AutoCanada Revisited

Hopefully you read my first post on AutoCanada, as I’m going to lean heavily on it in this one.

Why?

Because AutoCanada at that time (late 2020) was a turnaround story that kind of turned, and now is looking to turnaround more.

In 2020, AutoCanada had a management team that had been on the job for a little over two years, enough time to clean up much of the mess from the previous management team.

The company had a “Go Forward Plan” that focused on:

Realize synergies with bulk purchasing from vendors

Sell underperforming dealerships and excess land

Sale leasebacks of properties

Focus on finance, insurance, parts, service, collision repair

Start a specialty finance (mostly subprime) offering

Focus on increasing the sale of used cars as a proportion of cars sold (with a target of 1:1 used:new)

Start a wholesale division for the sale of used cars

Increase the occupancy of service bays

And to its credit, the company has been pretty darned successful with this plan:

I’ll get to the synergies later

AutoCanada sold a handful of dealerships

Sale leasebacks have been done, AutoCanada owns little real estate

Finance and insurance (F&I) and parts, service, and collision (PS&C) have increased significantly since

RightRide, AutoCanada’s finance origination arm, has grown significantly

The ratio of used sales to new sales is now consistently greater than 1:1

This has been done, not a huge business

Occupancy at service bays has increased (as has the number of service bays).

Given the success on these initiatives, you’d think the stock would have performed well right?

As you can see, AutoCanada has underperformed all of its peers except CarMax as well as the S&P 500 and TSX, since roughly the start of the Go Forward Plan. And since I wrote about the stock in late 2020, the stock price has made a big round trip but is basically at the exact same price.

Was the plan bad? Did AutoCanada screw something else up while implementing good changes? What happened?

It doesn’t exactly take a genius to point out why AutoCanada has underperformed. That’s because management has implemented a new plan: Project Elevate

I’ll give them something for their plan names improving.

That last point of modernizing corporate infrastructure I’m going to blow past. It sounds fine, I’m sure it will help, whatever. It’s tough to put numbers to it so I’ll let you decide what you think about it.

Gross Profit

The focusing on gross profit is interesting not because it is a bad idea, but because AutoCanada is already pretty good in this area. Here is a comparison of the gross margins of the publicly traded dealerships.

CarMax is the big outlier here so let’s ignore it.

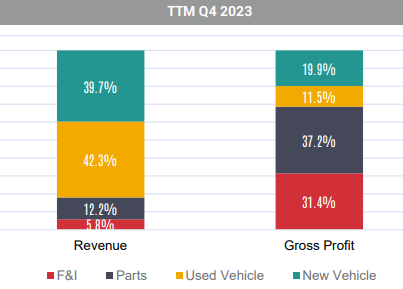

Let’s look mainly at parts and F&I, by far the highest margin sales for an auto dealer. Here’s how much the other dealership groups sell in those lines:

LAD - Parts 10.3%, F&I 4.3%

AN - Parts 16.9%, F&I 5.2%

SAH - Parts 12.2%, F&I 4.6%

GPI - Parts 12.4%, F&I 4.2%

ABG - Parts 14%, F&I 4.6%

The two positive outliers for gross margins are AutoNation (AN) and Asbury (ABG), and when you see that they have the highest proportion of revenues coming from parts & service and finance & insurance, their gross margins make sense. The question then becomes, how much higher can AutoCanada’s gross margins go? Could AutoCanada have 19% gross margins? With no growth in revenue, 19% gross margins would increase AutoCanada’s EBITDA by $100 million, a 40% increase from 2023’s adjusted EBITDA.

There are a few factors we can look at that should buoy hopes of higher gross profits. First of all, after a fair bit of turnover, both the president and COO formerly worked at AutoNation:

I’m not saying that having worked there that they implicitly can get any company’s margins up to those of AutoNation’s, but it doesn’t hurt.

Second, at least to my untrained eye, AutoCanada is focused on the right key metrics.

In 2023, AutoCanada’s gross margin on used vehicles was just 4.7% ($1742 per unit).

Compare this to to Asbury at 6.2% ($1949/unit), AutoNation at 6.5% ($1800/unit), Group 1 (GPI) at 4.8% ($1434/unit), Lithia (LAD) at 7.5% ($2215/unit), and Sonic (SAH) at 5.3% ($1626/unit).

There is almost certainly some improvement possible in the Canadian segment. I have yet to see a reason that Canadian used car sales would be done at lower gross margins than US used car sales. In fact as one example, if you go back to 2017, AutoCanada’s used vehicle gross margin was 6.1% while AutoNation’s was similar to today’s at 6.6% (others were in the same range as well, showing it wasn’t just a higher margin time). So if the Canadian used car segment can have gross margins of 6% (which it has and can), and the US operations can improve its margins 150 bps and still be among the worst of its US peers, it looks very possible that AutoCanada can improve its gross margins at least somewhat. That situation alone (6% in Canada, 4.7% in the US) would represent a $30 million increase in EBITDA. And presumably there’s no reason that AutoCanada can’t improve more than that, now that it is a focus.

I don’t have much to say on this point. The point management is trying to make looks good, and I can see how this could contribute to gross margin improvement. The revenue breakdowns above also suggest that with renewed focus on increasing sales of F&I and parts/repairs, and acquisitions of late being weighted towards collision and service centres, AutoCanada’s parts and/or F&I revenue could very well increase as a proportion of the total.

Cost Structure

This is the big one.

SG&A as a percentage of gross profits is a commonly focused metric for this industry. For all of the US listed dealership groups, it’s a prominently disclosed number.

AutoCanada has much higher overhead than its US peers (again with KMX being an exception). What is the cause of this?

I picked Asbury and Sonic as comparables because they are the smallest peers by revenue. There are definitely economies of scale so is it really fair to compare AutoCanada, with ~$4.7B USD of revenue to Lithia or AutoNation which both have revenue of over $25B? Sonic and Asbury are both much larger than AutoCanada (both around $14B in sales), but it’s as close as we’re going to get.

Looking at the breakdown of SG&A, it’s obvious that when employee compensation is the vast majority of costs, it it going to represent the biggest opportunity for AutoCanada to cut costs. And we can see this to be true. Both Asbury and Sonic spend ~7% of their revenue on employee compensation, while at AutoCanada that number is 9%. The difference between 9% and just 7.5% is over $100 million.

It has also been stated that there should be costs to cut in every category. What is all included in that line “administrative costs”? I don’t know everything but if AutoCanada could cut 10% of that we’re talking another $25 million.

For every 1% of SG&A as a percent of gross profit AutoCanada can cut, EBITDA increases $11.2 million. If AutoCanada can get down to Sonic’s 71%, its highest cost peer, EBITDA would increase $67 million, an over 25% improvement vs 2023. If it could improve to 65% (a rough average of its peers and the next highest number), that’s over $130 million and a 50% improvement in EBITDA. On the Q4 2023 conference call, Paul Antony mentioned that he thinks the mid 60’s range is a possibility.

Track Record

Like I said above, this management team has shown itself to be capable of pulling this plan off. You might think to yourself “why should I trust this team to cut costs when they’ve been in charge this long without doing so?”.

The reason is because until now, cost discipline has not been a focus. Management is hanging its hat on improving profitability to the levels of its peers by the end of 2025, a deadline just 20 months in the future. And while yes this management team has been in charge for 5+ years and still has bottom of the class SG&A as a percentage of gross profit, that number has improved modestly during Paul Antony’s tenure:

Prior to Antony, that number was consistently above 80%. Most likely attributable mainly to growth (revenues have doubled), that number has come down to where it is today.

And again, the Go Forward Plan was executed quite successfully. With more work to do and focus pulled in more directions, management improved gross margins, doubled revenue and more than doubled EBITDA, navigated a pandemic, greatly increased parts/service, F&I, and used car sales, and grew a not particularly successful yet but nascent used digital strategy.

Between the success of the Go Forward Plan and the new leadership bench strength, there’s reason to believe that Project Elevate isn’t just blowing smoke.

Valuation

AutoCanada’s current valuation is appealing enough. AutoCanada earned $2.06 per share in 2023 and $3.03 in 2022 (the decrease this year being largely the result of a $100 million increase in operating expenses/SG&A, with $36.7 million being related to SBC as part of buying the minority interest in its Used Digital division). Analyst consensus is for AutoCanada to earn $3.39 in 2024. Use whichever number you want. If you use 2022’s earnings, AutoCanada trades at 8x earnings, whereas if you use analyst estimates it’s a little over 7x.

That is roughly in line with its peers - GPI trades at 6.5x, SAH trades a little over 10x, the others are all between 7-8x.

The opportunity is if AutoCanada can succeed with Project Elevate.

Let’s imagine for a second that AutoCanada grows its gross margin, just on the used cars, to 6% in Canada and 4.7% in the US, like I posited above. That would increase gross profits and EBITDA by $30 million. Now let’s imagine that AutoCanada reduces its SG&A to 70% of gross profits, which is still at the high end (high being bad here) of its peers. That $30 million improvement in gross profit and 7% improvement in costs would grow EBITDA by over $80 million, net income by ~$59 million, and earnings per share by $2.40.

I don’t know if management can hit that, but I definitely think it’s possible and I think that results better than that are achievable.

On top of that, AutoCanada will likely generate something like $120 million to $150 million in free cash flow between now and the end of 2025*.

*AutoCanada reports it had $100 million+ in TTM FCF, but its definition does not count lease payments as an expense (blame IFRS) and adds back share based compensation. Some share based compensation will be non-recurring as it was payment for the Used Digital deal, but generally I think it’s bad practice not to count that as an expense. Once you account for those items, I get 2023 free cash flow as more like $60 million, possibly/probably higher the next two years when the Used Digital SBC is not a factor.

Management will use that cash to acquire new dealerships and collision centres, open new RightRide locations, and buyback shares.

Despite his focus on growth, Paul Antony has proven to be a prolific share repurchaser. At the end of 2017, there were 27.5 million shares. At the end of 2021, there were still 27.3 million shares outstanding. Today, after two SIBs and two years of NCIBs, that number is down to 23.5 million.

An investment in AutoCanada is putting a lot of faith in management to allocate capital correctly, so I’m not going to delve into what they will do with the cash flow. All I’ll say is that management have proven to be adept acquirers of dealerships and currently have the opportunity to buyback shares for less than 10x FCF.

Add two years of prudent capital allocation to our estimate of possible earnings (~$2-$3 + $2.40 from Project Elevate) at the end of 2025, and you have what looks like a very cheap stock. It’s very possible that AutoCanada could earn $6+ in 2026:

$3 “normalized” earnings baseline (re. rounding down from 2024 estimates but up from a poor 2023)

~$2.50 in Project Elevate savings/gross profit improvements

~$0.50 or more in earnings growth from acquisitions/growth capital spent or EPS growth from a reduced share count.

I said above that AutoCanada’s 7-8x earnings valuation is not out of line for the industry. If we apply that same 7-8x P/E to $6 of earnings, we get a 2026 target of $42-$48. Call it $45 for simplicity. That’s almost a double from here.

There is also cause to think AutoCanada could command a premium valuation. Sonic trades over 10x earnings, so it’s not unthinkable for an auto dealer. If AutoCanada were to trade at 10x earnings given its higher growth, its position as the only Canadian publicly traded dealership group, excitement over its digital division, excitement over the roll up strategy again, whatever, we’re looking at a $60+ stock in the next three years or so.

Used Digital & Kijiji Newco

I won’t spill a lot of type strokes on this. I did last time and it looks dumb in hindsight.

The used digital division started as a kind of Carvana/CarMax like business, where customers would shop for used cars online, and be able to test drive or buy their cars at any of AutoCanada’s dealerships (or any of its used car dealerships, it started out kind of unclear). It started with a (dumb in hindsight) corporate structure where the chairman Paul Antony owned 15% and AutoCanada owned the rest but would give shares to used car dealers who sold their dealerships to the division.

Through an expanded partnership with Kijiji, and a $25 million investment in December by iA Financial, the used digital division’s strategy has become more clear and the corporate structure cleaned up.

There is still a lot of potential for the Used Digital division, but it looks nothing like it once did. As an example, money losing Clutch, the closest Carvana clone in Canada, was once valued at $575 million and most recently secured financing at a valuation of just $15 million. The hype has died down, which is actually a positive for AutoCanada as competitors will find it harder to grow and will act more rationally. But it does hurt what we can say the Used Digital division is worth. No longer can we talk about double digit revenue multiples, billion dollar valuations…

As you can see, the corporate structure now includes “Newco”.

Newcois a placeholder name and is part of the partnership with Kijiji where AutoCanada will be the provider of warranty, insurance, and finance solutions on private seller car sales on Kijiji:

What’s notable is the valuation. iA didn’t just fall off the turnip truck.

iA is a sophisticated financial company, and has provided AutoCanada with warranty and insurance products since 2018, so it knew what it was getting into when it made the investment. Sure maybe iA would overpay for such a small investment (what’s $25 million to a company with more than $200 billion in AUM), but it is a decent indicator of the value of Newco.

The Used Digital division owns 90% of Newco, which based on iA’s investment can be valued at $250 million (again, this isn’t gospel). That gives the Used Digital division a value of at least $225 million. What are the other business lines of the division worth? I don’t know. I won’t speculate. It’s possible it’s worth nothing. It’s possible it’s worth less than nothing if the company continues investing cash into the division and doesn’t earn a return, though I think this is unlikely. The partnership with Kijiji where AutoCanada gets first crack at making instant cash offers on used vehicles is worth something. AutoCanada is investing in large used dealerships which are worth something regardless of whether they ever really tie into digital selling.

Again, I’m not counting too much on this division to provide value, but it is worth noting that at least one method of valuing this division implies a valuation of $225 million or more, while AutoCanada’s market cap is less than $600 million.

Risks

You know the risks.

This quote from CarMax’s fourth quarter results hits the nail on the head:

We believe vehicle affordability challenges continued to impact our fourth quarter unit sales performance, with ongoing headwinds due to widespread inflationary pressures, higher interest rates, tightened lending standards and low consumer confidence.

In Canada, those factors are only exacerbated. Affordability is much worse here. Our economy is performing worse than the US. Unemployment is up and going higher.

There are many households who haven’t yet been impacted by higher mortgage rates whose mortgages are set to renew in the next two years (December 2025 for me) who will be hit with major payment shocks. The list goes on and on.

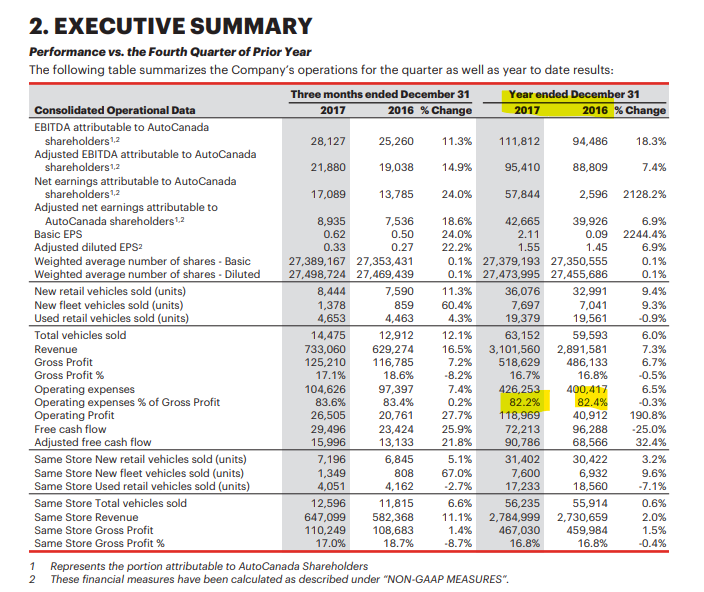

The biggest risk to AutoCanada is of course a recession/hard landing or however you want to label it. One just needs to look at AutoCanada’s 2016 annual report to see what a tough consumer environment can do:

2015 and 2016 weren’t necessarily terrible years for the Canadian economy, though they weren’t great, but at the time AutoCanada was very concentrated in Alberta which experienced very bad years due to the downturn in energy prices.

The company is stronger now in many ways. Obviously management is better. The company has diversified geographically. In 2014, the less cyclical business lines (used cars and parts/service) were just 33.5% of revenue, compared to 54.5% now, which should allow AutoCanada to absorb a bad market better today.

All this said, if the Canadian economy shits the bed (or does so worse than it is now depending on who you ask), an auto dealer is not going to do too well.

Conclusion

It feels weird to be writing about AutoCanada again after three and a half years, having sold in the meantime, and writing a very different pitch. Who thought we’d be here? Not me. AutoCanada is still probably going to be a good acquirer of dealerships and collision centres, so the roll up story isn’t gone. Barring a horrible economy it is still going to grow revenue, and probably take market share in the Canadian car sales space. It still has a nascent but possibly very profitable Used Digital division. But now the opportunity is different.

AutoCanada is still those things, but we have a renewed focus on costs and with such small margins, the cost savings AutoCanada is focused on can make a huge difference to the bottom line. Like I said above, simply getting employee cost per dollar of revenue close to peers saves $100 million, and there should be a lot more fat to cut than that.

I don’t know if Project Elevate will be successful. I don’t know if management can get company expenses down to the level of its peers (those peers being 3x AutoCanada’s size or bigger, and operating primarily in a different country). But the cost saving opportunity is substantial. Even a modest improvement, falling short of management’s goals, will lead to a large improvement in profitability and earnings for shareholders.

While waiting for the company to execute on that goal, you have a company trading at less than 10x earnings and free cash flow, with a management team that has successfully executed its business plans before, improved the company substantially, and shown itself to be good stewards of capital whether it’s performing M&A or buying back stock.

Without making crazy assumptions, I see AutoCanada earning $6 in 2026 as quite possible and there is the blue sky possibility (more growth than I assumed, more success cutting costs, etc) that it could earn more than that. This is without relying on a robust economy, though admittedly it relies on a not terrible one.

I ended my last post on AutoCanada, over three years ago this way:

I don’t know if I’d set a $60 target for four years from now, but I do think it’s more likely to be $60 than under $30 at that time, with a decent chance of being well over $60.

I don’t think the stock quite reached $60 in 2021 but it got damn close, so I wasn’t completely wrong. But here we are, with my four year timeline about six months away, and the stock under $30. That said, AutoCanada is a different investment today than it was then, so I’m essentially going to steal what I said last time.

I don’t know if I’d set a $60 target for three years from now, but I do think it’s more likely to be $60 than under $30 at that time, with a decent chance of being over that. And maybe in 2026 or 2027 earnings are around $6 but the multiple hasn’t expanded and it trades at 8x earnings like the other auto dealership groups. Is a double over three years the worst thing?