I don’t “do” an annual letter. I don’t have anyone to report to. But I have started writing more; if you have been a subscriber for a while you know this, and welcome to all the new subscribers. Between my desire to do more writing, my desire to more thoroughly understand my investments, and wanting to have some sort of record I could look back at, I thought writing an annual letter to myself would be worthwhile and possibly fun. The purpose of this will mostly be for me to have something to look back on and know what I was thinking/doing in 2024, but I also hope it’s enjoyable for you.

In 2024, I was just barely able to beat out the TSX, while losing out big to the S&P 500:

For readers who aren’t me, it’s also important to note that I own a small position in the ETF VFV, which I’ll discuss a little bit below. This year that position did pull up my returns a bit. That’s obviously not due to my investing acumen. I’m sure I could spreadsheet out exactly what my returns would have been without my 1.5% position in VFV, but that doesn’t seem like an important exercise. Point being, you could knock a bit off my performance number.

At year end here is the portfolio:

Due to finding Portseido, I’m now able to track the portfolio a lot better than I was (which was not at all), which is another big reason that I’m able to write this letter… because I actually have the tools to know what I own.

Portfolio turnover was 1.29%, entirely the result of my one sale this year - selling GFL in October. This looks like a mistake in hindsight. I sold at ~$54 and the stock is ~$64. Most of the proceeds went into Fairfax (FFH), which I both had more conviction in and wanted to own more of. Owning more Fairfax, which has performed very well since the trade in its own right, has softened the blow of selling GFL.

I was sad to see GFL go, but it was a small position and I probably wasn’t going to buy more at the price I sold. Since it was my lowest conviction, and probably least understood holding amongst my small positions, it made sense to me to use it as a source of funds when I decided I wanted to own more Fairfax. I still like the story at GFL, though obviously less at $60+ than before. I could see myself buying it again in the future.

Fairfax Financial

I do not want this to come across as a victory lap, or bragging. It absolutely isn’t. To prove my point, I’d like to point out the stock chart of Dream Unlimited:

Speaking of Fairfax, it has been the second largest contributor to my returns this year.

Fairfax has been discussed at length by others, including the writeups I linked to in my post above, by Viking on Corner of Berkshire and Fairfax, and by @BrownMarubozu on Twitter. I don’t need to discuss it here, but I’d highly encourage those looking to understand it better to hit up all those sources. I remain interested in owning more Fairfax at the current prices, and think the future is very bright. Whether it is where I put new money I’m not sure, but at a little under 10% position, I am convinced owning more Fairfax would be a good thing.

The dollar amounts are inconsequential, but the rest of the proceeds from the GFL sale added to my position in a stock that did more or less nothing over the course of my holding period, Strathcona Resources (SCR). Strathcona is actually up 40+% on the year. The reason I didn’t earn that return is because I didn’t receive the funds to initiate my position in it until May (the aforementioned windfall, the result of a real estate sale).

I’m a bit of a tourist in energy, I am well aware of that, but I wanted to have more exposure. At the time I had cash to buy, Strathcona seemed the best combination of valuation and management quality. Here is a decent write up, albeit dated, that does a good job of explaining my thought process:

Since that was posted, the stock price has hardly moved, but the story has only improved. Management has initiated a dividend, and the stock yields 3.2% at today’s prices. That dividend, and all maintenance and growth capex, is sustainable all the way down to $59 USD WTI. WTI is ~$72 today, and has been in that range for the last few months (after being considerably higher). At $70 oil, Stratchona is set to earn $700 million of free cash flow over and above its dividend and growth capex. At today’s $6.3 billion market cap, that seems like a good bet. And management announced one of the most thought out capital return programs out there, so I am very confident that the free cash flow will be spent well or returned to me.

I bought two other energy stocks this year, both of which did okay by me.

For a very long time I have wanted to own Prairie Sky Royalty (PSK). In May when I had the funds to start a position, $25 struck me as a fair to slightly undervalued valuation for a well managed, enormous portfolio of royalty lands. While the position isn’t a large one, this is a position I intend to hold for a very long time, reinvesting the dividends as I go.

The other energy company I bought and had wanted to own for a long time is Tourmaline Oil (TOU). I fully acknowledge I have no idea what that the price of natural gas will be long term. I have no position on that topic. But I do know that Mike Rose is one of the best CEOs in Canadian business, he knows what he’s doing, and he’s managing Tourmaline well. I wanted to be invested alongside him, and if the world needs a tonne more energy in the future and chooses to get some of it from natural gas, the price of gas might rise and Tourmaline stands to benefit. If the price stays low, Tourmaline is profitable, not very leveraged, and at the very least, not expensive. I do not want Tourmaline to be a big position, but I would like to own more. Right now my position is more or less inconsequential. I’d like to get it up to perhaps a 2% position. That is still a small position, but that’s about how I’ve sized my other “management bet” positions.

The largest contributor to my returns this year was Partners Value Fund (PVF.UN). This has been a good investment for me for a long time, but this year it outperformed all expectations, almost doubling. Not bad for an illiquid holding company very few people know about.

When I was starting out, I decided I wanted to own Brookfield (BN). That was a very good decision by young Tyler, but young Tyler figured things out slowly. First he figured out Brookfield would be a good investment, so he bought Brookfield (at the time it was known as Brookfield Asset Management (BAM), but it was the parent company now known as Brookfield Corp (BN)). He bought quite a bit, relative to his very tiny savings. Then he discovered that Partners Value Fund offered leveraged exposure to Brookfield, and traded at a considerable discount to its fair value. So he bought Partners Value too. I probably could have sold my Brookfield at the time and bought Partners Value to simplify my exposure, but I didn’t and can’t explain why. Regardless, that choice and the spinout of BAM from BN means my Brookfield exposure comes from Partners Value Fund, Brookfield Corp, and Brookfield Asset Management. If you combine those, the Brookfield complex would be my second largest position, and their combined contributions to my returns would be overwhelmingly the largest.

I made one more new investment that is worth discussing, Secure Energy Services (SES), soon to be known as Secure Waste Infrastructure.

Secure Energy Services

As I was early in the process of researching Secure Energy Services, I discovered this write-up by 310 Value:

Secure wasn’t my biggest financial win, but I’d say coming across Secure and taking the time to understand it was the best thing to come out of the year. I wish I had found Secure earlier as I bought my first shares around $11-$12, and I am pretty sure that if I had taken the time to look at it when it was $10 or $8 or even lower that I would have understood the company and been willing to buy. I was happy to buy at $12, and had/have the conviction to make it a big position, but if I had been turning over more rocks I’m confident I could own a lot more of it today and have made more money on the shares I own.

Not only did I not get to buy shares at under $10, but I didn’t get much chance to buy it at $12 even. It wasn’t long after I began buying, and after I posted my writeup on this Substack that the stock began going up each and every day.

Did I move the stock? No, no I did not. But the timing coincided and meant I could not buy as much as I wanted to at those prices.

My original intention was to build a large position. With the size of my portfolio vs my new savings/dividends and always being more or less fully invested, I’m unable to build a 5+% position very quickly (I realize it’s good problem to have). Secure has increased ~40% over my initial average cost of $11.72, and yet is still just a 3.9% position. I’ve added a little bit towards the end of the year, and would like to add more.

Despite the large increase, Secure remains undervalued; it’s still trading for less than 10x EBITDA. When I wrote my post, I figured fair value was $20-$25. The 100% upside from $12 was better than the 50% upside from $16, but between the assets, the management team, and the capital allocation I’ve seen, Secure is a company I plan to hold for a long time so I shouldn’t get so hung up on paying a bit more than I was.

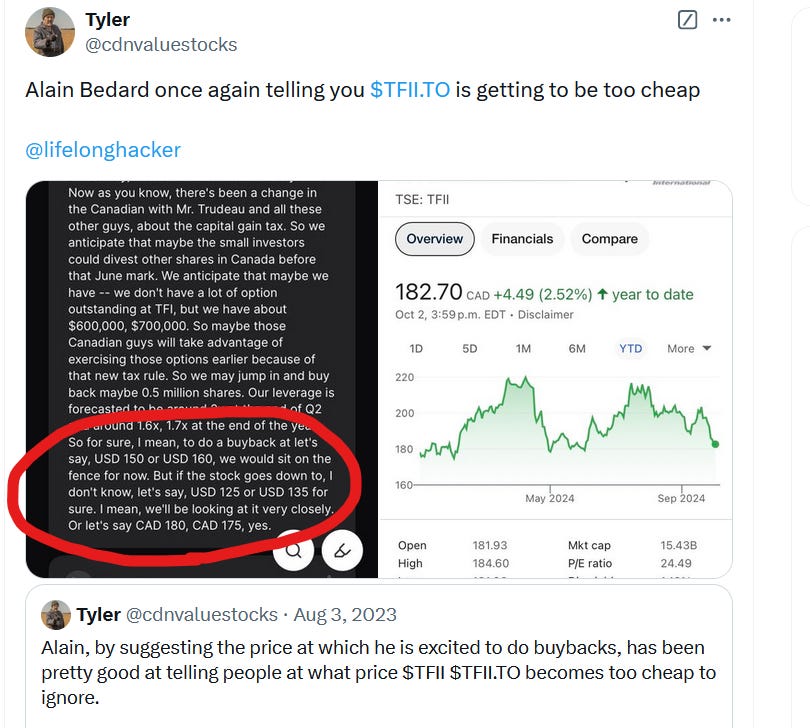

TFI International (TFII) and Constellation Software (CSU) are both small positions that I’ve held for years, plan to hold for the long term and don’t think about often. Everyone knows Constellation is run by a genius, but I think the same is true at TFI, and I want to remain invested with both management teams. TFI CEO Alain Bedard is very good at communicating to investors when he thinks the stock is cheap, via his commentary around at what price he wants to buy back stock. This year TFI twice got down to his stated price of ~$180.

Unfortunately, despite being on the ball when it dropped in September/October, I sat on my hands and did not take advantage (at least partly because I was lacking cash). TFI would not be at the top of my list of things to buy, but if it approaches $180 again, I wouldn’t mind buying more.

While I wouldn’t go so far as to say SmartCentres REIT (SRU.UN) is run by a genius (though I think you could make that argument), I think Mitch Goldhar is one of the best managers of real estate in Canada. I bought a very large position in 2020, and since then I’ve sold a lot of it, leaving small remnant position you see above. SmartCentres has a lot going right for it. On a cap rate basis, it looks very cheap. It has relatively high leverage, and most of the debt is at quite low rates, which the market probably was worried about refinancing at higher rates, but it looks like SmartCentres probably won’t face a big rate shock when the debt comes due. And finally it has spent a lot of capital on developments at various stages of completion. A lot of those will complete over the next two years, including more than 3000 storage units, a 200,000 sq.ft Canadian Tire location, and almost 400 senior’s apartments/retirement home units.

SmartCentres REIT

This is another post from the archives. I believe this was written in the very depths of COVID - SRU.UN at its COVID low sunk to mid $17’s, while this was written with units at about $19. I seemed to focus mainly on the quality of SmartCentres in this post, in fact, valuation was apparently almost an afterthought. Hence I left the post mostly as is. To …

SmartCentres is executing well, and I think it’s at least a little undervalued. Because of that, I’m happy to hold my small position and reinvest the distributions more or less forever. Most of my sales have come in the $30’s, and I think if I had something else I wanted to buy and SmartCentres was $32, I’d probably sell it if I didn’t have another source of funds. But I am not approaching SmartCentres as a trade and would be happy to own it for a long time.

My second largest position, Cymbria, bears mentioning. This is a closed end fund, and when I bought it there wasn’t any meaningful discount to net asset value (NAV) or anything. The discount when I bought it was about 10%, which is fairly large for Cymbria but is not a thesis in its self. The idea behind owning Cymbria was relatively simple:

I trust Edgepoint (the managers of Cymbria) to invest money well, with a decent chance of either beating the market or supplying me with a very satisfactory return for no effort.

I believe Edgepoint is a good company, and will continue to grow its AUM and earnings. Edgepoint is ~15% of Cymbria’s NAV, and Cymbria is the only public way to get exposure to it.

Cymbria is invested globally, so it is an easy way for me to gain international exposure without straying into markets I’m not comfortable or interested in.

Cymbria doesn’t pay dividends or distributions, so buying it in my margin account gives me an investment I think can perform at least as well as the market while also not creating any taxable events until I sell, which hopefully won’t be for decades.

The rationale for buying Cymbria was also having some assets that I myself don’t manage, some protection against the risk of my own ignorance or incompetence. It’s the same reason I own some VFV (an S&P 500 ETF for those unfamiliar). As my assets grow I’ll probably keep buying more Cymbria and VFV. I like the idea of having assets I don’t manage, just in case…

That brings us to my largest position, Dream Unlimited (DRM). As you can see, above, my largest position performed the worst. It’s a wonder to me that my performance was what it was given 40% of my portfolio returned just 5%. Maybe this is that diversification thing they’re always talking about?

I’ve talked about this position at length over the years, including this year:

My Story of Too Much Concentration

Recently, a Swedish pharmaceutical company (Moberg) that quite a few investors on Twitter concentrated heavily into reported poor results during a trial and dropped 61% on the day. One particular investor who took a lot of heat had 70% of their portfolio in this Swedish company, and another 10% in Cipher Pharmaceuticals, which holds the license to sell …

Dream remains the largest position in my portfolio by far, though it’s considerably smaller than when I wrote that in October. I haven’t sold any shares, but Dream has dropped by more than 30% then. That’s one way to diversify!

Without diving too deeply into politics (a topic I abhor discussing), all three levels of government have done their best to make housing unaffordable, with particular fault on the federal government for bringing in far more immigrants than our society could handle, and on provincial and municipal governments for their regulation, permitting, and fees making new home building so burdensome for developers. I posted about this early in the year, when it looked like the issues limiting supply were easing up (though not nearly enough), and the issues jacking up demand were going to remain.

Canada's Housing Market and Dream Unlimited

I’m a homeowner in Canada*, a rural Ontario town about two hours from Toronto (with no traffic, which obviously never happens). I’m also heavily invested in a Canadian real estate developer and property owner, as those reading this are aware.

Luckily for the country, it seems like the federal government was receptive to at least some feedback (though not nearly enough) and made a plan to reduce immigration, temporary residents, international students, etc. This combined with the other cost of living factors and an unideal economy, to put it mildly, has actually worked through the system and home prices and rents are both down. Rents in Toronto in particular are hard hit.

This is good for Canadians, but it’s not as good for developers.

In the third quarter, I was starting to look very smart again when Dream Unlimited rose to $33 mostly on the back of dropping rates. Since then REITs and real estate generally have fallen, but Dream Unlimited has had an outsized drop.

There have been a few good developments during the year.

Early in the year, Dream sold Arapahoe Basin for a large profit, and while the deal took a long time to be approved, it was approved in November and a special dividend paid with some of the proceeds on December 31st. It’s quite likely that Dec 31st will be my single highest dividend day for a very long time, possibly ever.

The Arapahoe Basin deal is worth discussing, as others have commented at length about it, discussions I’ve refrained from. Not long ago, CEO Michael Cooper specifically mentioned Arapahoe Basin as an asset he was unlikely to sell because Dream would owe so much taxes on the capital gain. It had performed wonderfully, and had been held so long, that after taxes Dream would be unlikely to find something that could return as much as it.

I was at the investor day as well, and heard the same sentiment.

Dream Investor Day

The truth is, since Dream put up the comprehensive presentation on its website, probably no one needed to go. And given the nightmare that is driving and parking in Toronto, I probably wouldn’t go again in hindsight. I met some people I only knew virtually, which was cool (you guys know who you are, it was good meeting you), but man do I hate the drive….

Well it was only about 5 months after Cooper said he was unlikely to sell Arapahoe Basin because of the taxes and because he couldn’t find something else that could earn its return (after paying taxes), that he sold it. It seems like it was a decent price, if not spectacular. With the proceeds of the sale, Cooper announced that he wanted to:

boost liquidity;

pay a special dividend

These seem like competing aims. To many it didn’t make sense, as the discussions on Twitter showed. I felt similarly. After the deal closed, Dream announced the $1.00 special dividend and that it would pay down $100 million of debt, so Cooper did both things he said.

But many saw selling Arapahoe Basin, after stating he likely wouldn’t (I don’t recall him specifically saying he wouldn’t, I could be wrong, but the gist was definitely he was unlikely to), as Cooper saying one thing and doing another. Those that saw it that way added it to a collection of optically bad/questionable decisions:

buying Dream Office units on the open market then tendering all Dream’s units shortly thereafter at lower prices;

buying back lots of stock during its big runup in 2021 then buying little to none after its big drop at much lower prices;

and talking about wanting more liquidity while also announcing a large special dividend

I admit I that I see these decisions in a similar light, but am much less annoyed by them.

Yes selling Arapahoe Basin looks odd with his prior comments, but it’s possible the sale price was higher than he thought would be available. It would have been nice if he’d acknowledge the price being too high too refuse or whatever, but decorum makes that hard.

The Dream Office thing looks dumb, but the purchases were for relatively small amounts, so it’s a minor thing. Tendering all the units suggests not a lot of faith in the office market, but he was obviously prioritizing the health of the parent company. Anyone looking at the Cooper’s incentives (almost all of his money is in Dream Unlimited as opposed to any of the other entities) should know that the parent company’s interests would come first.

I have been disappointed with the lack of buybacks under $25 or so. I also acknowledge that the market is very different than when he was buying back stock in 2021 and early 2022. I don’t find much fault in buying back the stock he did before, including what he bought at high prices, as at the time I didn’t mind so I’m not going to judge it with hindsight. I’d have loved for Dream to have the liquidity to buy back stock in 2022-2024, but I get being conservative with rates, the uncertain real estate market, development charges, construction costs, etc.

This one only makes sense when you consider Cooper personally receives $21 million or so. To be fair, liquidity is improved, high interest debt is paid down, and all shareholders receive the dividend as well.

On the last conference call, Michael Cooper mentioned that he would know/discuss more about buybacks in February, when the Q4 conference call will take place. I am eagerly awaiting his comments then. I am confident that Dream is worth $40+, and I’m pretty sure he thinks so too, so for me to consider Dream’s capital allocation a positive (as I’ve done through my time owning it), I will need to see that Cooper is either committed to buying back stock or that he has places in the business to put the money. If he thinks the return on a new development, or strategic land, or co-investing in a new managed fund, or buying Dream Impact Trust, or whatever is a better use of capital than buybacks, fine. But if the current stock price is a bargain, as I think it is, I’d like to see management agree and do something about it (as they’ve done before).

I’ve discussed before Dream’s inherent barbell. From say 2015-2021, the Toronto/Ontario real estate and development markets were very hot while nobody at all wanted to own real estate in Alberta, and having a bunch of land on which you could build houses didn’t appeal to anyone. During this time, Western Canada weighed Dream’s earnings and valuation down, while the diversification in Toronto was a saving grace.

Now, Toronto is about the worst market you can be exposed to, and Western Canada, while not booming per se, is a very good market to be in.

During both these times, the laggard market hurt Dream.

For a brief period of time, which is very noticeable on a chart of Dream’s stock price, both markets were ripping.

Dream hasn’t been keeping me up at night, but I will admit that the few annoyances or questions regarding capital allocation decisions have given me a bit of pause about my large position. When the stock was ever so briefly over $30, I thought a lot about selling some to diversify a bit more and bring the position back to some reasonable level. But I didn’t. I still like the assets, even assets that today are not worth what they were a year or two ago.

Koneko Research wrote a very detailed post that offers some lower valuations for some of Dream’s assets (in particular those held in Dream Impact Trust):

Whether Koneko is right about the values of those properties or not isn’t the most important thing. The important thing for my purposes is simply that the questions can be raised. At one time, nobody would have argued for values of $70/sq.ft for Toronto development land. Now, not only would the opinion not get you laughed out of a room, a decent number of people will be nodding along.

There are a lot of problems in the Toronto real estate market, especially for developers. I think the price of Dream reflects that. But Toronto is still a great city (I know some would argue but lots of cities are having similar issues and the issues are not beyond repair), and with a few changes from the city and province I think it could once again be recognized as such. The market can change. At $33 I thought Dream was undervalued, even considering some of its issues, but not so undervalued that nothing else in the market was an attractive alternative. I didn’t but I could have sold some of my position, remained massively overweight, and bought other companies I liked without hurting from the opportunity cost.

In the low $20’s I don’t want to do that. I’m sure I could find something out there that I thought had as much upside, or that would reduce the mental load of my portfolio and/or not raise the questions that Dream has. Leon’s would be a good example:

Leon's Furniture

Before I start, I feel obligated to tell you that there are two very good writeups about Leon’s by better investors and writers than me.

But I like Dream’s assets. I think it has a very good asset management business that isn’t getting properly valued by the market. I mostly think that management are good investors and capital allocators. And I know the company very well. It seems wrong to sell such a company at a large discount to what I think it’s worth when it is mostly executing well and markets it’s in are temporarily challenged.

My intention with the Dream position is to hold a large core position that I can kind of think of as a private investment. That’s the dream isn’t it? To own a private business run by exceptional managers who will keep reinvesting your money well and/or send you the excess cash flows. If you owned such a business as an actual private company, you wouldn’t be able to sell it easily, so your reaction to issues you see as temporary wouldn’t be to sell it. Particularly if the company was diversified, still earning profits while it was challenged, and still sending you a dividend cheque each quarter.

But you can’t trust a management team without verifying their results occasionally. You can disagree with some choices, and they don’t have to do everything you want them to do. I don’t think Dream’s management is incapable because of the choices that others are questioning. Paying down debt in an uncertain environment is hardly a terrible idea. Some ill-timed buybacks aren’t unforgiveable. Selling an asset (even one you’ve talked about holding onto) and paying investors a big chunk of the proceeds is understandable. I’d have preferred a buyback with the sale proceeds, but for all the arguing that others have done about the issue, it’s a relatively minor difference - yes I’m going to pay taxes on a decent chunk of the dividend and that sucks, but cash in hand does have benefits.

All that said, I do think that a material amount of buybacks is the objectively correct capital allocation at these prices. If management believes in its net asset value, or even its book value, then once the balance sheet is safe, it doesn’t make sense not to buy back shares. With the debt paid down after the Arapahoe Basin sale, the balance sheet is safe. The company has the liquidity it needs to take advantage of internal opportunities for growth, as well as acquisitions (as evidenced by the deal to purchase a portfolio of European apartments with partners). The quarterly dividend is well covered by cash flows, and there is ample room to grow that dividend, which is a goal of management (a goal I support for a few reasons). But if management can’t allocate capital to buyback say 1% of shares (at least), at prices they say are far too low, then I will need to hear some good justification for that decision.

For that reason, the February conference call and earnings release will go a long way to whether I think Dream is still deserving of being such a large position. I don’t need to hear Michael Cooper say “we will buy back stock”, but if he doesn’t I’d like to hear rational thinking about capital allocation.

Enough about Dream already, you can see the kind of things a 40% position do to your thinking…

Going into 2025 I would like to own more Tourmaline, likely to be purchased in my TFSA in January. I want to own more Strathcona. I added to Secure in December, and as long as it doesn’t run away from me, I’d like to keep buying more. I’d like it to be at least a 5% position. I want to own more Cymbria, and while I don’t think the discount to NAV that it often trades at is the most important driver of its returns, I admit that I follow the discount and am much happier to “punt” some of my cash when the discount is 10% or more - it’s approaching that discount now.

And these are just the things in my portfolio that I want to own more of. My portfolio is by no means complete. I own just 12 companies if you consider the Brookfield entities one. I’m under no illusion that is all I’d want to own. Leon’s is a perfect example of a stock I’d like to own but don’t yet because of my dearth of funds. I’ll hopefully look closely at 10-20 new companies in the next year. That is much more enjoyable if I can actually buy the companies I think are good investments. Barring any unforeseen circumstances, my new savings in 2025 are likely to be about 2%-2.5% of the portfolio’s starting balance. Non-reinvested dividends will add ~3.5% (including Dream’s dividends on December 31st). Clearly my eyes are bigger than my stomach/wallet, as that new cash essentially equals what I want to add to just my existing holdings.

I don’t know what 2025 will bring. The political situation in Canada is odd, to say the least, and we will be having an election and change of government this year (there I made a prediction!). Donald Trump will once again be President in the US, which only leads to more uncertainty. Interest rates and inflation are still headlines, and both could change considerably. Tariffs are on the table. Canada’s economy hasn’t been great for a while. I could go on. All I know is that I’ll keep investing.

Thank you for reading And thank you for subscribing and reading along for however long you have. I hope that I’m able to provide you some value in the year ahead. The comments and messages I receive here have made writing fun for me again, and the help has made it worthwhile otherwise, so I very much appreciate everyone who takes the time to read what I write.

A shameless plug

My original goal when I started the website Canadian Value Stocks years ago was to make money. I was young, idealistic, and quite frankly, an idiot. I thought I’d write some bullshit, put a few ads up, and be rolling in dough.

Thanks,

Tyler

Thanks for taking the time to write updates on the business you wrote on, I invested in secure energy after reading your article 👍.

Always interesting to hear your thoughts. If you think PVF.UN did well you should check the warrants. Also saw some PVF/V pref in there. How’d you assess this one?