In the interest of providing you, the valued subscriber, some value other than me writing new material, I’ve decided to post a few of the posts from the old blog on this Substack. Here’s the first.

I’m not going to update any numbers in this, as I think that takes away the gist of the post. What I will say is that Morguard Residential reported 2022 FFO at $1.47/unit. It has finally shown some growth. Properties are performing well. Best I can tell, I wrote this in mid to late 2021? The unit price at the time was in a range of about $16 to roughly $18 at the end of 2021. Today the price is ~$17. Valuations across the sector have changed, and as I said, the REIT has grown since this was posted, but I think given the REIT’s unit price now, this post should still help provide a framework for how I think about MRG.UN. Update a few numbers, think critically about what has changed, and I think this post could be valuable and/or entertaining to you.

Full disclosure, I have never looked at Morguard North American Residential REIT entirely because of the name:

It’s way too long. Four words prior to ‘REIT’ is completely unacceptable – remember that REIT itself is short for Real Estate Investment Trust . And they’re not short words for those typing it out

Morguard doesn’t have another residential REIT, so the ‘North American’ qualifier is pointless.

The fact that it’s not called Morguard Residential REIT is ridiculous.

That said, while I was thinking about Morguard REIT, a reader messaged me asking about MRG (I’ll be using MRG to refer to the REIT from here on out, for obvious reasons). I didn’t go on a childish rant about the name; I reserve that for here, where I make the rules, but I listened as he told me I was possibly missing out.

The thesis is actually remarkably simple, and in the interest of your time and mine I’m not going to pad this post with too much extraneous verbiage like I normally do most of the time.

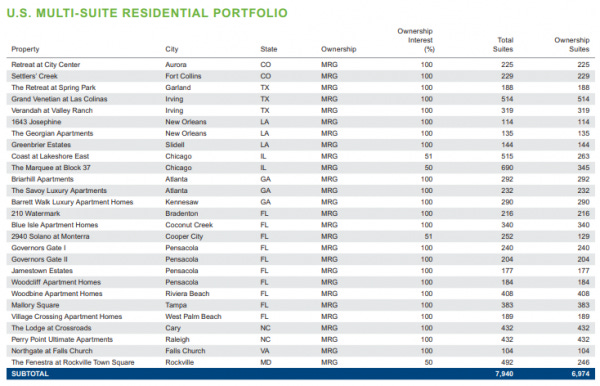

MRG owns over 12,000 apartment units – ~7000 in the US and 5000 in the GTA, Kitchener, and Ottawa (and one building in Edmonton).

Let’s focus on the US properties to start.

Much like BSR REIT, these are mostly garden style apartments in the US Sunbelt. It’s a decent quality portfolio: the buildings are relatively young (average 21 years old), the average monthly rent is $1490 and is up 4.4% over last year, and the occupancy is over 96%.

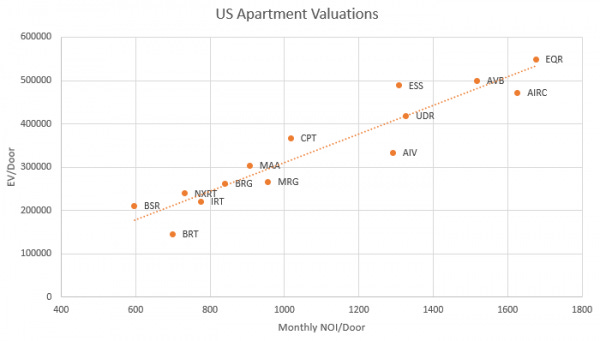

To me, those apartments are pretty valuable, though I admit to not knowing the US market well. But the data points above, plus NOI margin, do tell a lot of the story to me. I chose to look at a simple chart of the valuation of US apartment REITs based on a per door basis, and figured a decent proxy for “quality” would be NOI/door. My hypothesis was that NOI/door would have a high correlation with enterprise value/door. I was right.

For what it’s worth, this chart is almost identical to monthly rent/door. I thought NOI would tell the story better, but it seems like you can make the same comparison easier with rent/door.

It’s not a groundbreaking insight by any means, but a correlation that strong/apparent leads me to believe I’m not out of line for using the correlation to determine how MRG’s US properties should be valued.

MRG is in that data, and that’s where the exciting insight is. The data I used was MRG’s entire enterprise value, but just the NOI from its US properties… ie. if all MRG owned was the 7000 US apartments, it would be more or less fairly valued.

But MRG doesn’t just own those. As mentioned, it owns 5000 apartments in Ontario, which one could say you “get for free” (famous last words I know).

MRG is a story of two portfolios. It has the aforementioned high quality US portfolio, and this, a well located but lower quality portfolio of Canadian properties. Just two of these properties are under 30 years old. Occupancy for the Ontario properties is 93.4% while monthly rent for them is $1537. That occupancy is considerably lower than Ontario’s occupancy as a whole, and the monthly rent is probably in line or a little lower than the average rent in the GTA (this is the source for Ontario occupancy and rent, and the data is for 2020).

We have a much smaller sample size of multifamily REITs up here, but I actually came to like the NOI/door to EV/door comparison (I know it is just essentially cap rate), so I decided to see how the relationship held up in Canada.

I didn’t include CAPREIT in that chart because a not insignificant amount of its value is related to European properties, and I got frustrated trying to just value the Canadian properties. Same with Killam and its manufactured housing parks. I doubt it would have swayed the relationship much.

If you plug in MRG’s Canadian NOI/door into that trendline formula, you get $257,700/door, which seems somewhat reasonable and is equivalent to a cap rate of ~3.75%. $200,000 per door would be a cap rate of 4.8%. When you look at cap rates in the GTA (2.75%-4%), Kitchener-Waterloo (3%-4.75%), and Edmonton (4%-5.75%), as well as the valuation of Canadian apartment REIT peers (all sub 5%), I think we can agree that $200,000/4.8% is roughly the floor for the value of these properties.

At $200,000 per door, the Canadian properties are worth ~$18.71/unit, at $257,700/door, they’d be worth over $24/unit.

Keeping in mind the US properties justify the entire enterprise value, this means that MRG could have 100% upside (or more) from today’s price of $17.85.

We can quibble over the value of the US properties – I wouldn’t fault you for saying that MRG’s US properties shouldn’t be worth more than BSR’s for instance – but I don’t think you can place a reasonable value on the properties that would justify MRG’s value today.

FFO tells the same story. MRG trades at something like 14x FFO. As far as I can tell that is a much lower multiple than any other multifamily REIT/company. Even Boardwalk trades around 17x 2022’s estimated FFO.

What’s the catch?

A REIT isn’t just a collection of assets, it’s a company, and therein lies the rub. It’s as a company that MRG leaves something to be desired.

This is from the 2020 annual report, I think explains a lot about MRG’s valuation.

For five years (it will actually be six because 2021 isn’t going to be any better) MRG has failed to grow FFO/unit.

The reason is because Morguard seems to love diluting MRG unitholders for little or no gain. I circled units outstanding, which increased 21%, as well as total suites, which is actually lower now than it was five years ago. Mostly this is a result of upgrading its portfolio – as an example, in 2017 MRG acquired 1171 units while selling 1329 – , some capital investments in its existing properties, and a reduction of debt, but it’s tough to argue that MRG unitholders are better off after all the dilution.

When you look at those numbers, it’s easy to understand why someone would be nervous about investing in MRG. It may not be such a problem though if there was some reason Rai Sahi would do something to reduce the obvious discount of the equity. That doesn’t seem to be the case.

MRG has bought back almost zero stock (like I said it’s a significant net equity issuer) over the last six years, despite probably being cheap most of the time. Sahi has shown a willingness to sell fully priced assets, specifically at TWC (the Alaska railroad, his attempts (often foiled) to develop golf courses), but at MRG he seems mostly concerned with growing – which is odd when you look at the financials of the last five years.

This is Rai’s response when asked if he’d sell some Ontario assets given the high valuations at the time (late 2019):

Well, first of all, the REIT is not — that’s not necessarily our desire to think of selling just because it’s an optimum value, where — you can’t just spec and see that we’re going to time and sell something and go buy. Our objective continues to grow the portfolio. And trying to work out if it requires some upgrades and all of that in the existing portfolio. At this stage, we don’t have any immediate plans of selling anything.

The obvious answer should be the standard CEO speak of “we’ll sell at the right price of course”, but he goes with the odder “no I don’t want to sell anything”. Now of course this could be a flip comment, Rai is known to be a bit brusque on calls, or I could be misunderstanding him, but I think his preference is clear.

If you want to value MRG on a sum of the parts, as I presented here, you have to believe that Rai would either buy back units of MRG, which he hasn’t shown a willingness to do, or he’d sell some fully priced assets, which he has said he’s not keen to do. It seems clear to me the sum of the parts is probably conservatively $30+, probably $35+, but it would take a catalyst to realize that and it doesn’t look like a catalyst is likely.

Even so, if you look at a simple FFO multiple, it should be easy to justify a higher unit price without breaking it up or buying back units. If it weren’t for the horrible recent track record of growing FFO/unit, there would be no reason that MRG wouldn’t trade at a sector multiple. If MRG can finally show some growth on a per unit basis, why wouldn’t it trade at 20x? BSR REIT trades at 23x and is a decent comp for MRG’s US properties (and BSR is one of the cheapest US names), where as, with the exception of Boardwalk, every Canadian multifamily player trades well over 25x.

20x MRG’s estimated 2022 FFO would be $25.40 – not the huge undervaluation that the sum of the parts suggests, but 40% upside in an apartment REIT is tough to find.

Unitholders also can’t hang their hats on the hope of an activist coming in to save them. Morguard Corp owns 44.7% of MRG, and while it should have an incentive for growing MRG (Morguard earns an incentive fee of 15% of FFO in excess of $0.66/unit in addition to its other fee streams), Morguard clearly hasn’t been too worried about it. And the fees Morguard earns probably outweighs any incentive to sell the REIT and earn a windfall from its ownership stake.

Once again, I finish off without a firm conclusion. My instinct is to lean towards a “sum of the parts is too high and Sahi should be able to grow FFO/unit going forward” view, but that view was probably just as valid for the past five years and would have been quite wrong. I need to think more about it (which likely means I’ll pass).

Great review! A couple of things to update:

MRG has spent $5.8mm on its NCIB since December 2022 after years without activity. Insiders have also made net purchases of $580k.

I believe the low occupancy you noted for the GTA apartments was a strategic choice to avoid rushing to fill rent-controlled apartments when the market was relatively weak. When tenants have an opportunity to get in at a good price they may stay for a long-time and depress future rent growth. Occupancy rebounded to 98.6% at 3/31/23.