The TSX Composite is more or less at all time highs, but there are an awful lot of Canadian companies that are not trading anywhere near their highs. Many of these companies have previously had reputations as compounders, or high quality companies, or what have you. It seems like a great time to be an investor looking for stocks to buy. Hence, this break from my seemingly indefinite hiatus.

Spin Master is a company I have found interesting for a long time. One, I just love when a Canadian company grows from nothing to being a leader on the world stage. Two, I remember back to its early post IPO days when the stock ran from its IPO price of $18 in 2015 to a peak of $56 by mid-2018. A stock you’re aware of that has a run like that sticks in your mind. And three, the toy business just offers a charm that a lot of other businesses don’t have.

I hadn’t looked at Spin Master in quite a while, but it came up in a list of “Canadian companies trading well below their average valuation”, and while I don’t put any weight in the “it used to trade at 20x but now trades at 12x” method, I did find the list an interesting assortment of companies that offered a few it could be worth diving deeper into. Spin Master is the first of those I’ve chosen to highlight.

To get this out of the way, the lower valuation makes sense. Spin Master is the same price it was in the summer of 2016, eight long years ago. But the company and its prospects are quite different. This was what the press release for its Q2 2016 earnings looked like.

40+% increase in sales and EBITDA is certainly more exciting than this pack of results Spin Master reported in Q1 of this year:

When you look at it like this, of course Spin Master’s P/E ratio has gone from 30 something to the low teens.

The question isn’t whether Spin Master should return to 30x. It’s not whether Spin Master should return to its historical average P/E. It’s simply whether the current valuation is too low.

Background

Please note that Spin Master reports in US Dollars, so unless I specify otherwise, from here on out I will be using USD including using ~$20.50 USD as Spin Master’s stock price.

Let’s start with a brief background of Spin Master.

The company operates three segments: toys, entertainment, and digital games.

It’s pretty clear what the toys segment is. Spin Master designs, licenses, markets, and sells a bunch of different toys, including many that you - whether you are a parent or not - are probably familiar with. Some if its most noteworthy owned toy brands are PAW Patrol, Bakugan, Rubik’s (of cube fame), Kinetic Sand, Etch a Sketch, Air Hogs, and Tech Deck.

It also licenses brands from other companies to create toys of those brands. Spin Master currently has licenses for DC, Wizarding World (ie. Harry Potter), Gabby’s Dollhouse, Monster Jam and Supercross, League of Legends, Dora, and Sony’s Playstation brands (eg. God of War, The Last of Us).

Spin Master started as a toy company and toys is by far its largest division, accounting for ~80% of revenue in 2023, and toys will remain the dominant segment going forward. The large, “transformational” acquisition of Melissa & Doug, discussed below, is also contained within the toy segment.

Spin Master’s second segment is entertainment, which consists of movies, series, and videos (YouTube and the like) based on its brands. PAW Patrol is a long running series and now has two movies out, the latest of which grossed $200 million at the box office worldwide in 2023. That’s the crown jewel in entertainment. The company has quite a few things in the hopper in entertainment, but at least I don’t recognize them nearly as much. Maybe some of you reading this are familiar with Unicorn Academy?

The final segment is digital games. Most notable here seems to be Toca Boca, a mobile game developer Spin Master purchased for $31 million in 2016, and Originator, a developer of educational mobile games, which was purchased for $29 million in 2021.

As you can see, Spin Master has had success creating games/apps that resonate with children and/or parents.

Melissa & Doug

Melissa & Doug is a manufacturer of preschool age toys, and in 2022 had almost $500 million in sales. Spin Master paid $950 million to acquire the company.

Spin Master management has discussed the deal in depth, both in a conference call regarding the acquisition as well as both earnings calls done since the deal closed.

The rationale behind the deal is this: Melissa & Doug is one of the leading preschool toy brands, specializing in wooden sustainable toys and pretend play sets. It’s a leading toy brand on its own, but the sustainable toy angle is a kicker and possibly a larger selling point going forward (competitor Mattel has said it wants to expand its own wooden toy offerings). There is plenty of greenspace to expand internationally - only 10% of Melissa & Doug’s sales come from outside North America, compared to 40% for Spin Master. Spin Master can incorporate some if its brands with Melissa & Doug toys or play sets. It is a trusted preschool brand and due to age compression, preschool is arguably the most attractive toy market. Spin Master anticipates $30 million in synergies are attainable by 2026. And so on.

There’s more to it, but I am not here to talk about the acquisition in and of itself. analysts seem to want to beat it to death, so between what they have put out and what management (a couple press releases and a lot of conference call time), there’s plenty of material out there where you can read about the deal more.

Why Spin Master might be mispriced

There are a handful of reasons that probably contribute to Spin Master’s current valuation.

It’s a demonstrably bad market for toy makers.

The global toy market declined 6.5% in 2023. Spin Master, Hasbro, and Mattel are at best anticipating no revenue growth in 2024, or decreases. From reading comments, it seems that consumers are spending less on toys, spending on lower priced toys, or waiting for sales/discounts, and that isn’t expected to change much this year. I’m guessing as long as you are hearing about affordability and inflation in the news, Spin Master is going to be facing a tough market.

If you are expecting a bullish retort here, I can’t offer one. I could point to the fact that Spin Master had a mild gain in market share in 2023 (a result of sales only declining 4%), but I won’t do that. The fact is it is a bad market, and while management said on its Q1 conference call “our top retailers in the US over the last month have begun to express cautious optimism for the second half”, that is not a glowing endorsement of the environment. Looking at Spin Master with a long term lens, I don’t see the retail environment over the next 24 months as particularly relevant, and I’m guessing you reading this can see it as a possible opportunity as well.

Paw Patrol is an outsized part of the business and who knows how long it can last

If you go back through Spin Master’s history, you find that it has been very much a hit driven company.

The best example of that was Bakugan, a television series and toy line that was so significant to Spin Master’s business that Bakugan growth was listed as one of the phases of its history in its IPO prospectus.

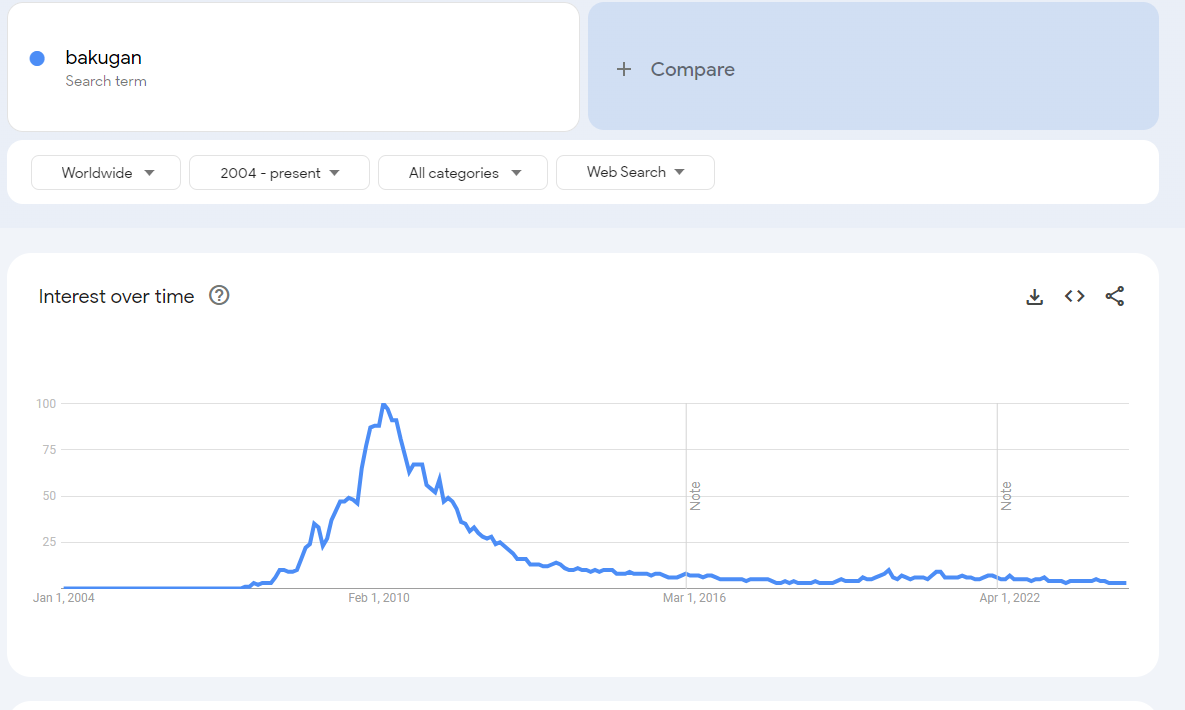

And when you look at the popularity of Bakugan and its sales, you can see the impact that can have on the company.

Investors could understandably think Paw Patrol might face a similar fate as Bakugan and numerous other preschool phenomenons. In fact, the reason Spin Master created Paw Patrol with Keith Chapman was that it knew that most of the shows aimed at preschoolers were on their last legs and the category needed a new hit.

From what I can tell, it isn’t possible to know how much of Spin Master’s business is Paw Patrol related, but we can find clues.

We know that Paw Patrol toys are included in the preschool segment, and that preschool was about 45% of toy sales in 2023.

After the acquisition of Melissa & Doug, the legacy preschool category is probably down to mid 30’s as a percentage of toy revenue (Melissa & Doug will mostly be in preschool but it obviously doesn’t have anything to do with Paw Patrol yet). Assuming Paw Patrol is the vast majority of preschool currently, we get to something like 25% of toy revenue being Paw Patrol in 2024.

I think it is conservative to assume that nearly all of the entertainment segment is related to Paw Patrol. Spin Master does have other entertainment brands, including a few reasonably successful ones, so we know Paw Patrol isn’t all of it. But in absence of more information, I think one has to assume Paw Patrol as being all of the segment’s revenue.

The digital games segment has a small amount of revenue associated with Paw Patrol (a new game called Paw Patrol Academy was recently released), but just as we assigned all entertainment revenue to Paw Patrol despite there being other shows, we’ll assign all revenue to other digital game properties here as Paw Patrol Academy is at best a very minor property.

At the high end, Paw Patrol might represent 35% of Spin Master’s revenue. That’s not quite as worrying as Bakugan’s peak of ~45% in 2009, but you can understand why investors may be worried.

There is reason to believe that Paw Patrol offers more staying power than Bakugan did, and can remain lucrative intellectual property for the foreseeable future. For one, Paw Patrol has resonated with children for over ten years now. The simple fact that it has been around and popular for ten plus years means it is more likely to remain around and popular (ie. The Lindy Effect).

Its lasting power can be seen in the big difference looking at Paw Patrol’s Google Trends page vs Bakugan’s above:

While the chart above does look like it is petering off as of late, it is still comparable to a few years ago.

I have no evidence to guide my opinion, but I also expect that the preschool market is less prone to fads than others.

One would expect that management has learned a thing or two since the Bakugan debacle almost ended their company, and they’ll be better able to handle Paw Patrol. The founders of Spin Master, Ronnen Harary and Anton Rabie, are both still on the board and involved in the company. The third early employee Ben Varadi is Chief Creative Officer. All three were around for Bakugan, and for the entirety of Spin Master’s existence. They must have learned some lessons and have a few more tricks up their sleeves.

It’s possible we’re seeing evidence of that, as the peak of the trends chart came in August 2021, when the first Paw Patrol movie was released.

The smaller peak after that was in October 2023, the release of the second Paw Patrol movie.

Neither popularity/consciousness boost was long lived, and the second movie having less of an impact (as well as being less profitable), but this does show one lever the company can pull.

Even after ten years new Paw Patrol toys coming out still manage to make a splash; the Jungle Pups vehicle assortment was the number new toy in the US preschool category in the first quarter this year. That’s another good sign that Spin Master is handling the brand well.

Bears would bring up how much attention Bluey has pulled from Paw Patrol. Another Google Trends chart shows why:

Since its 2018 debut, Bluey has rapidly increased in popularity. Paw Patrol has been running in place while Bluey caught up. It’s a fair point, but I remember being a kid, and I have spent time around enough kids to know they are very rarely entirely devoted to one show or interest or set of characters. Preschool boys will watch Bluey and Paw Patrol and play with dinosaurs and trucks and tractors and…

It’s not great that there is another growing giant preschool property, but it’s not a death knell either.

I guess what I’m getting at is that I fully understand why some would be uncomfortable with how much of Spin Master’s earnings come from Paw Patrol, 30+% of revenue is a lot. And I don’t want to go out on the limb of saying Paw Patrol will remain a big earner. But I think there’s an argument to be made that it isn’t a melting ice cube (and that the market might be valuing it as one).

Too reliant on home runs

This ties into my previous point…

Earth Buddies, Devil Sticks, Bakugan, Hatchimals, Paw Patrol…

For Spin Master’s entire existence, it has gone through phases of breakout toys becoming huge earners, then those earnings falling off and having to diversify and/or find a new cash cow.

Companies that are so reliant on home runs are often mispriced in the public markets. It’s the oft told story of the steady 10% return vs the volatile 15% return. Many want the steady, lower return.

Spin Master has become, and is still becoming, more diversified, more akin to the steady 10% returner.

Here is Spin Master’s revenue and net income history as a public company.

It is by no means a smooth line up and to the right, but it also does not show a huge boom and bust cycle, nor does it follow the popularity of Paw Patrol or Hatchimals (a huge hit in 2016 whose bust in 2017 and 2018 didn’t hurt the company much as a whole).

Paw Patrol has been a home run. Hatchimals was briefly. But Spin Master now has enough players in the line up who can hit singles and get on base, that it occurs to me it can now win a ball game even if it doesn’t ever come up with another phenom/home run property. Scroll back up and read the brands that Spin Master owns or for which it has the license. Add in the Melissa & Doug acquisition. It is always possible that Paw Patrol falls out of favour, and that would have a big impact on the financials, but I believe that it is no longer make or break for the company, assuming the decline is slow vs immediate (it takes an escalator down vs an elevator).

It’s also worth pointing out that management wants to get its digital games segment up to 20% of revenue, up from the current ~10%, which will go a long way to diversifying revenue. That reduces reliance on Paw Patrol and on toys in general. Currently the digital games segment is dominated by Toca Life World, but Spin Master has diversified the segment with Piknik, a single monthly subscription that gives subscribers access to many educational games, and Paw Patrol Academy, amongst other bets. It has a superficially compelling plan (which can be seen in an investor day presentation from August 2023) to diversify within the segment.

Not liking the Melissa & Doug acquisition

The Melissa & Doug acquisition cost $950 million, a very large acquisition for a company with a market cap of a little over $2 billion USD. That alone may be enough for some to question its merits, but then there is the valuation.

When discussing the deal at the time, management said it was being done at 10.5x 2022’s EBITDA, or “ 8.1x adjusted EBITDA, including run rate cost synergies at the midpoint of the range”.

That was assuming that Melissa & Doug’s 2022 EBITDA of ~$90 million was kind of a baseline. But when Spin Master on its 2024 Q4 conference call discussed Melissa & Doug’s 2023 results, management revealed that Melissa & Doug’s revenue declined 25% in 2023, with a similar EBITDA margin, implying 2023 EBITDA of something like $67 million.

Spin Master’s stock chart suggest to me that Melissa & Doug’s 2023 Q4 performance, or lack thereof, seems to be at least a part of why the market may not like the acquisition.

The first circle is when the acquisition was announced. Stock price goes up. It was a short lived bounce, but the stock price did not go below where it had been trading pre-deal until Q4 results were announced. Spin Master’s own Q4 results weren’t the best, but were nothing compared to Melissa & Doug’s 25% revenue/EBITDA decline. I don’t like interpreting rationale to short term stock price movements, but I interpret this as turning sour on the acquisition after its Q4 was revealed.

On the conference call, management attributed the revenue decline to Melissa & Doug’s former owners not investing in the brand in Q4, not discounting or promoting in a retail environment that required discounting (as stated by Spin Master and Mattel on their conference calls) and promotion.

Spin Master clearly sees this as a temporary issue, but there is the possibility of it being an issue that lingers, or simply starts the business from a lower base.

Spin Master was partly compensated for this poor performance by the two sides agreeing to remove the potential $150 million earn-out, but still, this turns a 10x EBITDA acquisition into a 14x EBITDA acquisition. Or if you use Spin Master’s guided ~$82 million (management guided Melissa & Doug’s revenue and EBITDA margins), an 11.6x acquisition.

An acquisition done at 10-11x EBITDA is tough enough to get excited about. The kicker is that Spin Master has begun buying back shares; the company spent a little over $10 million on buybacks in 2023. Spin Master reports its adjusted EBITDA as the number it wants to highlight, so let’s use management’s own metric here. Before the deal, Spin Master had a market cap of ~$2.6 billion USD, with net cash of $650 million, for an enterprise value of ~$2 billion. Meanwhile, in 2023 it had adjusted EBITDA of $418 million. So right before Spin Master purchased Melissa & Doug for 10x EBITDA, it was buying shares of itself for less than 5x. Unadjust the EBITDA (to $350-$360 million) and it was still trading under 6x.

For the Melissa & Doug acquisition to make sense over buybacks at a much cheaper valuation, one needs to believe that Melissa & Doug can increase its earnings quite a bit through partnering with Spin Master brands, or having been underearning, or synergies, or what have you. Or that Melissa & Doug, through the diversification it provides, makes Spin Master a safer company (in spite of the half a billion dollars of debt it necessitated).

Understandably, these lines of reasoning are tough to follow for some.

I think all of the issues I’ve discussed above should be resolved with time. The toy market isn’t going to stay this poor forever. Paw Patrol should prove to hold some of its appeal, even if its popularity declines, for a few more years after which the market will have a better idea of its staying power. The third Paw Patrol movie gets released in 2026, which should be a good indicator of the earning power the franchise has at that point. As Melissa & Doug is integrated, digital games grows, and Spin Master acquires more properties/companies or diversifies organically, Paw Patrol and any other new hit in the future becomes less and less important to the company. It will become less and less reliant on producing monster earners and have more stable growth. And management’s vision for Melissa & Doug either will or won’t come to fruition. Either it will go down as an expensive acquisition that probably weighs on valuation for a while as the market questions the M&A ability of management, or Spin Master grows Melissa & Doug, realizes synergies, and management proves they knew what they were doing. Regardless, uncertainty for better or worse will abate and that should help the stock price.

Is there a reason for a premium multiple?

Spin Master trades at ~11x earnings my estimate of 2024’s earnings, but also ~14x 2023’s earnings. Hasbro lost over $10 per share last year, yet the stock is at $57. Even vs peak 2021 earnings, that would still be a multiple of over 18x. Mattel is trading at 27x its 2023 earnings, and ~12x its 2024 guidance.

Valuation

From 2021 to 2023, Spin Master earned GAAP earnings per share of $1.89, $2.45, and $1.43. That of course equates to P/E multiples of ~11, 8.4x, and 14.3x.

Spin Master also prominently points to its adjusted EBITDA and adjusted EPS. Here are the adjustments management makes:

I highlighted a few, that seem to be more or less recurring (in varying amounts) and are real costs to the company. I hate seeing SBC added back to earnings, that one is obvious. But the other ones are real costs too, and if every year in the last three has had acquisition related deferred incentive compensation of between $7-$11 million, why should those costs be adjusted out?

I am not saying the GAAP net income is the number most representative of what shareholders earn, but neither is the adjusted earnings. But I am comfortable coming up with my own number between those two. I come up with something like $1.75 in earnings for 2023.

Spin Master’s acquisition of Melissa & Doug closed on January 2nd, which makes it easier to estimate Spin Master’s full year earnings with the acquisition.

Management has guided that Melissa & Doug will earn about $75 million in adjusted EBITDA, which should equate to net earnings of something like $50 million, or $0.48 per share (105 million shares outstanding). Consider the guidance for the legacy Spin MAster business of roughly flat revenue this year, and the new interest expense with the acquisition’s debt (a hit of something like $40 million), and Spin Master should earn around $1.90.

On an EV/EBITDA basis, Spin Master will report something like $420 million in unadjusted EBITDA (you’ll see consensus at almost $500 million but that is the adjusted figure). At the end of Q1, the enterprise value was ~2.4 billion. That’s a multiple of just ~5.7x.

As for free cash flow, after some adjustments, I get Spin Master having roughly $180 million in 2023 (the reported $123 million includes net working capital change of over $100 million, which shouldn’t repeat), or $1.70 per share. Melissa & Doug will add free cash flow as well.

10.5x 2024’s earnings. 5.7x EV/2024’s EBITDA. 12x 2023’s FCF and probably a little cheaper on 2024’s. That’s where Spin Master trades today. On its surface seems cheap.

Hasbro lost over $10 per share last year, yet the stock is at $57. Even vs peak 2021 earnings, Hasbro would still be at a multiple of over 18x. Mattel is trading at 27x its 2023 earnings, and ~12x its 2024 guidance. EV/EBITDA makes the difference more striking, with Mattel trading around 8x and Hasbro around 12x.

Hasbro has been mismanaged for years (recall Alta Fox Capital’s activist campaign two years ago). Mattel had an actual blockbuster from the Barbie movie, which seems to have revitalized growth. It’s also a favourite of Edgepoint (Mattel is a top five holding of Cymbria, Edgepoint Global, and Edgepoint Global Growth & Income), a fact I use as a strong indicator of an investment’s possible attractiveness. If Spin Master is at a lower multiple than Mattel, and Edgepoint thinks Mattel is cheap - even if the thesis isn’t as simple as Mattel is too cheap vs earnings, as it seems to be more about undermonetized IP - it gives me good reason to believe that Spin Master is probably cheap if managed well. From what I can tell, analysts seem to be expecting Hasbro and Mattel to grow earnings from here, while having muted expectations for growth from Spin Master. That probably explains a lot of the valuation discrepancy, while also providing an opportunity if the analysts are too pessimistic about Spin Master.

Even without comparing to the other North American toy companies, Spin Master occurs to me to be a company that the market should value more highly:

Good returns on its capital

Based on my estimate of net income and Q1’s balance sheet, the company will have a roughly 15% return on equity this year. That is with little debt ($470 million at Q1, ~1.1x EBITDA) and a fairly large cash balance ($200 million, net debt <$300 million). In 2023, ROE was almost 17% after removing excess cash from the balance sheet. 2022 was 25% after removing excess cash and a large gain on foreign exchange.

Spin Master also earns and looks set to earn a mid teens ROIC.

Spin Master is able to earn high returns with its asset light model (PP&E is just $65 million) and by utilizing third party inventors more than its competitors, which allows it to spend less on product development (the inventors fund a lot of it) in exchange for a royalty on sales. Combine these facts with its strong brands and management team, and I expect that the high returns should be able to continue.

Brands

Yes the toy business has very much been a hit based business. Have I beaten that point to death yet? It’s not a foregone conclusion that Paw Patrol or Toca Boca remain as popular as they are. It will take a good strategy from management. It will take some luck. But they are defensible and a lot of the hard lifting has been done. To name just one, every toy and/or entertainment company in the world would love to have the rights to Paw Patrol. Imagine what an acquirer would pay for Paw Patrol alone.

Owner-Operators

The two founders, Ronnen Harary and Anton Rabie, are both on the board, involved in the company’s strategy, and own 29% and 27% of the company respectively. Ben Varadi owns another ~10%. Through their ownership of multiple voting shares the three of them together have complete control of the company.

Capital Allocation

In 2022, Spin Master began paying a dividend of ~$0.24 per year. The dividend was just doubled to $0.48. In the conference call after the announcement, the CFO said the Board wanted the dividend yield to be around 1.5%, and the payout ratio to be similar to what it will be now, which is about 20% of earnings. It stands to reason that the dividend will likely increase in the future as earnings and Spin Master’s stock price increase. This should open up the stock to many new possible buyers.

Management is also committed to reducing debt. Before the Melissa & Doug acquisition, Spin Master had over $700 million in cash with no debt. It took on $525 million of debt for the acquisition, which closed on January 2nd, and by March 31st had already paid down $50 million. Nobody would claim that Spin Master has too much debt as is (just over 1x EBITDA), but when a company does face cyclical and consumer preference risks, a focus on a strong balance sheet should be desirable.

Finally, as mentioned the company is now buying back shares. In 2023 it bought back ~400,000 shares at an average price of ~$35 CAD. Through April Spin Master had already purchased almost 600,000 shares at an average price of ~$33 CAD. The buybacks haven’t stopped either; over 250,000 shares were bought back in June at lower prices yet.

It’s nice to see a management team that is willing to buy more shares as the share price gets lower.

Spin Master’s NCIB is for ~3 million shares, which is less than 3% of total shares outstanding, but is 10% of the traded, subordinate voting shares, ie. the float.

If Spin Master is committed to maxing out this buyback, which it seems like it is and is affordable, and management does not sell any shares, the buyback almost can’t help but push the price up. If it does, then the question of should management continue the buyback arises, but that is a future problem, and a good one to have at that.

Conclusion

Since going public, Spin Master has a good track record of growing revenue and earnings; though there is cyclicality to the business, the overall trend has been positive. The company is currently facing some of the headwinds that has marked the mild cyclical downturns, and because of that the company is available at a valuation it rarely has been.

Spin Master owns one of the best children’s brands in the world right now in Paw Patrol. It owns one of the most popular children’s apps (Toca Boca). It owns a lot of smaller brands that have value as well as licenses in popular franchises (Gabby’s Dollhouse, DC, the Playstation entities, etc). And it has demonstrated that it is capable of successfully developing new brands. The leaders of the company have led the company for 30 years, grown it from a single product into a giant in the toy industry, control the company, and have a tonne of skin in the game. They’ve recently begun focusing on returning capital to shareholders (started and increased the dividend, begun buybacks, and paying down Melissa & Doug debt) as the company now has excess cash flow after funding its growth opportunities.

If a few things go right, Spin Master looks set up to deliver very attractive returns to shareholders willing to look out a few years.

I think an update is overdue! :)

Thank you. I have just read this article.

There’s a great podcast with Harary on How I Built This, where they cover Spinmaster/PAW Patrol. As with most businesses, they had to get lucky with a few hits at the start to get where they are today.

I think the only difficulty I have is wrapping my head around the R&D to ensure that they keep investing in new products. I think having the founders still on the board likely help to keep that mindset going.