This is one of the few posts I can remember exactly when I wrote it, and it’s because the date is so apparent from the stock chart:

Okay I actually don’t know the exact date, but I know it was sometime around the end of May, because the stock jumped a lot the date I published the post below. While the stock was ~$5 when I wrote this, and when I bought it, I came to the conclusion that the company was worth much more than that, so I don’t think shares trading at $6 now invalidates what I wrote.

Nor do I think the value has changed too, too much. The value of Madison Pacific’s industrial real estate likely hasn’t changed much - if you look at the chart of Granite REIT and Dream Industrial REIT you’ll find them both at roughly the same price as May 2021. I know interest rates are up essentially infinity percent since then, but the cap rates of industrial real estate have held up (or down rather) remarkably well. It’s Madison Pacific’s large residential developments that are more questionable.

In keeping with the theme of these archives posts - as well as the simple fact that I’m not doing much investment research, or active investing generally, these days - I have not gone looking to see if progress has been made on the developments, or the CRA tax case. I think this post holds up very well to time though, and would present a solid starting point to someone wanting to research Madison Pacific on their own.

Madison Pacific Properties… another on a long list of companies that I have been asked about in the past and that I never got around to really looking at – or liking – until, well, now.

I was never really introduced to the company. A couple years ago, I don’t know when, I was asked “do you have any thoughts on Madison Pacific?”. If I knew anything at all about the company at that point (I’m not sure I did), I would have quickly looked at something that showed where its properties were, looked quickly at the price to book value, then probably dismissed it as “not for me”. And I don’t regret that stance. Believe it or not, people seem to care what I think about companies, so I get asked about a lot of them. I am forced to resort to quick opinions like that often.*

*What I’ve come to do now actually is, in my first reply, unless I’m intimately familiar with a company, ask the inquirer to give me their thoughts on it first. This has so far proven easier for me, as it gives me a start to work off when I take a superficial look at the company, but I think it’s also insightful for the questioner as well, independent of my thoughts. I don’t think people practice so called “elevator pitches” enough.

The problem with that is, I miss things. If someone had said to me “hey Tyler, it’s not just Vancouver real estate at a discount to book value, you have to look closer”, maybe I would have listened and seen what I see now. But no one did, and the value wasn’t obvious from a first read through the financials, so here I am buying 50% higher than I should have. C’est la vie.

The story is actually pretty simple. Madison owns an impressive, if somewhat small, collection of industrial properties in BC. If Madison’s industrial portfolio were marketed privately, it would garner a lot of attention. Take a look at CBRE’s latest Vancouver industrial market report:

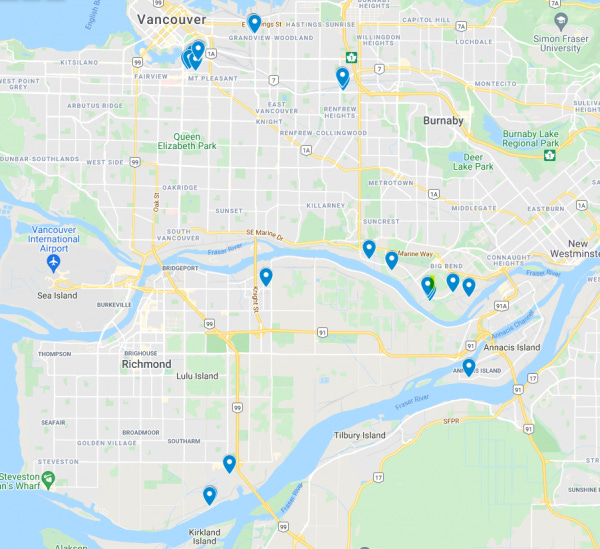

Madison owns 1.2 million square feet in BC. While it of course isn’t all worth the roughly $400/sq.ft that Colliers and CBRE are reporting (Madison owns some small properties that don’t fit the highly demanded property mould), but take a look at this map of Madison Pacific’s industrial properties:

There are also properties in Kelowna and Abbotsford/Langley that aren’t pictured

That is over 1 million square feet, and there is a not insignificant amount of excess land or properties that could be redeveloped into higher value uses.

Madison also owns 2 small office properties, essentially fully leased, in Vancouver, some BC retail properties, 50% of a Vancouver apartment building, and some more industrial buildings in Alberta.

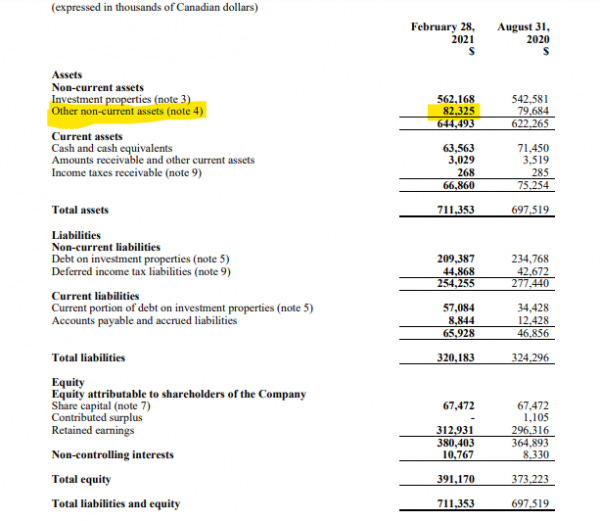

$562 million of Madison’s $711 million of assets is tied to these investment properties, and if you think about how hot the BC industrial market is, think about the excess land, you can be pretty confident in the valuation of the investment properties. There probably is some upside, but at the very least the value is correct.

Madison Pacific is trading in the $4.50 to $5.00 range (before posting it has broken the $5 mark but not by much) while book value is $6.34. And if that was all there was to the story, it would be interesting, but you know lots of real estate stocks trading below their NAV or book value.

No, the real value comes from this line on the balance sheet:

While the line makes up a much smaller proportion of the company’s balance sheet, it’s also more mispriced.

That line contains three assets.

$17.3 million deposited with the CRA while the company fights a tax reassessment.

~$17.9 million for its 33.85% stake in Grant Street Properties (GSP).

50% of two redevelopment projects marked at $46.6 million.

The CRA deposit? Well I’m not a tax lawyer so I don’t know how to evaluate it. I didn’t look into it either. In my experience, the CRA can take a long time getting to these (though there were hearing in 2020 regarding the case) and most likely Madison loses its case and this money is gone.*

*As Devin states in the comments, and another reader emailed me, the $17.3 million isn’t the extent of the company’s liability. If Madison loses its case, which based on some discussions I’ve had seems likely, the company will both lose this deposit AND have to pay out more cash to settle the case. I think the point still stands that it doesn’t greatly alter the thesis, but it’s important to note and could/probably does knock off $0.60 off any NAV estimate.

The $17.9 million investment in GSP? There are a couple ways to value it, but no matter how you do it, you get somewhere in that neighbourhood. You can reasonably make an argument it’s worth more, but the difference isn’t material.

What is really important here is the development land.

First there’s 2800 Barnet. This is a Rona location in Coquitlam, sitting on 4.5 acres of land. In 2018 Madison Pacific sold 50% of the property to Polygon Homes. The JV then submitted a proposal to build 1181 residential units (mostly condos) in three mixed use towers, on the property, along with ~145,000 sq.ft of commercial space.

For some reason, BC development land prices are not nearly as publicized/tracked as Toronto’s, so it’s tougher to find what ~1.3 million buildable square feet (taking a wild guess at ~1000 sq.ft/residential unit) in Coquitlam is worth, but this 2018 Colliers report suggests that $100+ per buildable sq.ft is on the low end, as does this one.

Those values are from 2018, and I’m pretty sure values have only gone up, but let’s run with them for now.

At $100/buildable, Madison’s 50% interest in this project would be worth $65 million. At $150 it’s almost $100 million. Could it be worth more than that? Sure it could. If the application gets approved, why wouldn’t it be? I won’t speculate on the land being worth more than $150/buildable, because I don’t need to. I think you can see how this affects the net asset value of Madison Pacific. Its two redevelopment properties are held on the balance sheet at $46.6 million, and the smaller of the two can reasonably be valued at $65 million alone, or $100 million, or more.

The second development project is 1389 acres located in Mission, BC.

“Silverdale will eventually have about 40,000 people,” said Stacey Crawford, head of Mission’s economic development office. “It will double Mission’s population. It is like building an entirely new city.”

Silverdale: District will need almost 12,400 dwelling units over the next two decades in order to accommodate its projected population growth. Based on development trends, and land capacity in other parts of the District, outside of Silverdale, Mission can accommodate approximately 6,371 dwelling units, comprised of 3,141 single detached homes, 1,592 townhouses, and 1,638 apartments.

What is the absolute minimum you can say the Silverdale stake is worth? I’d argue that it would be the price Madison paid for the last large chunk of the land, and the costs put into the Silverdale LP are about as low as a bear could reasonably estimate. I think the land is worth more, but I expect even the most bearish people would think the low price Madison paid 3 years ago is a minimum, and it should be reasonable to assume that any cash invested into the LP has at least held its value.

In December 2017 the LP purchased its final 459 acres for $64,300 per acre. Since that purchase Madison has put $11.25 million into the LP, but that money was also used to purchase the final few acres of land.

Let’s say the 1389 acres purchased prior to 2018 are worth $64,300 per acre. Madison’s 50% would be worth $43.7 million. Add that value to the $11.25 million of cash put into the LP, and we get a minimum value of ~$55 million. The land is worth more, my point is just that the minimum plausible value is well over its balance sheet mark.

I’ve argued before that Dream Unlimited’s land ought to be worth at least $100,000 per acre, an opinion nobody has ever really called me out on (if they have disagreed, they did it privately without telling me) and one supported by transactions. Now a lot of that land is serviced, whereas most of the Silverdale land is raw right now (I think), but… I’ll be frank… Dream’s land is in Alberta and Saskatchewan. That doesn’t mean it’s not great to own (it is), that doesn’t mean it’s not worth a lot (it is), it’s simply an acknowledgement that there is more demand for land in Mission.

What if the Silverdale land is worth $100,000/acre? That still seems way too low, but then the 50% would be worth $69.5 million.

Much more likely to get us an accurate value is looking at recent Silverdale land sales. A reader was kind enough to compile a list of such sales and share the info with me…

These are all publicly easy to find, but would haver taken me a lot longer. Thanks ______!

The highlighted column is what we are interested in. Not a single sale below $160,000/acre. Several sales over $400,000/acre.

Having Polygon Homes as your partner on your land and controlling such a large land package are both reasons why Madison’s land should be on the higher end of any valuation range. The first 38 acres have been approved for 161 townhouses and 65 single family lots, construction has started, and sales for this first phase are likely beginning shortly – another point in favour of the land package being worth more than average.*

*One point against the argument this land is worth more than average is large packages will have more land devoted to parks/greenspaces/etc, and is seen here. Of the 38 acres, a little under 20 acres is protected forest. While the ~5.9 homes/acre is not too low, it’s possible that when you buy a 2 acre parcel you get to build on the whole thing and get “more” out of it. In 1400 acres you’ll have parks, roads, hilly areas you can’t build on, etc. I don’t overlook this fact, I just think the pros of the large land package outweigh it.

I think you can easily argue that this Silverdale land is worth at least $300,000/acre ($208 million to Madison). I think the land is probably worth more than that too, but this is all just additional upside.

IFRS says that the book value of Madison Pacific Properties is $6.34 per share, but there are two very valuable assets that accounting conventions mark wrong. Just to emphasize how big of a difference properly valuing the development properties makes, if 2800 Barnet is worth $150/buildable sq.ft and Silverdale is worth $300,000/acre, the NAV of Madison Pacific is 67% higher than book value, at $10.81.

NAV could be higher, but maybe more importantly, NAV can go up, both in reality and in the market’s eyes, if there are approvals at either project or as Silverdale construction and pre-sales progress.

Why The Opportunity Exists

Of course there are all the usual factors – small cap, low liquidity, no analyst coverage, etc. That’s not novel enough to discuss though.

Normally when these land development companies are cheap, I’m not too surprised. I know Melcor is valued well below book value because so much of its book value is made up by Alberta real estate and land. I know Dream Unlimited is cheap because its land is in Alberta and Saskatchewan, and it has exposure to a Toronto market viewed as risky or overheated. I know TWC is cheap (no longer against IFRS book value but it’s probably still cheap vs the sum of the parts) because every town fights keep their golf courses and there’s a risk the town wins concessions which lower the value of the land.

With Madison Pacific I think the reason is a bit different.

When I was asked about Madison Pacific a few years ago, I wasn’t told “they have an interesting land play too”. When I looked (quickly) at the financials, I didn’t notice the land.

I don’t remember when I looked at Madison Pacific exactly. My guess would be sometime between 2017 and 2019. And honestly, I probably just looked quick at a P/B chart, looked maybe at the portfolio page on the website to see where the properties were, and that was probably it. So even if everything was properly disclosed and easy to see, I may have missed it.

But the Silverdale lands weren’t well disclosed until pretty recently.

Polygon bought into the Silverdale package in early 2017. Prior to that Madison Pacific owned a good chunk of land in Silverdale, but it was working with a developer, Genstar, who threw in the towel on the project. When that happened, Madison decided to try to sell its land together with Genstar’s as a package. Whatever ended up changing I don’t know, but when Polygon bought the Genstar land, Madison decided to partner with Polygon vs selling to Polygon.

So before January 2017, Madison owned 460 acres in Mission, BC, in a future development with all the same attractive characteristics I described above. What was in the 2016 AIF you ask?

That’s right, the only mention of Silverdale is mentioning that something called Silverdale Hills LP exists. What is the Silverdale Hills LP? The AIF doesn’t say, it’s never mentioned again in the document.

2017’s AIF is better.

If I had read this AIF (not sure I did), I at least would have stood a chance of recognizing Madison Pacific owned the land, and seeing the value. But if I looked just at the financial statements, this is what I would have seen of Silverdale (from the 2017 annual report):

If I just saw that, would I think Silverdale is a significant asset that is worth multiples of its value on the balance sheet? No.

These are all arbitrary numbers of course, but this is the way I sort of think about this. If there are 1000 investors in a room:

Maybe only 400 can invest in a company as small as Madison Pacific

Maybe only 300 of those are interested in real estate

Maybe only 200 of those will invest in a dual share class company

Maybe 50 of those can deal with the low liquidity

Of those 50 people, how many are going to even be aware of Madison Pacific? Then how many people are going to ever research the company? And then finally, how many people are going to go far enough with their research to figure out what the Silverdale Hills LP is, what it owns, and how valuable it is?

I think it is an awfully small number. The pool of potential MPC shareholders is miniscule to begin with, and then the lack of/inconsistent disclosure has hid the value from a lot of those potential investors. There are few eyeballs on the company, and only astute eyeballs (who went to the AIF) that have looked at the company since November 27th, 2017 had a chance at knowing it owned this land. There are simply not many people that know the complete Madison Pacific story.

I know, because I am one of those 50 people who could invest in Madison Pacific Properties. I was one of the fewer people who was aware Madison Pacific Properties existed. I was one of the fewer people who took at least a glance at the company. And I didn’t see the whole story.

Conclusion

Madison Pacific Properties trades at a substantial discount to book value – there should be enough liquidity for most people reading this to buy a full position at $5-$5.50, which is 80%-85% of book value. Most of that book value is made up by BC industrial properties. Industrial real estate is in favour right now (take a look at the valuations of industrial REITs), and the BC market, particularly around Vancouver, is one of the hottest out there. You’d think that buying a lot of BC industrial real estate with redevelopment potential (I didn’t even touch on it but Madison Pacific has several industrial and retail properties which could also be worth a lot more if redeveloped) at 75% of book value would be enough of a pitch. Madison is the purest public play on Greater Vancouver Area industrial real estate out there, which I don’t think a lot of people know, and could warrant a premium to book value from that fact alone.

Then you add on 2800 Barnet where you’re going to build 1200 residential units, and Silverdale where you’re going to build 7000 homes (at 100%). If you use any reasonable value for those assets, you can see book value is understated significantly.

If Madison Pacific chose to liquidate, I’m positive that shareholders would receive $10+ more for their shares.

But the company also has an excellent asset base to create value for a long time. Between developing 2800 Barnet, developing Silverdale (though the JV is probably nearly self funding at this point) , and capitalizing on the redevelopment potential of some of its investment properties – a retail property on 3rd Ave and Fir St, and 3 large, contiguous Rupert Square properties (located between Burnaby and Vancouver on the property map above) offer particularly high potential – Madison Pacific can reinvest all of its cash flow (and then some) into the assets at high rates of return to continue building value for shareholders.

Madison Pacific isn’t without its risks. There are two classes of shares, and control of the company is held by a small group of players. There are related party transactions – for instance, while Madison owns 33.85% of GSP, part of the other 66.15% is held by a related party. In many ways it’s a public company run like a private company. There’s the low liquidity and small market cap. I can understand someone pegging the value of Madison Pacific below NAV for those reasons. But if NAV is something like $12 to $15, a discount to NAV still suggests a fair price of what, $10? $12?

Buying at anything close to $5 seems like a good bet to me.

Hi Tyler, thank you for reposting this.

Did you write up Crescita in the past? If so would you consider reposting that one? Thanks

Great write up - I’m putting it on my watch/buy list if it comes back a bit - what do you think of this ? https://www.bnnbloomberg.ca/canada-likely-sitting-on-the-largest-housing-bubble-of-all-time-strategist-1.1962134