As I was early in the process of researching Secure Energy Services, I discovered this write-up by 310 Value:

Obviously, considering the author, it was fantastic (as all of his stuff is). It helped me a tonne. I liked it so much that I didn’t really see a point in writing something myself. What value could I add? But I like Secure’s story enough that I decided to try and write something that could add value, or at least spread the word a little more.

Secure Energy reports two business segments, waste management and energy infrastructure.

Energy infrastructure is the smaller of the two segments. In Secure’s words this segment “includes a network of crude oil gathering pipelines, terminals and storage facilities. Through this infrastructure network, the Corporation engages in the transportation, optimization, terminalling and storage of crude oil.” It also buys oil from customers and resells it, as a service for customers that are already using Secure for the other services of the energy infrastructure segment.

There are two things to note in this screenshot. In the second quarter, energy infrastructure made up just 17% of revenues and ~30% of EBITDA, and the oil purchase and resale line really screws with the financials (I’ll get back to this point).

Waste management is the primary industry of Secure now.

SECURE’s Waste Management segment includes a network of waste processing facilities, produced water pipelines, industrial landfills, waste transfer stations, metal recycling facilities, and specialty chemicals. Through this infrastructure network, the Corporation carries out business operations including the processing, recovery, recycling and disposal of waste streams generated by our energy and industrial customers. Services include produced and waste water disposal, hazardous and non-hazardous waste processing and transfer, treatment of crude oil emulsions, metal recycling, drilling waste management and specialty chemicals.

This segment owns a bunch of scrap metal yards. It owns landfills approved to receive oilfield and industrial waste (one of which is approved for hazardous materials). It owns water pipelines and facilities that separate oil and solids from water, allowing Secure to sell the recovered oil (year to date Secure has recovered ~630,000 barrels of oil from waste it has processed), put the solids in a landfill, then treat the water to dispose of it in disposal wells (or one salt cavern well it owns). This segment also sells production chemicals and fluids to oilfield customers.

This segment is by far the largest, with the specialty chemicals business just a small part of it.

If we went back 10 years, or even 5 years, the company’s earnings streams would look very different.

Secure’s reporting segments have changed over the years, so it is tough to really compare, but this slide clearly shows how the company has changed. Very little of Secure’s revenue is dependent on new drilling. Much more of it comes from waste processing and most of that is wste producd during run of the mill production, not new drilling.

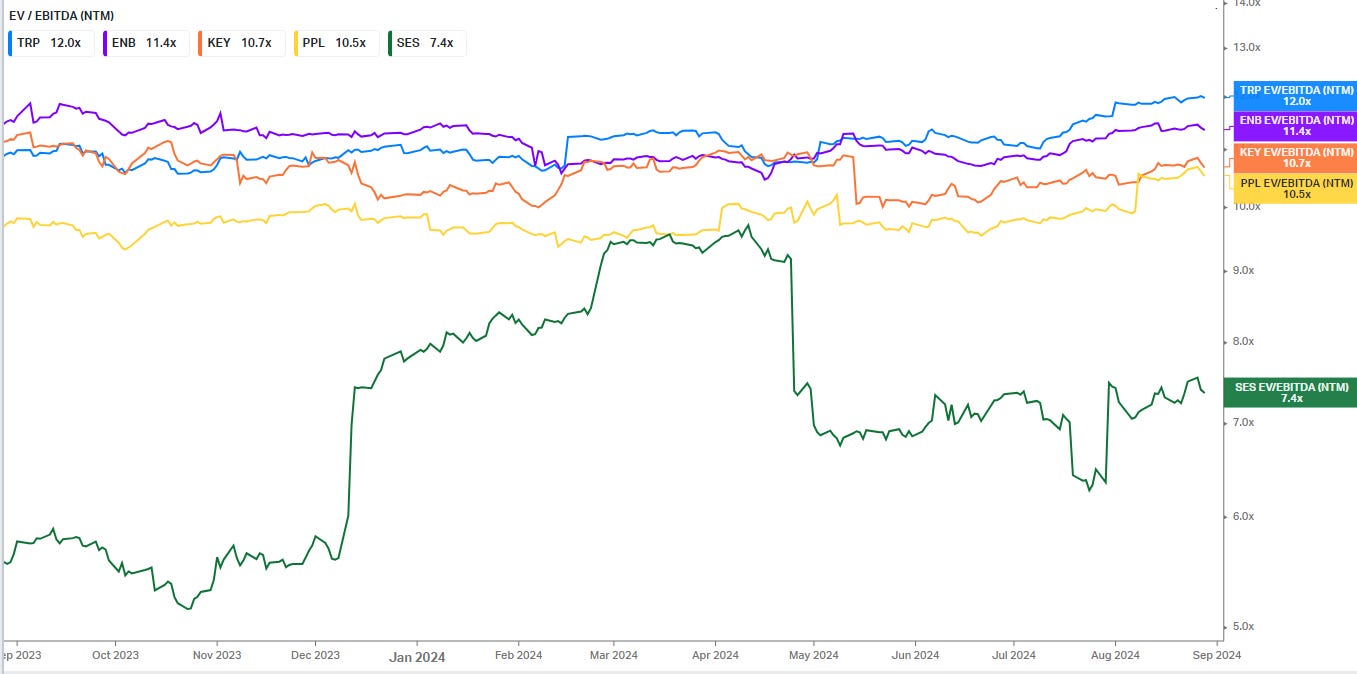

30% of Secure’s EBITDA comes from its energy infrastructure business. Obviously this is an energy business, but its much more akin to the pipeline companies, which trade at high teens earnings multiples and double digit EV/EBITDA multiples.

The waste management segment, with the exception of the specialty chemicals, bears a close resemblance to the other publicly traded waste management companies. Sure, a landfill that handles the waste of oil and gas producers is different than a landfill that handles my household garbage, but they share a lot of similarities. The popular, publicly traded waste companies treat water, much like Secure does. TAnd they do scrap metal recycling. And the other waste companies provide a lot of services to the oil and gas sector.

Considering all this, to what companies should Secure be compared?

Does it make sense to compare Secure to Precision Drilling? Trican Well Service? Pembina Pipeline? Keyera?*

*Not every website does this, but enough of them do that clearly some people are confused. I also know that Secure isn’t the only company this happens too, but I think, especially with the name, the problem is more pronounced.

Maybe it does make sense to compare the energy infrastructure segment to Pembina, TC, Enbridge, and Keyera. I could get behind that.

But 70% of EBITDA comes from a waste management business not so different than Waste Connections, Waste Management, GFL, Casella, Republic, etc, or at least some of the services that those companies provide. Doesn’t it stand to reason that Secure should be compared to those waste management companies more so than TerraVest or Enerflex?

If we work under the assumption that Secure should be valued at least similar to waste companies, it looks severely undervalued. It’s trading somewhere around 7x EV/EBITDA. At 10x - which would still be a 3x discount to the lowest valued waste company - Secure would be worth ~$17.50. 13x would over $23.

Well 30% of the business is energy infrastructure… maybe it should trade in line with those? Maybe this sample of peers is not the most applicable, but I don’t actually think it matters too much. It appears to me that the 10x EBITDA multiple I threw out there fits this valuation well too. Trading at the low end of this group would put Secure at ~10x.

I’m not out here to put out targets, but a weighted average of valuing the business segments at the low end of the peer ranges would come out to a blended multiple of ~12x (~$21 and change).

Why do waste companies trade at those relatively rich multiples though?

They have durable earnings. They have relatively limited competition. The industry has barriers to entry. There’s always going to be more waste.

Secure checks these boxes.

Secure has 70-75% market share for its waste services in Western Canada, compared to Waste Connections (R360) having 20-25% as a result of Secure’s forced divestiture of assets.

The only other competitor of any consequence is Waste Connections, renowned for being a good operator and rational pricer/competitor. In North Dakota Secure has 40% market share and is the dominant player. This is just market share, but the regulatory burdens also favour Secure. Canadian oil production is expected to grow in the near term (ie there’sgoing to be more waste). The same dynamics that allow the waste companies to organically grow via price increases are at play for Secure (if not being more attractive at Secure). It suggests to me that, if we’re comparing Secure to the waste sector, based on its competitive dynamics, it shouldn’t necessarily trade at a discount.

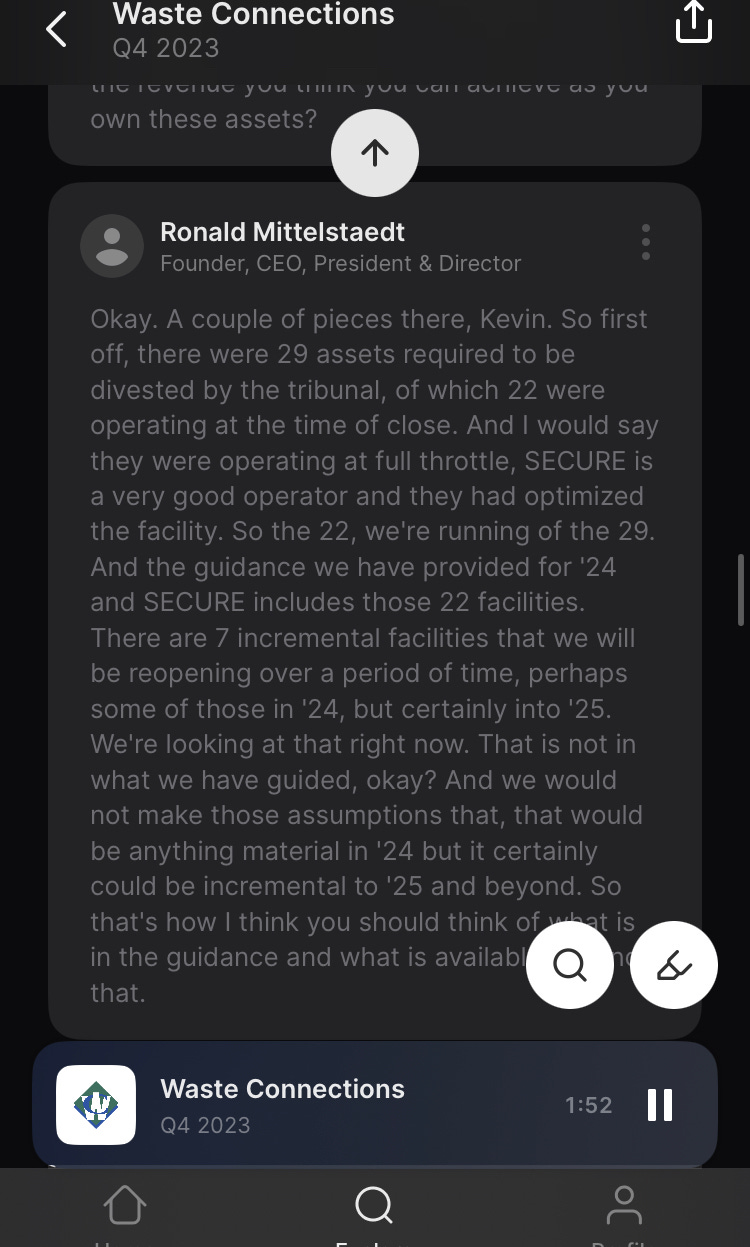

I’ll just add one final point regarding Secure’s valuation. Canada’s Competition Tribunal forced Secure to sell certain assets it had acquired in the Tervita acquisition. In a government forced sale, Secure sold assets that are essentially the same mix as its own waste assets, to a company that has a long track record of making good acquisitions, for 7-7.5x EBITDA. Waste Connections CEO Ron Mittelstaedt stated specifically that the valuation was not because Waste Connections could increase margins or realize synergies:

I’m sure that people who have studied Waste Connections can speculate as to what assets Waste Connections buys in a forced sale for 7x EBITDA are worth, but I’m confident saying they are worth more than the 7x Waste Connections paid. And if those assets are very similar to Secure’s remaining assets, it’s another point in favour of Secure being worth more than its current price.

Growth

Secure has several ways it can and should grow over the next few years. As mentioned, Secure is in an excellent competitive position to take price in its waste processing facilities, being the dominant player in the market, with the only real competitor being one which is also probably interested in increasing pricing.

Oil and gas production in Canada is expected to increase for the next few years, and the completion of some large infrastructure projects (LNG Canada, TMX, etc) suggest the growth could continue. Increasing production will lead to increased waste volumes for processing and landfills. Management has stated the the waste processing facilities are currently running at 65% of capacity, so a lot of growth can take place with little capital investment.

Lots of organic growth can come from pricing and volume, but Secure also states it has many ways to spend growth capital internally. In the last two years, Secure has spent almost $200 million growth projects. 310 Value wrote that he expects Secure can spend ~$100 million doing that each year. I see no reason for that not to be the case. Management has said repeatedly that they pursue these projects once they have customer commitments in place, and we have a lot of evidence of the returns Secure gets/expects (I’ll use the screenshots of the most recent investor presentation tell this below), so I’m comfortable making the assumption that organic growth capex is goint to be well spent.

Finally, there is a long runway of acquisition opportunities. As mentioned above, the North Dakota industrial waste market is very fragmented with many small players. That seems like a good avenue for acquisitions. Secure purchased a group of metal recyclers for $31 million in Q2 this year, at what management described as an accretive multiple (so definitely less than 7x EBITDA, likely considerably lower). This is another fragmented market with probably a lot of companies available at cheap multiples. I’m sure there are other acquisition opportunities (Secure purchased a specialty chemical company in Q1 this year), but you get the point.

Why Does this Opportunity Exist?

If I’m right that Secure Energy Services is significantly undervalued, why would that be the case?

I believe the name of the company scares people off from even looking at Secure. What makes me believe this? It has scared me off. I have seen Secure come up multiple times (someone talking about it, seeing it in a fund’s holdings, it popping up as a result in a screener, whatever). Each time I assumed it was an energy company of some description, and while there’s nothing wrong with that, it’s usually not what I was looking for. It wasn’t until I saw discussion of the asset sale to Waste Connections that I realized Secure wasn’t in the oilfield services sector. So I can say with certainty that the name has been a deterrent to attracting at least one investor, and likely many more.

Secure is also at the tail end of quite the transformation. A few years ago, it wouldn’t have been so simple to claim Secure is primarily a waste services company. The company has divested many of its oilfield businesses and most of its drilling dependent businesses. A few years ago, even if you liked the waste assets, 1) Secure was in a much weaker competitive position pre-Tervita, and 2) you could rightly decide that there was too much energy/drilling exposure. I’m willing to bet many people looked at Secure pre-2021, developed an impression of what Secure was, and have not looked at it again or updated their thinking.

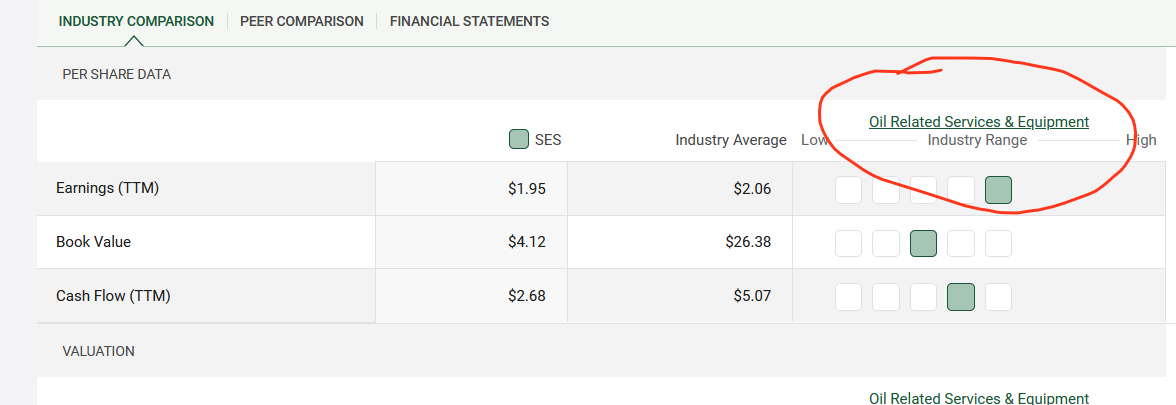

Secure also faces an uphill battle to show up in screeners at all. Because of the aforementioned oil purchasing and reselling, the financials of Secure look all screwed up. If you wanted to screen for high quality companies, high margins might be something you’d look for, right? And you might consider Secure’s high 30’s EBITDA margins as an indicator of its quality, right? But if you just take a surface level glance at Secure to see if you want to investigate further, this is what you’d see:

I’m not great at mental math, but $93 million gross profit on $2.55 billion seems pretty low.

I’m not saying it’s a huge factor, and analysts/the company are well aware of this issue (management has derided the issue on conference calls), and again, I’m sure it’s not every website that does this, but I don’t see how this could possibly not keep Secure off some people’s radars. Maybe the dollars involved are not large, but there have to be investors investing solely based off info like this.

Frankly, without looking reasonably closely, it is not that easy to see what a good company Secure is.

Conclusion

Secure Energy is trading at like 10x free cash flow and 7x EV/EBITDA, while waste management peers (the most applicable peer group) and pipeline/energy infrastructure peers (the next most logical comparison) both trade at considerably higher multiples. Despite the large discount, Secure can grow quite a lot with limited capital (via increased utilization of its waste processing facilities) plus has a lot of ways to spend capital on very high return projects and a long runway for accretive acquisitions.

It has a very safe balance sheet, with debt currently at just 1x EBITDA and the capacity to lever up to 2-2.5x EBITDA. The dividend comes out to a 3.3% yield at less than 40% of free cash flow. Management has been emphatic in saying the stock is undervalued and has backed that up, returning even more to shareholders by buying back over $700 million of stock in the last ~18 months, reducing shares outstanding over 20% since the end of 2022. And the majority of those buybacks were done around $11.40, via a substantial issuer bid and repurchase from the largest shareholder just a few months ago, so the share price today is not that different. Management has reiterated the valuation discrepancy and seems committed to maximizing the current NCIB and I suspect will continue buying back stock at/near today’s price.

I don’t know how much Secure Energy Services is worth. 12x EBITDA seems very reasonable. Given Secure’s superior margins, grwoth, ROIC, etc, why shouldn’t it trade at the low end of waste service companies? Without bothering to compare the free cash flow multiple to peers, 10x feels quite low for a business as good as I consider Secure. In five years I believe Secure’s earnings will be a fair bit higher. There’s a good chance it will trade at a higher multiple of those earnings as the markt wakes up to the new Secure. And if the multiple doesn’t increase, shares outstanding should continue going down as management dedicates some of its ample excess free cash flow to further share buybacks.

At one time I may have said “the easy money has been made” and moved on after looking at the stock chart, but Secure is a quality company trading at what seems a wonderful price. Regardless of what the stock has done, I like the odds that the future will be good to shareholders too.

Disclosure: I own Secure Energy Services (TSX:SES).

Great article!

thanks, your added value is not going to Waste , good energy!