This is another post from the archives. I believe this was written in the very depths of COVID - SRU.UN at its COVID low sunk to mid $17’s, while this was written with units at about $19. I seemed to focus mainly on the quality of SmartCentres in this post, in fact, valuation was apparently almost an afterthought. Hence I left the post mostly as is. To touch briefly on valuation here, SmartCentres at this moment is trading at roughly $24, and in 2022 earned practically the same in FFO before and after adjustments as it did in 2019 (the number I reference in the post). Disappointing growth for many I’m sure.

Despite posting this (which could be seen as a tacit endorsement of SmartCentres’ prospects as an investment today), I don’t think SmartCentres is the lay up it was at $19 in March 2020 - I know that’s a bold leap. Interest rates are up a tonne since then. You don’t need me to tell you that. But SmartCentres provides a great example of this. In June 2020, SmartCentres issued $600 million of unsecured debentures, with a weighted average term of 8.5 years (half at 7 years, half at 10), and an average interest rate of something like 3.35%. Then in December 2020, it issued $750 million of 5 year and 8 year debentures, at essentially 2%. When rates are that low, investing in a REIT with a 10% yield and 10x FFO makes a lot of sense, especially when that REIT can raise money at 2% to fund developments yielding 5+% or whatever.

Within the last month, SmartCentres issued a new round of unsecured debentures. $300 million. 5 years. 5.354% interest rate. Those are very different terms. Money has become much more expensive for the REIT. At the same time, I can log on to EQ Bank and buy a 5 year GIC and get 5% on my money. I didn’t look at GICs in 2020, but I know the rates were much lower, if there was a rate at all. SmartCentres yields a little under 8% now - 8% yield compared to 5% GIC rates is a very different investment than a 10% yield vs an infinitesimal GIC rate.

Not to mention that SmartCentres’ debt has been piling up. Debt is now at 52% of gross book value, and there’s reason to believe that gross book value is overstated (that’s not a statement on SmartCentres exclusively, that statement applies broadly to most REITs (there’s also reason to believe that book value is accurate, there’s arguments for both)). The weighted average interest rate of its debt is up to 3.89% and rising. Those same numbers a year ago were 50.8% and a 3.11%. Not going in a great direction.

That’s the doom and gloom. The bright side is that in 2017 debt was at 52.3%, and the WAIR on it was 3.7%. Not exactly the same, but pretty comparable to now. At that time, SmartCentres was over or around $30. The trouble is, the debt to gross book value is similar due to the large fair value gains since then. While I believe a lot of those fair value gains are probably warranted, debt to EBITDA tells a different story. That metric is around 10x now, compared to 8.2x at the end of 2017. Debt to EBITDA increasing by ~20% or something makes the unit price decline to now make more sense.

SmartCentres is a very different REIT now than in 2017 of course. That should have been apparent in the post below, if I wrote it well (that’s up to you). But SmartCentres is pretty different now than when I wrote this in March 2020. Let me highlight a few differences that positively affect what units are worth:

Occupancy up a tad (98% vs 97.3%)

Rents up, though it barely or didn’t keep up with inflation ($15.53 vs $15.37, note that this is only for retail)

Properties under development up to 19 from 14. Space under development up to 41.2 million sq.ft from 32.5 million sq.ft. Development projects are up to 273 from 256.

Later this year all 5 phases of the Transit City condos will have closed.

Later this year SmartCentres will have completed 1000 apartment units to hold as income properties.

There’s been some other good news, particularly around projects being approved or furthered through the development process, but you get the idea. The core retail portfolio has held up, while value has been created with the development pipeline. At the same time, units outstanding have crept up, as has debt. And the market hates development right now - between rates having gone up and development costs having increased so fast, the market is saying, correctly in a lot/most cases I’m sure, that developments are not going to make as much money as they were projected to.

I for one, am not terribly shocked at the price of SmartCentres. I’d like to say I saw this coming, as I sold most of my position around $26, but that was already after a big decline. I saw the debt creeping up, the rate on its debt creeping up, the high payout ratio, and a lot of developments which both need funding and will not be favoured by the market, and figured that it would do poorly for a bit. I was right, but I held on to enough units that I can’t claim I handled it brilliantly. I don’t expect the market to drastically change its mind on SmartCentres in the near term. But what I have left I am happy to hold on to, and I’m happy to DRIP my distributions.

I ended this post with the following paragraph:

“If you are looking to buy an investment to hold for years, and you can ignore some very ugly headlines about Covid-19, the death of small businesses, rent deferrals, and some higher vacancies, the valuation of SmartCentres REIT does indeed make no sense. I am not sure it is the best deal available as it seems like every REIT in Canada has been crushed (though many were probably overvalued to begin with), but I do know it’s a great deal and one I’m ecstatic to buy now.”

I’ll edit that a bit here to update my thoughts:

“If you are looking to buy an investment to hold for years, and you can ignore some very ugly headlines about Covid-19, the death of small businesses, rent deferrals, and some higher vacancies interest rates, development costs, a possible recession, the death of small businesses, runaway inflation, the valuation of SmartCentres REIT does indeed make no sense seem like a decent entry point. I am not sure it is the best deal available as it seems like every REIT in Canada has been crushed (though many were probably overvalued to begin with), but I do know think it’s a great pretty good deal and one I’m ecstatic to buy now okay with holding on to what I have and slowly increasing the position it by reinvesting the distributions at these prices.”

Any and all real estate in Canada has been killed, and anything commercial even more so. There are a lot of REITs or real estate companies in Canada where I really like either the ground they own or their tenants, but I have never particularly looked at them because they were expensive on even a cursory glance. Just one example is Canadian Apartment Properties REIT (CAR.UN), which people have raved about for years. But, and I’m going off memory here so I might be wrong, it has been over 20x FFO for as long as I can remember. Yes owning apartments in Toronto is clearly an excellent idea going forward, and CAR.UN’s chart shows it has been an excellent idea for a long time, but I couldn’t pay that much for it when other apartment owners were much cheaper (and should have been cheaper but less so).

SmartCentres is one of those REITs. I have long admired it from afar, both for its land, its incredible lead tenant, and the chairman of the board. This post will be shorter than my usual writeups (but still much longer than necessary) because I think the opportunity is pretty glaring, and I don’t want to get too busy spreadsheeting it.

On the chairman, I won’t go too far into it, but Mitchell Goldhar is pretty impressive, and if there was a Mount Rushmore of Canadian real estate icons, he’d be on it (as would Rai Sahi). For the uninitiated, Goldhar is the guy that brought Walmart to Canada, is one of the richest men in Canada, and essentially built SmartCentres from nothing (before merging it with Calloway REIT). As you know I’m a big fan of great management, and with Mitch Goldhar at SmartCentres, I am quite happy.

On the tenant, yeah it’s Walmart. About 25% of SmartCentre’s rent comes from Walmart, and of its 165 properties, 115 have Walmart as the anchor tenant*, another 20 having a grocery anchor, and a few have Canadian Tire as an anchor.

*Or shadow anchor meaning the anchor is not on owned land, but in theory close enough to perform the anchor’s function of increasing foot traffic for tenants on the owned land.

The appeal goes beyond Walmart holding up well in the carnage of Covid-19, which it is. It is more about the storefronts near a Walmart always being desirable. At the risk of doxxing myself, I used to live close to a SmartCentres property in Alliston, ON, and it was a great example of the appeal of being beside a Walmart.

That Great Clips and Tooth Doctor were always much busier than you’d expect given their not great services, and their not-walkable location. The ability to get your hair cut, then go to Walmart for groceries and whatever else is certainly in the pro-column for Great Clips over the other hair cutting places in town.

Fun fact, within minutes of Great Clips charging me $22 for like a 3 minute buzz cut, I had bought buzzers at Walmart and have cut my own hair ever since, because I am not paying $20 for the only hair cut I need. My hair is much rarer than it used to be unfortunately so about all I can do with it is a buzz cut, though with self-isolation I’m thinking of growing it out again:

The worry in the market right now is that no retail or commercial tenants will be able to pay their rent with the shutdowns that are in place. It’s a valid worry. Using the Alliston location as an example, we know that Walmart and Dollarama are going to pay their rent on the 1st just like every other month, neither are shut down and both are still doing lots of business. But that dentist, and hair cutting place (barber? hairdresser? I don’t know), and the Subway, and the New You Optical, they are definitely struggling right now. I can’t say whether they are going to pay their rent, but it’s a risk.

For what it’s worth, Goldhar said this about the matter:

“Our centres have always been about selling at low prices. That is what people need, especially now or in slower economic times. Therefore some of our tenants are very busy like Walmart and Loblaws. Others are not as busy or temporarily closing. I spoke this week with one small independent retailer whose business is very affected by the virus, and I assured her that we have every intention to stand by her and help her through this, even if it includes some form of rent deferral. But, as a percentage, very few tenants have requested rent deferrals, and of those, all are small businesses, which in SmartCentres’ case make up only 3.5 per cent of our space.”

My guess would be that maybe SmartCentres is going to have to do something like these rent deferrals for a lot of tenants, and it will probably be for more than that 3.5% of their space. Those small tenants pay much more for rent, so it will have a disproportionate affect on revenue and NOI for a while. But if you have a storefront right beside a Walmart, are you going to give it up easily just because it will be hard to make rent for a while? I’d say no. You’ll ask SmartCentres for a deferral of your rent, then you’ll essentially do whatever they ask. If they say sign a longer lease at a higher rent to make up for the missed months, you will. If they say starting September your rent will be higher for a year to make up for the missed months, you’ll pay it. And while that will work for some tenants, the fact of the matter is a lot of their tenants are going to fail regardless of rent solutions from SmartCentres. In those cases, SmartCentres and its occupancy will suffer for a while until businesses are once again in a position to rent space.

I know I make it sound like SmartCentres is a vampire here, but I don’t think that. It’s just they hold a very valuable commodity; someday the world will be more normal (if never fully back to normal) and people will want to rent space next to Walmarts. It may be the current tenants, or it may be new ones.

It is also worth taking into account that the Canadian and provincial governments are doing quite a bit to make sure businesses handle the crisis as best they can. With the EI/CERB incentives for laid off and furloughed workers, and now paying 75% of wages for small business employees, plus a bunch of other programs that I probably don’t know about or will come out in the coming days and weeks, rent will be one of the only expenses left for companies. Yes there will still be deferrals, but there will be a lot of companies that can make it through the shutdowns that may have otherwise gone broke with 2 or 3 months of zero or greatly reduced revenues.

So my point on the tenants of SmartCentres is that most of their rent will be safeish through this crisis (compared to most retail landlords with rent coming from Walmart, grocery stores, and other large retailers), and once the world is approaching normal again, the other tenants will want to be paying rent for their spaces, lest they lose their prime locations. There is a reason that SmartCentres has an almost crazy for a retail REIT 98% occupancy rate.

And finally, on the land, SmartCentres owns great land, and has the ability to sell, develop, or redevelop it. The REIT’s investor presentations exhibit these projects well, and without picking like 12 pictures I find it tough to convey just how impressive the land is. This isn’t land in Alert or Medicine Hat (both lovely towns I’m sure). This is desirable land in places that lots of people live.

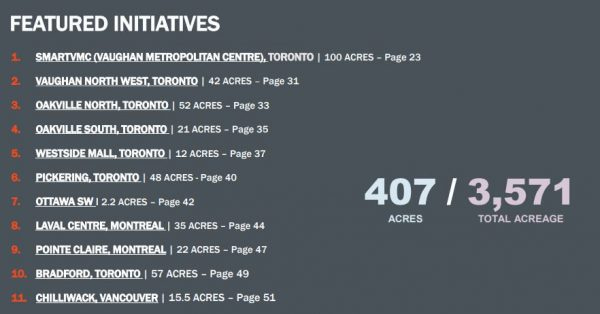

The map is zoomed out pretty far, but I think you can infer just how many of the properties SmartCentres is going to intensify are in the GTA and other valuable locations. I think just the ten projects below should give you an idea of what kind of value we’re talking about here

And here’s what they want to put on the land.

Putting condos, apartments, storage units, and seniors’ housing on SmartCentres’ prime land seems like an incredible way to build value.

Just to emphasize how important future development is to SmartCentres, this is a video of Mitch Goldhar specifically saying “our story is about development right now”.

Valuation

For a long time, I think you were paying up for the fact that its largest tenant is one of the best in the world, and also paying a bit for the development pipeline. I’m not sure that’s the case any longer.

In 2019, SmartCentres earned $2.15 in FFO before any adjustments ($2.27 with them). And using the more conservative ACFO, and adjusting units outstanding up by a couple million, SmartCentres still earned $1.91 in ACFO. That compares to a unit price of somewhere around $19 right now – when stock prices go up and down 12% every day I have no idea what the price will be when you read this.

You are paying just 10x ACFO, or 8.4x FFO, and you get an almost 10% distribution yield for being Walmart’s landlord. At anything close to these prices, you are not paying up because of Walmart, and you certainly aren’t paying anything for those future developments. I think if SmartCentres never developed another square foot of its land, and simply tried to run its existing properties as well as it could, you could justify paying the current unit price.

I don’t know if I’d go this far, but here is what Mitch Goldhar said about SmartCentre’s valuation.

“It makes no sense…[the market is pricing SmartCentres like] 50 per cent of our retail space in existence will be closed not just for two weeks, not just for one month or for three months, but forever, never to open or be leased again, ever, to anyone, as if the buildings will disappear off the face of the Earth, along with the land under them, never again to generate revenue.”

If you are looking to buy an investment to hold for years, and you can ignore some very ugly headlines about Covid-19, the death of small businesses, rent deferrals, and some higher vacancies, the valuation of SmartCentres REIT does indeed make no sense. I am not sure it is the best deal available as it seems like every REIT in Canada has been crushed (though many were probably overvalued to begin with), but I do know it’s a great deal and one I’m ecstatic to buy now.