Before I start, I feel obligated to tell you that there are two very good writeups about Leon’s by better investors and writers than me.

In his mid year 2024 letter, Daniel Smoak wrote a concise (5 paragraphs) pitch of Leon’s stock. He purchased the shares much cheaper, but the stock is similarly priced to when his letter came out, so you don’t have to read that and think you missed out. This is a fantastic example of something akin to an elevator pitch.

To contrast the very concise Smoak Capital letter, Adam Wilk of Greystone Capital wrote a great long piece on Leon’s in his Q3 letter to investors. Adam goes through the history of Leon’s and gets into the competitive advantages of the business today, providing a lot of context to the current opportunity.

Similar to my Secure Energy Services writeup, I considered not writing anything about Leon’s because those two pieces do such a good job of telling the story.

Secure Energy Services

As I was early in the process of researching Secure Energy Services, I discovered this write-up by 310 Value:

Alas, I liked researching Leon’s and wanted to write something if only to solidify my own understanding, though I will say both of those articles played a large role in my research and writing so I want to give full credit to them.

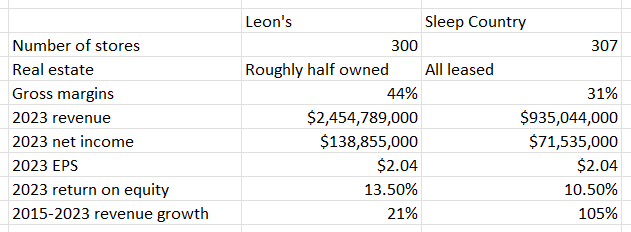

Anyone in Canada will be very familiar with Leon’s and The Brick, the two brands which represent the majority of Leon’s locations. According to a few sources (those sources being several sites that pop up when you Google “number of furniture stores in Canada”), there is somewhere between 3000 and 3600 furniture stores in Canada. Leon’s has 300 locations, some corporately owned and others franchised. Sleep Country Canada, which is slightly different but clearly in the same vein, at 307 stores is the only retailer in the same ball park.

Through similarly rigorous research, it seems the Canadian furniture market is approximately $23 billion to $25 billion, so Leon’s with its ~$3 billion in system wide sales has somewhere around 12% of the market*. IKEA Canada has roughly the same revenue, and then again, I don’t think any other retailer is particularly close to them.

*Notably, Adam wrote in his letter “I estimate that Leon’s controls slightly above 15% of Canada’s retail furniture market, which I think can grow to 25% within the next decade”. I can guarantee he did more or better work coming to his estimate, so I’d happily default to it.

I want to touch on the two real estate catalysts that are by no means secrets, but seem to still be overlooked.

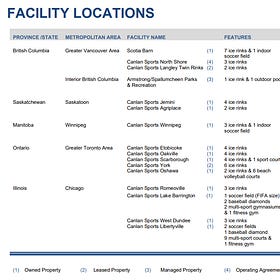

Last May, Leon’s announced that it would be creating a REIT with its 5.2 million square feet of real estate, a mix of retail stores, distribution centres, and warehouses.

The REIT IPO/spinoff is something we’ve seen done by Empire (Crombie REIT), Canadian Tire (CT REIT), and Loblaw’s (Choice Properties REIT). It’s something Canadians understand well and seem to like.

This real estate isn’t particularly comparable to anything on the Canadian market currently. It is 5.2 million sq.ft, which is on the smaller side for retail REITs. For all intents and purposes it’s going to be a single tenant REIT, and that tenant, as strong as Leon’s is (I’ll try to convince you of that in a bit), is by no means what investors will be looking for in an anchor tenant. Look at the presentations of retail REITs and you’ll see them highlight grocery stores, Shopper’s Drug Marts and/or other pharmacies, and Walmarts. Canadian Tire represents 92% of CT REIT’s rent/square footage, yet even that I’m guessing will be much lower than Leon’s, and Canadian Tire would be viewed by many as a more desirable tenant (though not by all I’m sure). Given the size and the fact that Leon’s wants to retain a major stake in the REIT, the liquidity will be quite low.

Canadian retail REITs on average are trading around $250 per square foot, but for the reasons listed above I am guessing Leon’s REIT is going to trade at a poor valuation once it goes public. If Leon’s REIT traded at $200/sq.ft it would be worth a little over $1 billion. $180 per square foot, lower than almost all non-industrial REITs in Canada, would be $940 million.

There is one factor that would seemingly not help Leon’s REIT valuation right now, but to my mind should be a positive. From the 2023 annual information form:

In aggregate, the Company’s owned portfolio of retail stores, warehouses and distribution centres sit on a total of 430 acres of land, which includes a significant amount of excess and undeveloped land.

At one time, retail real estate owners intensifying their properties by building apartments/condos or whatever on lands that were being used for parking lots or unused land on their properties was rewarded by the market. Perhaps it’s because retail real estate is more in favour now, but it certainly seems that public markets are not rewarding retail REITs nearly as much for the redevelopment/intensification potential. In fact, Riocan just announced it wouldn’t be doing any more development given the costs of building. I’m not blaming Riocan, everything you hear is that new developments don’t pencil out, but it goes to show how valuable land optionality isn’t being rewarded. Regardless, of that 430 acres, it’s hard to know how much is excess land, how much real estate could be added to those properties, etc. It’s just important to know that there is value in that excess land which is not earning income now but could in the future. Maybe the land would lead to a slightly higher per sq.ft valuation for the REIT, maybe not, or maybe not now but will sometime in the future, but $180-$200/sq.ft is a very reasonable valuation one way or the other.

On the topic of excess land, in January of this year Leon’s announced it has rezoned a 40 acre parcel of land it owns in Toronto at the intersection of the 401 and the 400. For non-Canadians, the Toronto section of Highway 401 is the busiest stretch of highway in North America. This an absurdly busy area that should be very valuable.

The plan is to eventually have 4.6 million square feet of retail, which will include a new flagship Leon’s store, residential and commercial on the site.

If you’ve read some of my older stuff, you know I’ve written a lot about land values, particularly those in Toronto and Alberta. This article about Canlan Ice Sports is the most recent:

Canlan Ice Sports Group

“We used Ken Cooper as an inspirational guest speaker at LTV in 1968 or 1969. We looked carefully at trying to tie Cooper and the Aerobics Center into Wilson. You’d set up a number of tennis and health centers and sell your Wilson merchandise there. But I’m afraid that due to a lot of diversionary activities, that thought was never pursued. I don’t reme…

While Toronto land princes have been trending down, land in the city is still very valuable.

This parcel of land in particular should be valued pretty dearly given its proximity to those highways. And imagine the synergies! A huge furniture store surrounded by 4000 new homes!

We can argue about exactly what the land would be worth to a developer, but the value is so much higher than whatever value the market is ascribing to it that there’s no point in the argument. What if it’s only $60 per buildable square foot? That would be $275 million. You can throw at some big numbers for the high end of the value - $200/sq.ft would be over $900 million (and not unreasonable because so rarely do 40 acre contiguous parcels become available) - but I think a value of $100 is a conservative valuation to settle on. $460 million from one plot of land, just 40 acres of the aforementioned 430 acres. This plot is the most valuable by far, but there will be a lot of land that can be intensified. As Leon’s hits milestones in the process of developing this land (another one, the secondary plan, will be coming mid-late next year), the market should reward the stock.

Finally I get to the business.

Leon’s is a very strong business. Furniture is a reasonably cyclical industry, but Leon’s has shown steady if unremarkable growth while remaining profitable and improving its operating margins for a long time.

Leon’s was profitable in 2007 and 2008 and 2009, and every year since. I’ll leave you to read the Greystone letter to get a good idea for the quality of the business. Adam goes over it well.

In 2023, Leon’s earned $2.04, so it’s ~13x last year’s earnings, which were down from roughly $2.66 in both 2021 and 2022. According to Morningstar, analyst consensus for earnings this year is $1.95 (which seems accurate since YTD EPS are down $0.10) and $2.15 for next year. At today’s enterprise value of ~$1.8 billion, EV/EBITDA is around 7x.

13x earnings and 7x EBITDA for an industry leader, with significant scale advantages, and a long history of profitability in a cyclical industry, with a net cash balance sheet, seems like a decent valuation.

But we have a very close comp for valuation from Fairfax Financial’s recent acquisition of Sleep Country Canada.

In July, Fairfax announced that it was acquiring Sleep Country Canada for $35 per share, which was an enterprise value of $1.7 billion. Wow, that’s oddly close to Leon’s current enterprise value.

While Sleep Country isn’t a perfect comparison - though Leon’s is Canada’s second largest mattress seller, Sleep Country is much more narrowly focused - it’s a good one and the comparison will still be helpful.

Sleep Country has superior growth and a handful more stores, but that’s about it. By almost any other metric, you’d expect Leon’s to be worth more than Sleep Country. Sales are 2.5x higher, margins are higher, earnings are almost double, and Leon’s has higher ROE despite lower leverage.

I’ll add that if you surveyed 100 investors familiar with the company, you’d get mixed impressions of Fairfax’s investing acumen, but generally I think the company is a good acquirer. If Prem Watsa is saying Sleep Country is worth owning at that valuation, and Leon’s is at least of similar quality, it reinforces my opinion that the fair value of Leon’s is close to that. This opinion cuts both ways though, as Fairfax had held Leon’s stock for a long time (going back to its acquisition of The Brick in 2013), and sold it in 2021 for $25. Seeing as those proceeds probably went to funding buybacks of Fairfax stock that year, and what Fairfax stock has done since, you can’t say that sale was a mistake.

What happens when Leon’s has to start paying leases on all its owned real estate? How much will earnings go down? We can look at it two ways to get a range.

First, Leon’s already rents a lot of real estate, so we can compare its current rent expense to what will be newly rented real estate.

To rent 6.6 million square feet of space, Leon’s paid $93 million in 2023, or ~$14 per square foot. Of course the rent Leon’s pays currently is going to be a good indication of what Leon’s would pay for rent on the newly “REITed” properties, but the properties aren’t identical and there are going to be older leases mixed in there, so $14/sq.ft is the low end of what rent might be.

Second, we can look at what a similar REIT charges for rent. If forced to choose, I’d say CT REIT is the most comparable to Leon’s, so its rent figure seems applicable. CT REIT charges about $19/sq.ft for rent. Again though, Canadian Tires are going to be more desirable properties, so I’d expect that would be the high end.

Leon’s new rent payments will likely fall somewhere in that range. 5.6 million square feet of newly rented real estate will likely end up costing Leon’s $78 million to $106 million. For simplicity I’ll use $90 million.

$90 million of new expenses on ~$140 million of earnings seems like a huge hit, but there are mitigating factors.

Leon’s is going to receive a tonne of capital from the REIT IPO. I don’t know if Leon’s will choose to pay off its $90 million of debt, or apportion the debt to the REIT, but if it does either of those, the whole interest expense goes away. Management could also choose to leave the debt on the balance sheet, so I can’t say for certain all interest will go away, but this will balance out some of the effect of the new leases.

Owning real estate isn’t free, and all the expenses associated with the properties will leave Leon’s income statement and go to the REIT’s. Again, looking to CT REIT, property expenses are about 22% of its rental revenue. I’d guess Leon’s, with just 5.2 million square feet to CT REIT’s 30 million square feet, will likely have higher expenses per square foot. If we assume that 25% of rents go towards property expenses, those expenses are no longer paid by Leon’s, that’s ~$22 million of the rent recouped.

Finally, Leon’s is going to retain majority ownership of the REIT, and as a unitholder will receive distributions from the REIT. Estimating the AFFO margins and payout ratio of a REIT that doesn’t exist seems dumb, but needless to say, the REIT’s distributions flowing up to Leon’s will offset even more of the rent.

Combine all that and the net new expense of not owning the real estate could drop to half of the new rent payments, or less possibly.

Adding it all up

The value of the 40 acre property in Toronto seems to be the easiest piece to solve for. I’m very confident that that land is worth $100/sq.ft. I’m pretty sure it’s worth considerably more, but we can run with $100. That should be a price which would make any acquirer happy today, as well as being a conservative net present value of the cash flows the land will bring in as it’s developed. This land alone is worth $460 million, or $6.70 per share.

The REIT at just $180/sq.ft would be worth $946 million, $13.75 per share.

What about the business?

After subtracting the land and REIT value, the market is valuing the furniture business at just $400 million. For a high quality business that is likely to earn around $100 million in a normal year post REIT creation, with growing earnings, that seems far too cheap.

Getting back to Sleep Country, it was acquired for over 17x 2023’s earnings, and 8.6x EBITDA. Yes, it was growing faster so let’s say it should be worth more than slow growing, steady Leon’s. Maybe Leon’s current valuation of 13x earnings or 7x EBITDA is right? 13x earnings would be ~$19 and 7x EBITDA would be ~$25, taking some liberties with post REIT financials.

All three of those pieces I think are worth more than what I said, but still you come up with a sum of the parts of $40-$45.

If you are a little less conservative, $150 per buildable sq.ft for the land, $200/sq.ft for the REIT, and 17x earnings/9x EBITDA for the business gets you to a range of $50-$57. None of those are unreasonable assumptions.

Sum of the parts investments have gotten a bad rap in recent years. Understandably so, because a lot of them either don’t work out or work out on such a long timescale that investors don’t have the patience for it (and/or they take long enough that the return isn’t that impressive).

Leon’s is different. Two of the biggest reasons that some sum of the parts investments fail is that 1) one or more of the parts are not worth what the investor thinks (or often are worth little to nothing on their own), and 2) there is no catalyst for value to be realized. Leon’s has already told the market “we are realizing this value”. That’s why the stock is $27 now vs the high teens stock price it was before the REIT announcement or the high teens stock price it was before announcing the Toronto lands have been rezoned and will be developed.

The master planned community in Toronto is going to take years for value to be realized. At any time Leon’s could announce it has sold 50% to a developer partner, which would be a way of crystallizing value and pulling some cash flows forward, but it’s just as likely the land slowly builds in value over many years. A 40 acre community like this could easily take 15 years from this point to be completed. This is a part that would usually get undervalued in a sum of the parts, but in this case the company has at least announced the intention to realize its value, a big first step.

The REIT meanwhile was announced a year and a half ago, so has been in planning at least that long (probably much longer). The company has said it will IPO the REIT when the market will maximize its value, which is the smart approach. Leon’s new CEO Michael Walsh was at Canadian Tire at the time it IPO’d CT REIT, so has at least been around the process which gives me some confidence in how the IPO will be executed.

So yes, Leon’s can be seen as a sum of the parts investment (though you could write a thesis for Leon’s that doesn’t rely on that), but we know the parts are valuable, management knows they are, and management is already well down the path to realizing the value. That’s not your typical SotP. It’s better.

By my calculations, Leon’s is conservatively worth 50% more than it trades for today, and without making unreasonable assumptions, I could argue for 100% more. If the REIT IPO doesn’t happen - I’ve had/seen interactions on Twitter that suggest investors may be getting impatient since there has been no news for over a year - Leon’s to me is still an attractive investment. It is a market leader, growing its earnings and dividend, it has allocated capital to share buybacks well over the years and probably will continue to buy back shares, and it’s available for 13x earnings without accounting for 40 acres of prime developable land in Toronto. When a similar comparable company got acquired by a smart acquirer for 17x, that strikes me as an acceptable risk-reward.