial to residential. Assets are weighted 58%/42% recurring income to development. We all see how commercial real estate is valued in the market, and we know that development projects are not being valued like they are privately. Dream Impact is a perfect storm of what the public investor doesn’t want right now.

In 2026 though, that should shift. Dream Impact is adding 843 apartments, a 140% increase over what it owns now. Plus all of those will be brand new. It is going to add just 63,000 sq.ft of commercial space, increasing its commercial GLA by just 8%. 100 Steeles and 49 Ontario will likely switch to development projects from commercial properties. At that point, Dream Impact, to the extent it looks like a REIT at all, is going to resemble a residential REIT much more than it does a commercial REIT. Impact hitting its goal of assets being 70%/30% recurring income to development will go a long way towards Impact looking like a REIT with a development pipeline than a developer with a few rental properties.

Both those shifts should help the valuation. Dream Impact has to look like something, and it will help if that something is more like a multifamily REIT.

Dream has put forth the goal/expectation that in 2026 Impact will go from ~$16 million in NOI to $40 million.

At one time I thought you could do a simple NOI - interest - G&A = FFO calculation to get to a FFO multiple for Impact in 2026. I now see the error of my ways; that NOI number includes NOI from equity accounted investments, and those equity accounted investments have their own interest expenses. Those interest expenses will be much harder to forecast (Impact’s company level interest would be hard to forecast as is), so I’m no longer confident in applying a future FFO multiple to Dream Impact.

I expect one could do it. I’m just not going to.

Conclusion

Dream Impact Trust owns a collection of commercial properties that both produce decent cashflow now and have lots of development upside (just at 100 Steeles and 49 Ontario the potential is massive). It owns an assortment of Toronto and Ottawa apartments that are performing very well. And finally it owns a collection of irreplaceable development assets in Toronto.

To the best of my knowledge, Dream Impact represents, if not the best, one of the best Toronto land packages out there. Certainly it is the best way for you or I to own a piece of the Toronto waterfront.

It has its warts. The overhead is a bit higher than you’d like. It is very levered right now and cash flow will be tight for a few years.

If you simply look at the assets Dream Impact Trust owns, I think it’s undeniable that they are available vie MPCT.UN at an enterprise value well below what you could ever hope to pay privately. I’ll leave it up to you to decide how much value you ascribe to the assets and how much of a discount to apply due to the aforementioned warts. I personally think Dream Impact Trust presents a very attractive ownership opportunity at these prices.

I think Dream Impact has failed and should be significantly restructured or privatized by DRM. Issues:

1) Impact concept is too vague it can feel like a label attached after-the-fact to something that was going to happen anyway, like “100% Gluten-Free construction materials used here!” A single mandate as as Affordable Hosing or Carbon Reduction or Social Inclusion could have retail investor appeal. MPCT has some of each of those, but the “impact” of key development projects is “TBD”. What is the social benefit of the Forma condos? Are they inclusive? Are they affordable? Maybe they can promote community wellness by adding a vaginal steam room to the spa? Victory Silos, 49 Ontario, “Berkeley Properties”, and 100 Steeles are all extremely attractive developments with TBD impact.

2) Undercapitalized. Dream has put extremely attractive development sites into MPCT, but MPCT's stretched balance sheet cannot support construction. MPCT will have to share the value creation with financially stronger third party partners.

3) Overhead is too high and fee compensation is opaque. I believe MPCT deserves to trade at a substantial discount unless/until it has a new management contract with DRM with a low base fee and then incentives for value realization (like the DIR contract).

4) Segment reporting obscures understanding. The “Recurring Income” segment includes projects like 49 Ontario and 100 Steeles where all the value is really in future development. The “Development & Investment Holdings” segment includes projects that will provide future recurring income.

It might be simplest if DRM privatizes MPCT and then launches a more focused Impact vehicle in 2-3 years when some of these projects have been completed.

Thanks for the article Tyler, always appreciate your content on the Dream entities. For the line below, do you have a sense on how much additional debt would be taken on to complete these projects? Hard to tell based on the expected occupancy dates. Think the debt amount in the $620M EV may just be costs incurred to date.

$300,000 per apartment and $250 per sq.ft for the commercial space (those values are pretty close to the hard costs according to Altus) being completed in the next 3 years is ~$270 million.